Carnival Cruises 2010 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2010 Carnival Cruises annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

On the cost side, we will further enhance the product and service offerings to our guests while taking advantage of economies of scale in our back

office functions and procurement activities and have cited many opportunities we can mine over the coming years. Our focus on cost containment

initiatives continues, both within brands and across brands, to maintain the lowest unit costs in the industry.

While building new and innovative ships to strengthen the leadership position of our brands remains an integral part of our strategy, our current

intention is to have an average of two to three new cruise ships entering service annually in 2012 and beyond, which is less than the five ships per

year we averaged in the last decade. We believe the cruise vacation market continues to have growth potential because of its low penetration

levels and other favorable characteristics. In North America, just over 3 percent of the population cruises each year and less than 20 percent of the

population has ever cruised. The penetration levels in Europe and the rest of the world are lower and, in some cases, are just a fraction of these

levels. As we have now established critical mass in both North America and Europe, we will continue to grow our cruise brands but at a more

measured pace. Based on our current ship orders, the capacity of our North American brands will grow 3 percent, compounded annually through

2013, which we expect to be in line with the growth rate for the leisure travel market in general. Given the lower relative penetration levels and

higher projected return on investment, we continue to focus our growth toward our European brands which will grow capacity by 7 percent

compounded annually through 2013.

The significant amount of capital required to build a new cruise ship and the complexities surrounding their operation, lead us to expect long-term

cruise industry supply growth to slow, while demand accelerates as global economies recover and emerging markets develop. We believe this

favorable supply-demand balance will have a positive impact on our ability to profitably grow our business.

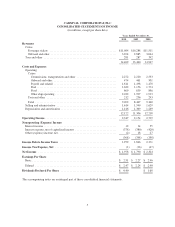

Although we remain the most profitable leisure travel company, we believe we are only achieving a portion of our true earnings potential. In 2011

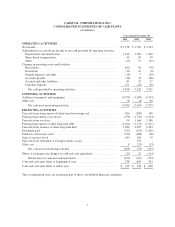

to date, we are well on our way to another significant increase in earnings. Based on our current 2011 guidance, our cash from operations should

exceed $4 billion, and our capital investments will drop to $2.6 billion resulting in significant free cash flow. In January 2011, we more than

doubled the quarterly dividend from $0.10 to $0.25 per share, just one year after its reinstatement, a testament to our confidence in the future of

our business and the resilience of our global cruise brands. In 2012 and beyond, based on our more measured pace of growth, we expect to

continue to generate significant free cash flow which should provide us additional opportunities to increase the amount of cash we return to

shareholders.

SUSTAINABILITY

Today, our reputation and business viability are contingent on being transparent and sustainable. This means providing satisfying vacations while

keeping our guests safe, developing our workforce, and strengthening our stakeholder relationships.

We publish Sustainability Reports which demonstrate our commitment to maintaining clean oceans and air, as well as, the pristine destinations we

visit. These reports enable us to benchmark our performance and identify opportunities for future improvements. One of those opportunities is

addressing climate change. As a result, we have established a corporate target to reduce the intensity of our 2015 shipboard carbon dioxide

emissions by 20 percent from our 2005 baseline. We are also proud that socially responsible agencies have acknowledged our efforts by including

us in the following indices: Carbon Disclosure Leadership, Maplecroft Climate Innovation, and FTSE4Good.

THANKS AND RECOGNITION

I would like to welcome Admiral Sir Jonathon Band, recently retired First Sea Lord and Chief of Naval Staff for the British Navy, as the newest

member of Carnival Corporation & plc’s board of directors. Admiral Band is an excellent addition to our board, possessing extensive maritime

experience from his distinguished career that spanned more than four decades.

I would like to thank Richard Capen, who retired from the Carnival Corporation & plc board after his 16-year tenure. He was a valued member of

our board and we benefitted from his many years of dedicated service to our company.

I would also like to thank our shareholders for their continued support, as well as our talented management teams and board of directors for their

guidance and leadership over the past year. In addition, I would like to acknowledge the tremendous efforts of our almost 90,000 employees, both

in our corporate offices worldwide and aboard our ships, who continue to provide our guests with high quality, memorable vacation experiences.

Finally, we would like to acknowledge the more than nine million guests who chose to spend their vacations aboard a Carnival Corporation & plc

ship this past year. Our success would not be possible without your support and we look forward to welcoming you aboard again soon.

Sincerely,

Micky Arison

Chairman and CEO

3