Carphone Warehouse 2008 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2008 Carphone Warehouse annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Total Shareholder Return

0

50

100

150

200

250

300

350

400

450

500

550

The Carphone Warehouse Group PLC

FTSE 100 Index

Value of £100 invested on 29 March 2003

Mar 03 Mar 04 Mar 05 Mar 06 Mar 07 Mar 08

by rising costs as we evolved the business, a disappointing performance

from our non-store channels and the losses incurred in exiting our Swiss

retail business. UK Fixed Line EBITDA was up from £69m to £226m.

EBIT also grew strongly from £20m to £126m, as we moved a significant

proportion of our broadband customer base onto our own network and

enjoyed much lower running costs as a result.

Headline earnings per share rose 70% to 20.1p (2007: 11.8p). Statutory

profit before tax, after the amortisation of acquisition intangibles and

reorganisation costs relating to the AOL acquisition, was £124m (2007:

£68m), while statutory earnings per share rose 73% from 7.5p to 13.0p.

Cash generated from operations was up 83% to £468m (2007: £256m)

with year-end net debt of £843m (2007: £617m) affected by the

strengthening of the Euro and Swiss Franc in the latter part of

the year. The Board is proposing a final dividend of 3.00p, taking the

total for the year to 4.25p (2007: 3.25p). This represents a year-on-year

increase of 31% and underlines the Board’s confidence in the Group’s

continued growth.

Joint ventures

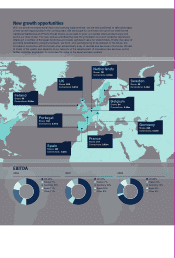

In May 2008 we announced that we had reached agreement with Best

Buy, our US partner, to form a new company to pursue growth opportunities

across Europe. As part of the agreement, we are contributing our retail and

related businesses into the new company. Best Buy will pay Carphone

Warehouse £1.1 billion for a 50% stake in the venture. We believe that

the combination of the two companies’ skills will allow us to accelerate

the development of our own retail proposition, as described above, and to

introduce Best Buy’s large format consumer electronics stores into Europe.

Both of these opportunities are significant and we are confident that they will

deliver material value to shareholders over the longer term. The proposed

transaction remains subject to shareholder approval and is expected to

complete by the end of June 2008.

A key reason for our enthusiasm for working with Best Buy in Europe is

the great early success we have enjoyed with them in the US, where we

have a share in the profits of its new mobile retail format, Best Buy Mobile.

We are in the middle of a very rapid roll-out across all of Best Buy’s US

stores, which is expected to be complete during calendar year 2008 – a

year ahead of our previous plans. Store conversions have been achieving

an extraordinary uplift in sales, and customers are responding

enthusiastically to our proposition.

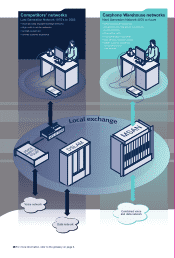

UK Fixed Line business

In our Fixed Line business, we expect to complete the integration of AOL

over the next six months. This will deliver additional cost efficiencies and

allow us to offer a fuller product suite to AOL customers on our network. In

addition, we have accelerated our Network Unification Project, which allows

us to scale up capacity into all our exchanges to address our customers’

growing demand for bandwidth. The project will deliver significant additional

capacity with little impact on fixed operating costs and gives us excellent

visibility of our network economics for the foreseeable future.

Outlook

A year ago I wrote here about our great disappointment over our failure

to deliver an adequate service to our broadband customers, and our

determination to get it right. We are only halfway there – but we would never

have got this far if it were not for the dedication, passion and aptitude of our

employees, whether in stores, contact centres, IT or management. These

are the same qualities that will enable us to be famous again for good

service, and re-invent our retail model with the changing times. On behalf

of the Board I extend my warmest thanks to all of our employees.

John Gildersleeve,

Chairman

Overall, the Group has made further substantial progress this year. In our

Distribution business, we have not only continued to grow our European

footprint, but have successfully identified and exploited new areas of

growth in mobile data, which have offset a slower handset market. Our

Fixed Line business has delivered on its promises, achieving a remarkable

uplift in margin through the migration of customers onto our own network.

Improving customer service

Importantly, we have also made significant investments in, and

improvements to, our broadband customer service, which let our customers

down last year. We still have much work to do to meet our aspiration of

differentiating ourselves positively through the service we offer, but we are

now firmly on the right track, as recent surveys have begun to indicate.

While people often think of customer service as the speed and accuracy

of response in our call centres, which has improved markedly, the customer

experience should also encompass the simplicity of the product, the ease

of set-up, and the quality of the connection in terms of both speed and

reliability. All of these elements continue to have our full attention.

Financial performance

Financial performance this year has been strong. Group revenue for

the period was £4,474m, a rise of 12% on last year’s figure of £3,992m.

Headline pre-tax profit was up 75% to £216m, reflecting the reversal of last

year’s steep losses incurred as we launched Free Broadband. The divisions’

financial performance reflected a reversal of last year’s trends. Distribution

EBIT was broadly flat at £175m, as good top line growth was offset

“We have successfully

identified and exploited new

areas of growth in mobile

data, which have offset a

slower handset market”

Chairman’s Statement

6 The Carphone Warehouse Group PLC Annual Report 2008

John Gildersleeve, Chairman

Source: Thomson Financial

This graph shows the value, by 29 March 2008, of £100 invested in The Carphone

Warehouse Group PLC on 29 March 2003 compared with the value of £100

invested in the FTSE 100 Index. Values are calculated on a rolling 3-month average

basis. The other points plotted are the values at intervening financial year ends.