Carphone Warehouse 2003 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2003 Carphone Warehouse annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Earnings per share (EPS)

Headline EPS, before amortisation of goodwill and

exceptional items, was 5.25p, compared with 4.41p in

the previous period. Basic EPS was 2.60p (2002: loss

per share of 3.39p).

Balance sheet, cash flow and dividend

At 29 March 2003, the Group had net cash and short term

investments of £29.1m, compared to £53.0m (including

£18.4m in respect of the Group’s London offices) at the end

of the previous period. During the year the Group generated

cash flow from operations of £77.7m (2002: £29.4m), and

total free cash flow (excluding the capital cost of new stores

and before acquisitions) of £50.8m (2002: £0.5m).

The Group is heavily focused on cash generation and

working capital management, as reflected in this strong

performance. As a result we are delighted to be proposing

our maiden dividend for the March 2003 year of 1.0p

per share, which will be satisfied wholly in cash. This

decision reflects confidence in our ability to generate

sufficient funds both to return cash to shareholders and

to continue to invest in the future growth of the Group.

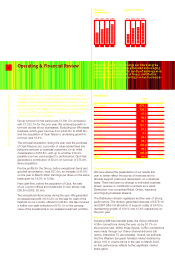

Net funds

2003 2002

£m £m

Operating cash inflows 77.7 29.4

Tax and interest (1.5) (9.1)

Capex (ex-new stores) (25.4) (19.8)

Free cash flow 50.8 0.5

New store capex (10.9) (18.5)

London offices 31.5 (7.0)

Acquisitions (62.1) (43.4)

Net cash inflow (outflow) 9.3 (68.4)

Opening net funds 34.6 102.9

Shares and foreign exchange (14.8) 0.1

Closing net funds 29.1 34.6

Financing and treasury

The Group’s operations are largely financed by retained

profits and equity. During the year, the Group’s existing

£150m revolving credit facility (expiring April 2003) was

replaced with a new committed facility of £180m maturing

in August 2005, of which £27.4m was utilised at the year

end (2002: £24.7m). The Group was in compliance with

the covenant conditions of the new facility at the year end.

Borrowings peaked during the year at £108m due to the

Opal acquisition and investment in working capital during

the peak Christmas trading period.

In addition to the revolving credit facility, the Group has

a number of uncommitted loan facilities, overdrafts and

guarantee lines which enable it to optimise cash management

efficiency, particularly at times of peak working capital

requirements. Surplus cash that cannot be utilised to offset

other Group debt, or which is ring-fenced for insurance

purposes, was £34.2m at the period end (2002: £29.4m).

Funding of our subsidiaries is arranged and monitored

centrally and on an arm’s length basis. Currency risk on

inter-company funding is hedged using foreign exchange

swaps or currency borrowings, as appropriate, at all times.

Other than inter-company loans, balance sheet translational

risk is not hedged against adverse movements in exchange

rates and the results of any such movements are taken to

reserves. The Group is exposed to limited cross-border

transactional commitments and where significant, these

are hedged at inception using forward currency contracts.

The Group does not trade or speculate in any

financial instruments.

Shareholders’ funds and return on shareholders’ funds

Total shareholders’ funds at March 2003 were £459.5m

(2002: £407.3m).

Post-tax earnings before amortisation and exceptional

items generated a return on average shareholders’ funds,

excluding goodwill on minority interests acquired in

the period to March 2001, of 15.8% (2002: 14.1%).

Roger Taylor, Chief Financial Officer

9

The Carphone Warehouse Group PLC Annual Report 2003