Carphone Warehouse 2003 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2003 Carphone Warehouse annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Average ARPU on our UK customer base increased by

20% during the year, thus demonstrating our ability to

create meaningful value for the networks.

inadequate VAT documentation in one of our overseas

subsidiaries from trading in the period ending March 2000.

We believe that this could give rise to a liability of £2.4m

and have therefore provided for this amount within the

result of the Wholesale division.

The other activities included within Wholesale, our voucher

distribution business and the wholesale shipment of trade-in

handsets, continue as normal.

Telecoms Services

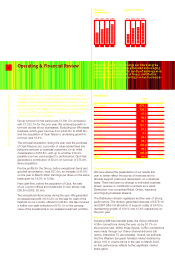

2003 2002

£m £m

Turnover 158.8 67.3

Mobile 82.7 67.3

Fixed 76.1 –

Contribution 26.0 13.9

Mobile 18.0 13.9

Fixed 8.0 –

Support costs (10.4) (6.7)

EBITDA 15.6 7.2

Depreciation (5.7) (3.2)

EBIT 9.9 4.0

Before amortisation of goodwill and exceptional items.

The Group’s Telecoms Services division is split into

two businesses, Mobile and Fixed. The Mobile business

encompasses our facilities management operations,

managing customers on behalf of networks, and our own

customers including our MVNO, Fresh. The Fixed business

comprises Opal Telecom’s core business fixed line service

and the new residential service, talktalk™. Turnover for the

division grew 135.7% year-on-year, and EBIT grew 150.3%,

both boosted by the acquisition of Opal in November 2002.

Mobile

The management of customers beyond the point of sale

is an important element of our strategy to align our interests

more closely with our network partners and generate more

value from our customers throughout their mobile lifetimes.

We continued to make progress in Mobile Telecoms

Services during the year. Turnover grew 22.8% to £82.7m,

and contribution grew by 29.7% to £18.0m. The key drivers

of this business are the customer bases we manage, the

ARPU on those bases, and the efficiency with which we

provide our management services.

Customer numbers in our FM operations increased 15.1%

to 994,000. This was achieved through the organic growth

of our Vodafone and O2customer bases in the UK, which

increased by 49.6% to 394,000. We continue to manage

600,000 customers on behalf of Orange and SFR in France.

Average ARPU on our UK customer base increased by

20% during the year, thus demonstrating our ability to

create meaningful value for the networks. Meanwhile we

continue to seek to improve our bad debt management

performance, and are exploring ways to make our call

centre operations more efficient.

We continue to pursue opportunities to manage customers

on behalf of third parties in the UK and France, while also

assessing potential means of developing a similar model

in some of our other major markets. Just after the year end

we were delighted to sign an agreement with Sainsbury’s to

provide mobile and fixed line services for the supermarket

chain’s 11 million UK customers.

Our own MVNO, Fresh, had a satisfactory year. To our

surprise, the networks demonstrated a renewed interest

in the pre-pay market, to the extent that pricing became

very competitive and our core Fresh product was a

relatively less attractive customer proposition. Nevertheless

our Fresh customer base grew from 92,000 to 120,000.

Our strategy for Fresh is to avoid heavily subsidising the

product, but rather to take advantage of profitable niche

opportunities in the market as and when they arise. A further

example of this strategy was the launch, just after the year

end, of a new Fresh contract product aimed at the first-time

subscription customer seeking a low monthly line rental.

Within our own customer base we have been managing a

number of service provision customers on behalf of SFR, a

base we acquired as part of the acquisition of CMC in May

2001. Just prior to the year end, this base was transferred

back to SFR as part of an arrangement made at the time

of the acquisition.

Fixed

We have been delighted with the progress made by

Opal since it became part of the Group in November 2002.

It has continued to generate the impressive rates of growth

it had demonstrated prior to acquisition, with significant

new business wins and growth in the number of minutes

switched through the Opal network.

7

The Carphone Warehouse Group PLC Annual Report 2003

9214 1,019 1,115

02 03 01 00

Mobile managed

base

(000s)

70 166 322

03 0201

Opal switched

minutes

(m)