Carphone Warehouse 2003 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2003 Carphone Warehouse annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

We launched talktalk™, our residential fixed line

service, within three months of the acquisition of Opal.

We are very excited about the market opportunity for

talktalk™and intend to pursue it vigorously.

growing business in its own right, offering low fixed line

calling costs and value-added services to its SME customer

base. It is able to offer highly competitive prices thanks to

the efficient way in which its network has been developed.

By owning switches and building its own interconnects into

the BT network, but leasing its trunk fibre, the network has

relatively low capital and operating expenditure requirements.

At the same time a software layer has been integrated into

the network, allowing Opal to provide a number of bespoke

services to its customers on a variable cost basis.

Successful launch of talktalk™

In addition to a valuable core business, we identified two

attractive opportunities for additional growth through the

acquisition of Opal: the launch of a residential fixed line

service to compete with BT and other providers; and a

corporate mobile offering combining The Carphone

Warehouse’s mobile expertise and retail asset with the

corporate customer base and focus of Opal.

We launched our residential fixed line service, talktalk™,

in February 2003, and the initial response has been very

encouraging. By our year end we had attracted over 32,000

applications. Providing this service is a natural extension

of our existing proposition, offering value and a high quality

service in personal communications, and in particular

demystifying the confusion of tariffs available in the market

by offering a £500 guarantee to be cheaper than BT.

We are very excited about the market opportunity for

talktalk™. Recent changes in the regulatory environment

make it much easier to switch from BT to an alternative

provider and we intend to pursue this opportunity vigorously.

The efficiency of the Opal network allows us to be highly

competitive while still generating attractive margins. Our

cost of customer acquisition is low given our existing retail

presence, and the residential business also incurs very

little marginal capital expenditure: the Opal network is busy

during weekdays serving business traffic, but idle in the

evenings and at weekends when the majority of residential

calls are made.

Outlook

We are encouraged by the outlook for the coming year. We

expect to see retail capacity continue to contract throughout

Europe, with the networks developing a more segmented

approach to their distribution channels. Our continuing ability

to deliver high volumes of high quality customers means that

we are benefiting from better commercial terms than many

of our competitors, allowing us to price competitively while

maintaining our margins.

Additionally the launch of MVNOs and new 3G networks

is increasing the competitive tension between our suppliers.

We are now seeing a concerted effort by both the incumbent

and new networks to drive the adoption of valuable data

services. This year we expect to see picture messaging

services pick up in earnest now that network interoperability

is in place. We also anticipate a growing interest in the

mobile gaming market and an ongoing convergence of

mobile phone and PDA products as mobile e-mail becomes

an increasingly important application.

These developments are likely to be supported by an

impressive new product pipeline. We continue to see high

levels of innovation from all of our handset suppliers and the

desire to own the latest handset continues to be the major

driver of replacement demand. The manufacturers, too, are

becoming more adept at segmenting their market and we

expect to see a widening range of handsets targeting more

specific subsectors of the market.

Our continued success is thanks to the dedication and

expertise of all our employees. We will continue to invest

in recruitment, training and development to strengthen and

extend our customer service proposition. Our business

is also indebted to our strong management team and our

supportive investors, suppliers and business partners.

I would like to take this opportunity to thank Des Wilson

for his strong contribution to the Board over the last three

years, and welcome Martin Dawes with his many years

of experience in the mobile industry that should prove

invaluable to the Group as it evolves. Over the next year, we

intend to build on our position as the leading independent

retailer of mobile phones and services in Europe and deliver

further profitable growth through our existing business and

new opportunities.

Charles Dunstone, Chief Executive Officer

3

The Carphone Warehouse Group PLC Annual Report 2003

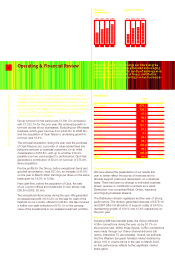

20.3 38.4 57.7 77.1

02 030100

Contribution from

recurring revenues

(£m)

27.5 33.7 44.7 49.7

02 030100

Contribution from

recurring revenues

(%)