Carphone Warehouse 2003 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2003 Carphone Warehouse annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Our retail operations outside the UK have clearly

benefited from the restructuring exercise we undertook

in 2002. The adoption of group-wide best practices

for back office processes and retail proposition has

delivered a strong pick-up in our business across much

of continental Europe.

Connections (000s)

2003 2002

Subscription 1,909 1,767

Pre-pay 1,972 1,613

SIM-free 483 235

Total 4,364 3,615

of which Online 261 200

We continued to achieve good growth in new subscription

connections, which are the lifeblood of our recurring

revenue businesses. Total subscription connections grew

by 8.1% to 1.91m. Although the first half was relatively slow

for subscription growth, this accelerated in the second half

and growth in the fourth quarter was 17.9%.

In the first half of the year the networks showed a renewed

appetite for pre-pay customers and some subsidy returned to

that segment of the market. As a result, pre-pay connection

growth was very strong at 22.3%, although this was flattered

to some extent by a very weak comparative period.

The first full year of our SIM-free offer, where we sell

a handset without a network connection, was highly

successful, with 0.48m handsets sold without a SIM card,

more than double the figure in 2002. As a result of these

relative growth rates our subscription mix deteriorated from

48.9% to 43.7% but this was offset by the overall higher

level of connections growth than we had anticipated.

We continued to expand and upgrade our store portfolio

during the year. By March 2003 we were trading out of

1,140 stores (2002: 1,104 stores), having opened 90 stores

and closed 54 underperforming stores during the year. Total

average selling space increased by 4.0% from 60,800 sqm

to 63,233 sqm.

Total retail revenues grew by 18.5%. Like-for-like, revenues

grew by 11.6% and gross profit by 4.8%. This was achieved

through a significant improvement in average connections per

store from 3,219 to 3,688, and a strong performance on high

value accessories such as Bluetooth headsets and camera

attachments. Average revenue per connection fell by 4.2%

and average gross profit per connection fell by 11.9%, both

held back by the shift in the business mix towards pre-pay

connections and SIM-free sales.

Retail gross profit increased by 10.9% to £234.5m but the

gross margin deteriorated by 210 basis points to 31.8%.

This was mainly as a result of the change in terms of trade

with certain networks near the start of the year, whereby we

exchanged an element of upfront commission for a greater

share of ongoing ARPU. This is reflected in the strong

performance of Ongoing revenue described below.

Contribution from the retail business grew by 11.7% to

£67.2m, with contribution margin decreasing from 9.7% to

9.1%. The leverage to fixed costs, achieved by higher sales

volumes, was offset by the lower gross margin and a higher

cost of customer handset repairs than in previous years.

In the UK, our store portfolio increased from 461 stores

to 475 stores. Within this net movement, we opened 42

stores and closed 28, through a series of site upgrades

and relocations. In the summer we opened Europe’s largest

mobile phone store in London’s Oxford Street and at

Christmas a further major store in the centre of Leeds.

We expect to open a few additional ‘experience’ stores in

major city centres in the coming year. The bulk of our new

openings in the UK will be in retail parks, where we have

been very pleased with the level of store profitability and

the rate of payback on investment.

Our retail operations outside the UK have clearly benefited

this year from the restructuring exercise we undertook in

2002. The adoption of group-wide best practices for back

office processes and retail proposition has delivered a

strong pick-up in our business across much of continental

Europe, aided latterly by a recovering market. We have

continued to build on the good work started in the previous

year, particularly in the area of shared service processing.

Our business in France continued to perform well despite

a weak market. We opened 15 new stores and 5 franchise

outlets, and closed 2 stores, taking the total in France to

169, and we expect to accelerate the opening programme

in the new year both through directly operated stores and

franchise outlets. We remain under-represented in the

French market relative to its population and market size

and we believe there is a significant opportunity to gain

market share.

In Spain, we achieved very strong growth supported by

a recovering market and the aggressive pursuit of market

share by our network partners. Spain is a key growth

market for the Group and will be the focus of a significant

store opening programme in the coming year.

5

The Carphone Warehouse Group PLC Annual Report 2003

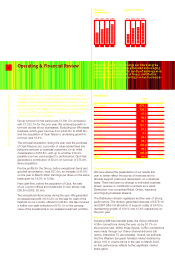

54,200 60,800 63,233

030201

Average

selling space

(sqm)

11,350 10,200 11,676

030201

Sales per

square metre

(£)