Carnival Cruises 2010 Annual Report Download

Download and view the complete annual report

Please find the complete 2010 Carnival Cruises annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2010 ANNUAL REPORT

Table of contents

-

Page 1

2010 ANNUAL REPORT -

Page 2

... with 10 new ships scheduled to be delivered between March 2011 and May 2014. Carnival Corporation & plc also operates Holland America Princess Alaska Tours, the leading tour company in Alaska and the Canadian Yukon. Traded on both the New York and London Stock Exchanges, Carnival Corporation & plc... -

Page 3

... United Kingdom and Continental Europe and are now focused on development in South America, Australia and Asia. In just two years, we have grown our guests sourced from new and emerging cruise markets by 50 percent, and these new markets represent over 12 percent of our passenger base. A NEW DECADE... -

Page 4

...three new cruise ships entering service annually in 2012 and beyond, which is less than the five ships per year we averaged in the last decade. We believe the cruise vacation market continues to have growth potential because of its low penetration levels and other favorable characteristics. In North... -

Page 5

... nominee statement) to your travel agent or to the cruise line you have selected. NORTH AMERICA BRANDS CARNIVAL CRUISE LINES Guest Administration 3655 N.W. 87th Avenue Miami, FL 33178 Tel 800 438 6744 ext. 70450 Fax 305 406 6477 Email: [email protected] PRINCESS CRUISES* Booking Support 24844... -

Page 6

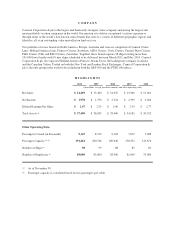

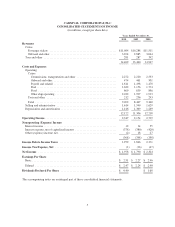

... OF INCOME (in millions, except per share data) Years Ended November 30, 2010 2009 2008 Revenues Cruise Passenger tickets ...Onboard and other ...Tour and other ...Costs and Expenses Operating Cruise Commissions, transportation and other ...Onboard and other ...Payroll and related ...Fuel ...Food... -

Page 7

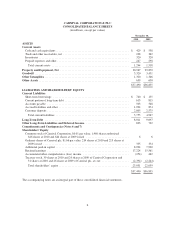

...Customer deposits ...Total current liabilities ...Long-Term Debt ...Other Long-Term Liabilities and Deferred Income ...Commitments and Contingencies (Notes 6 and 7) Shareholders' Equity Common stock of Carnival Corporation, $0.01 par value; 1,960 shares authorized; 646 shares at 2010 and 644 shares... -

Page 8

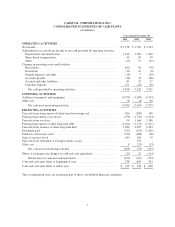

CARNIVAL CORPORATION & PLC CONSOLIDATED STATEMENTS OF CASH FLOWS (in millions) Years Ended November 30, 2010 2009 2008 OPERATING ACTIVITIES Net income ...Adjustments to reconcile net income to net cash provided by operating activities Depreciation and amortization ...Share-based compensation ...... -

Page 9

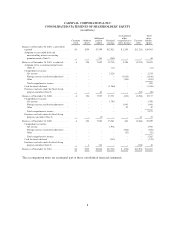

CARNIVAL CORPORATION & PLC CONSOLIDATED STATEMENTS OF SHAREHOLDERS' EQUITY (in millions) Additional paid-in capital $7,599 Accumulated other comprehensive (loss) income $ 1,296 Total shareholders' equity $19,963 Common stock Balances at November 30, 2007, as previously reported ...Adoption of ... -

Page 10

... capacity, the number of cruise ships we operate and the primary areas or countries in which they are marketed are as follows: Cruise Brands North America Carnival Cruise Lines ...Princess Cruises ("Princess") ...Holland America Line ...Seabourn ...North America Cruise Brands ...Europe, Australia... -

Page 11

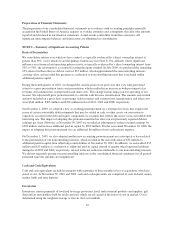

.... Inventories Inventories consist primarily of food and beverage provisions, hotel and restaurant products and supplies, gift shop and art merchandise held for resale and fuel, which are all carried at the lower of cost or market. Cost is determined using the weighted-average or first-in, first-out... -

Page 12

...original cost, as follows: Years Residual Values Ships ...30 Ship improvements ...3-28 Buildings and improvements ...5-35 Computer hardware and software ...3-7 Transportation equipment and other ...2-20 Leasehold improvements, including port facilities ...Shorter of lease term or related asset life... -

Page 13

...is not material. Future travel discount vouchers issued to guests are recorded as a reduction of cruise passenger ticket revenues when such vouchers are utilized. Cancellation fees are recognized in cruise passenger ticket revenues at the time of the cancellation. Our sale to guests of air and other... -

Page 14

...as P&O Princess Cruises plc) completed a DLC transaction, which implemented Carnival Corporation & plc's DLC structure. The contracts governing the DLC structure provide that Carnival Corporation and Carnival plc each continue to have separate boards of directors, but the boards and senior executive... -

Page 15

... are required to be used to pay the obligations of the other company, if necessary. Given the DLC structure as described above, we believe that providing separate financial statements for each of Carnival Corporation and Carnival plc would not present a true and fair view of the economic realities... -

Page 16

..., $37 million and $52 million in fiscal 2010, 2009 and 2008, respectively. Ships under construction include progress payments for the construction of new ships, as well as design and engineering fees, capitalized interest, construction oversight costs and various owner supplied items. At November 30... -

Page 17

... at 4.3%, due in 2013 ...Sterling fixed rate notes, bearing interest at 5.6%, due in 2012 ...Publicly-Traded Convertible Notes Notes, bearing interest at 2%, repaid in 2010 ...Notes, bearing interest at 1.75%, net of discount, due in 2013 ...Other ...Total Unsecured Long-term Debt ...UNSECURED SHORT... -

Page 18

... dates through 2014. (e) In 2010, we borrowed $445 million under an unsecured floating rate export credit facility, the proceeds of which were used to pay for a portion of Queen Elizabeth's purchase price. This facility bears interest at LIBOR plus 160 basis points ("bps") and is due in semi-annual... -

Page 19

... to cancel each one until 60 days prior to the underlying ship's delivery date. At January 31, 2011, our committed ship financings are as follows: Month/Year Committed Fiscal Year Scheduled for Funding Cruise Brands and Ships North America Brands Carnival Cruise Lines Carnival Magic ...Carnival... -

Page 20

... At November 30, 2010, we had 10 ships under contract for construction with an aggregate passenger capacity of 27,500. The estimated total cost of these ships is approximately $6.1 billion, which includes the contract price with the shipyard, design and engineering fees, capitalized interest... -

Page 21

... fiscal 2010, AIDA and Costa recognized a $30 million income tax benefit from an Italian investment incentive related to certain of their newbuild expenditures. Carnival Cruise Lines, Princess, Holland America Line and Seabourn are primarily subject to the income tax laws of Panama, Bermuda, Curacao... -

Page 22

... our financial position. NOTE 9 - Shareholders' Equity Carnival Corporation's Articles of Incorporation authorize its Board of Directors, at its discretion, to issue up to 40 million shares of preferred stock. At November 30, 2010 and 2009, no Carnival Corporation preferred stock had been issued and... -

Page 23

... program. At November 30, 2010, there were 38.9 million shares of Carnival Corporation common stock reserved for issuance substantially all pursuant to its employee benefit and dividend reinvestment plans. In addition, Carnival plc shareholders have authorized 18.6 million ordinary shares for future... -

Page 24

... the fair value of our publicly-traded convertible notes and their carrying value was primarily due to the impact of changes in the Carnival Corporation common stock price underlying the value of these convertible notes. The fair values were based on quoted market prices in active markets. Financial... -

Page 25

...yields, net cruise costs including fuel prices, capacity changes, including the expected deployment of vessels into, or out of, the cruise brand, weighted-average cost of capital for comparable publicly-traded companies, adjusted for the risk attributable to the cruise brand including the geographic... -

Page 26

.... We estimated fair values based upon a discounted future cash flow analysis, which estimated the amount of royalties that we are relieved from having to pay for use of the associated trademarks, based upon forecasted cruise revenues and royalty rates that a market participant would forecast. The... -

Page 27

... values reported for cruise revenues and cruise expenses in our accompanying Consolidated Statements of Income. Weakening of the U.S. dollar has the opposite effect. Most of our brands have non-functional currency risk related to their international sales operations, which has become an increasingly... -

Page 28

... several years, the U.S. dollar and sterling cost to order new cruise ships has been volatile. If the U.S. dollar or sterling declines against the euro, this may affect our desire to order future new cruise ships for U.S. dollar or sterling functional currency brands. Interest Rate Risks We manage... -

Page 29

... this new cruise segment presentation. There were no changes made to our Tour and Other segment. Our North America cruise segment includes Carnival Cruise Lines, Holland America Line, Princess and Seabourn. Our EAA cruise segment includes AIDA, Costa, Cunard, Ibero, P&O Cruises (UK) and P&O Cruises... -

Page 30

... with a land tour package by Holland America Princess Alaska Tours, and shore excursion and port hospitality services provided to cruise guests by this tour company. These intersegment revenues, which are included in full in the cruise brand segments, are eliminated directly against the Tour and... -

Page 31

... of Income as selling and administrative expenses and $3 million, $4 million and $6 million as cruise payroll and related expenses in fiscal 2010, 2009 and 2008, respectively. Stock Option Plans The Committee generally set stock option exercise prices at 100% or more of the fair market value of... -

Page 32

... quoted market price of the Carnival Corporation or Carnival plc shares on the date of grant, and is amortized to expense using the straight-line method from the grant date through the earlier of the vesting date or the estimated retirement eligibility date. During the year ended November 30, 2010... -

Page 33

...plans' benefit obligations at November 30, 2010 and 2009, we assumed weighted-average discount rates of 5.0% and 5.4%, respectively. The net asset or net liability positions under these single-employer defined benefit pension plans are not material. In addition, P&O Cruises (UK), Princess and Cunard... -

Page 34

...per share data): Years Ended November 30, 2010 2009 2008 Net income ...Interest on dilutive convertible notes ...Net income for diluted earnings per share ...Weighted-average common and ordinary shares outstanding ...Dilutive effect of convertible notes ...Dilutive effect of equity plans ...Diluted... -

Page 35

... public accounting firm that audited our consolidated financial statements, has also audited the effectiveness of our internal control over financial reporting as of November 30, 2010 as stated in their report, which is included in this 2010 Annual Report. Micky Arison Chairman of the Board... -

Page 36

... of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements are free of material misstatement and whether effective internal control over financial reporting was... -

Page 37

... and tax costs, fuel expenses, costs per available lower berth day ("ALBDs"), estimates of ship depreciable lives and residual values, liquidity, goodwill and trademark fair values and outlook. These factors include, but are not limited to, the following general economic and business conditions... -

Page 38

...ships, which increased our passenger capacity 7.1%. We had a 14.0% increase in our Europe, Australia & Asia ("EAA") cruise segment passenger capacity, while our North America cruise segment passenger capacity grew by 3.4%. Our net income increased $188 million in 2010 compared to 2009. This increase... -

Page 39

...-term vacation market conditions, competition and historical useful lives of similarly-built ships. We have estimated our ships' weighted-average useful lives at 30 years and their average residual values at 15% of our original ship cost. Given the size and complexity of our ships, ship accounting... -

Page 40

... future operating results, including net revenue yields, net cruise costs including fuel prices, capacity changes, including the expected deployment of vessels into, or out of, the cruise brand, weighted-average cost of capital for comparable publicly-traded companies, terminal values, cruise... -

Page 41

...many onboard activities, and sales of goods and services primarily onboard our ships not included in the cruise ticket price including, among other things, bar and some beverage sales, shore excursions, casino gaming, gift shop sales, photo sales, spa services, internet and phone services and cruise... -

Page 42

... capacity increase in ALBDs, which accounted for $206 million. Onboard and other revenues included concession revenues of $958 million in 2010 and $881 million in 2009. North America Brands Approximately 75% of 2010 total revenues are comprised of cruise passenger ticket revenues. Cruise passenger... -

Page 43

... offset by the benefits from cost reduction programs and economies of scale and lower air transportation costs due to fewer guests purchasing air travel through us. Selling and administrative expenses of $902 million were flat in 2010 compared to 2009 despite our 3.4% capacity increase in ALBDs. The... -

Page 44

... travel agent commissions, cost of air and other transportation, certain other costs that are directly associated with onboard and other revenues and credit card fees. Substantially all of our remaining cruise costs are largely fixed, except for the impact of changing prices, once our ship capacity... -

Page 45

... are no specific rules for determining our non-GAAP current and constant dollar financial measures and, accordingly, it is possible that they may not be exactly comparable to the like-kind information presented by other cruise companies, which is a potential risk associated with using these measures... -

Page 46

..., 2010 2009 Constant Constant Dollar 2009 Dollar 2010 2008 Cruise operating expenses ...Cruise selling and administrative expenses ...Gross cruise costs ...Less cruise costs included in net cruise revenues Commissions, transportation and other ...Onboard and other ...Net cruise costs ...Less fuel... -

Page 47

... the sale of P&O Cruises (UK)'s Artemis and Cunard's litigation settlement decreased 2.2% in 2010 compared to 2009. Fuel costs increased $466 million, or 40.3%, to $1.6 billion in 2010 from $1.2 billion in 2009. This was driven by higher fuel prices, which accounted for $417 million, a 7.1% capacity... -

Page 48

... dollar, decreased commissions as a result of our lower ticket revenues and lower fuel consumption, resulting from fuel saving initiatives. This decrease was partially offset by our 5.4% capacity increase in ALBDs, which accounted for $485 million. Selling and administrative expenses decreased... -

Page 49

... dollar, decreased commissions as a result of our lower ticket revenues and lower fuel consumption, resulting from fuel saving initiatives. This decrease was partially offset by our 8.2% capacity increase in ALBDs, which accounted for $288 million. Selling and administrative expenses decreased... -

Page 50

... as well as the reduction in travel agent commissions as a result of lower cruise ticket prices. Liquidity, Financial Condition and Capital Resources Maintenance of a strong balance sheet, which enhances our financial flexibility and allows us to return free cash flow to shareholders, is the primary... -

Page 51

... 30, 2010 deficit included $2.8 billion of customer deposits, which represent the passenger revenues we collect in advance of sailing dates and, accordingly, are substantially more like deferred revenue transactions rather than actual current cash liabilities. We use our long-term ship assets to... -

Page 52

Future Commitments and Funding Sources At November 30, 2010, our contractual cash obligations were as follows (in millions): Payments Due by Fiscal 2011 2012 2013 2014 2015 ThereAfter Total Recorded Contractual Cash Obligations Short-term borrowings (a) ...Long-term debt (a) ...Other long-term ... -

Page 53

... are trading at a price that is at a premium or discount to the price of Carnival plc ordinary shares or Carnival Corporation common stock, as the case may be. This economic benefit is used for general corporate purposes, which could include repurchasing treasury stock under the Repurchase Program... -

Page 54

... in May 2013 and May 2014. We have not entered into any foreign currency contracts to hedge these ships' currency risk. Therefore, the cost of each of these ships will increase or decrease based upon changes in the exchange rate until the payments are made under the shipbuilding contract or we... -

Page 55

...mitigate our exposure in the event of a significant decrease in market interest rates. Fuel Price Risks We do not use financial instruments to hedge our exposure to fuel price market risk. We estimate that our fiscal 2011 fuel expense would change by approximately $3.5 million for each $1 per metric... -

Page 56

... consolidated financial statements and the related notes. 2010 Years Ended November 30, 2009 2008 2007 2006 (dollars in millions, except per share, per ton and currency data) Statements of Income and Cash Flow Data Revenues ...Operating income ...Net income ...Earnings per share Basic ...Diluted... -

Page 57

... this 2010 accounting pronouncement. (c) Total shareholders' equity was increased by $4 million, $39 million, $54 million and $2 million at November 30, 2009, 2008, 2007 and 2006, respectively, as a result of our adoption of a new accounting standard, which required us to include our noncontrolling... -

Page 58

... on a number of factors, including our earnings, liquidity position, financial condition, tone of business, capital requirements, credit ratings, availability and cost of obtaining new debt and future debt and equity market conditions. We cannot be certain that Carnival Corporation and Carnival plc... -

Page 59

... Carnival Corporation dividends are reinvested on an annual basis, multiplied by the market price of the shares at the end of each fiscal year. 5-YEAR CUMULATIVE TOTAL RETURNS $175 $150 $125 DOLLARS $100 $75 $50 $25 2005 2006 2007 2008 2009 2010 Carnival Corporation Common Stock FTSE 100... -

Page 60

... the indexes noted below. The Price Performance is calculated in a similar manner as previously discussed. 5-YEAR CUMULATIVE TOTAL RETURNS $175 $150 $125 DOLLARS $100 $75 $50 $25 2005 2006 2007 2008 2009 2010 Carnival plc ADS FTSE 100 Index Dow Jones Travel & Leisure Index S&P 500 Index... -

Page 61

... also increases due to ships being taken out of service for maintenance, which we schedule during non-peak demand periods. In addition, substantially all of Holland America Princess Alaska Tours' revenue and net income is generated from May through September in conjunction with the Alaska cruise... -

Page 62

... Emeritus, Holland America Line Inc. Meshulam Zonis (1933-2009) Director Emeritus, Carnival Corporation Horst Rahe Life President of AIDA Cruises The Lord Sterling of Plaistow GCVO, CBE Life President of P&O Cruises OTHER INFORMATION Corporate Headquarters Carnival Corporation Carnival Place 3655... -

Page 63

Carnival Place 3665 N.W. 87th Avenue Miami Florida 33178-2428 U.S.A www.carnivalcorp.com Carnival House 5 Gainsford Street London SE1 2NE UK www.carnivalplc.com