Boeing 2010 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2010 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

1

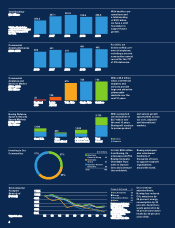

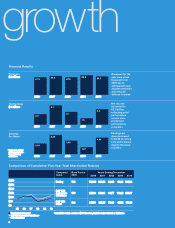

2010 2009 2008 2007 2006

Revenues 64,306 68,281 60,909 66,387 61,530

Net earnings 3,307 1,312 2,672 4,074 2,215

Earnings per share* 4.46 1.87 3.65 5.26 2.84

Operating margins 7.7% 3.1% 6.5% 8.8% 4.9%

Contractual backlog 303,955 296,500 323,860 296,964 216,563

Total backlog† 320,826 315,558 351,926 327,137 250,211

2010 Financial Highlights

U.S. dollars in millions except per share data

* Represents diluted earnings per share from continuing operations.

†Total backlog includes contractual and unobligated backlog. See page 21 of the 10-K.

QEarned net income of $3.3 billion,

or $4.46 per share, compared with

$1.3 billion, or $1.87 per share, in 2009.

QDelivered revenues of $64.3 billion,

compared with $68.3 billion in 2009.

QCaptured $69 billion of new orders

during the year and grew our backlog

to $321 billion—five times current annual

revenues.

QContinued to provide strong liquidity

with operating cash flow of $3.0 billion,

and cash and marketable securities of

$10.5 billion.

QDelivered 462 commercial airplanes,

including record 737 deliveries for the

second year in a row, and won 530 net

orders, increasing Boeing Commercial

Airplanes contractual backlog to 3,443

airplanes valued at $256 billion.

QDelivered 115 production military

aircraft, two launch vehicles and four

satellites, and increased backlog at

Defense, Space & Security to $65 billion,

more than twice the business unit’s

2010 revenue.

QExtended core Defense, Space &

Security programs, including contract

awards for 124 F/A-18E/F Super Hornet

and EA-18G Growler aircraft for the

U.S. Navy; low-rate initial production

of up to 51 AH-64D Apache Block III

helicopters for the U.S. Army; and six

new commercial satellite orders.

QExceeded 2,500 hours and completed

75 percent of flight testing required for

delivery of the 787 Dreamliner.

QSurpassed more than 1,700 hours of

flight testing for the 747-8 Freighter, and

completed final assembly and “power on”

of the first two 747-8 Intercontinental

passenger airplanes.

QDelivered the 900th 777 and started

assembly of the 1,000th 767.

QAchieved key Defense, Space &

Security milestones, including delivery of

the first P-8A Poseidon for flight testing;

unveiling of two unmanned aircraft—

the fighter-sized Phantom Ray and the

hydrogen-powered Phantom Eye—in

preparation for flight testing in 2011; first

flight of the UK Mk4 Chinook rotorcraft; and

winning the coveted Collier Award for the

International Space Station.

QAdvanced our environmental leader-

ship by testing biofuels on commercial and

military aircraft; creating sustainable

aviation biofuels research projects around

the globe; demonstrating next-generation

energy smart grid technologies; improving

the global air traffic control system; and

continuing to reduce the environmental

footprint of Boeing operations.

Operational Summary

Strong operating

performance and

exceptional cash

generation from our

core businesses

in 2010 helped

mitigate the impact

of development

program challenges.

strength

h