Blackberry 1999 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 1999 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

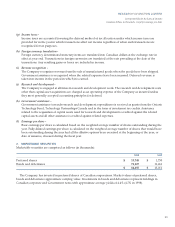

(a) Income taxes -

For Canadian GAAP purposes the Company uses the deferral method of accounting for income taxes such

that deferred assets or liabilities arise from differences between financial statement income and taxable income.

These deferred income tax assets and/or liabilities are recorded using the income tax rate in effect at the time

and are not affected by subsequent changes in income tax rates. A deferred income tax asset may be

recognized when there is “virtual certainty” that these benefits would be realized. Under U.S. GAAP, deferred

tax assets and liabilities arise from differences between the financial statement carrying amounts of existing

assets and liabilities and their respective tax basis, and are adjusted to reflect expected tax rates. Under U.S.

GAAP, deferred income tax assets are recorded net of a valuation allowance to the extent that it is “more likely

than not” that some or all of the deferred tax asset will not be recovered.

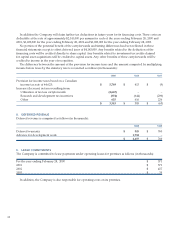

The Company has determined that under U.S. GAAP a deferred tax asset of $3,000,000 net of valuation

allowance of $4,500,000 could be recognized for the year ended February 28, 1999. (1998 - $700,000, net of a

valuation allowance of $6,200,000, 1997 - nil net of a valuation allowance of $1,940,000). Of the total asset,

$2,500,000 ($700,000 for 1998) is associated with financing costs which have been deducted from the proceeds

of the Company’s issue of common stock during fiscal 1998 and 1999. The remaining $500,000 is associated

with the utilization of tax losses and other carryforward balances.

(b) Statements of comprehensive income -

Under U.S. GAAP, SFAS 130, Reporting Comprehensive Income establishes standards for the reporting and display

of comprehensive income and its components in general-purpose financial statements. Comprehensive income

is defined as the change in net assets of a business enterprise during a period from transactions and other

events and circumstances from non-owner sources, and includes all changes in equity during a period except

those resulting from investments by owners and distributions to owners. The Company does not have any

reportable items of comprehensive income other than its net income.

(c) Accounting for stock compensation -

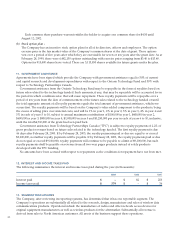

Under U.S. GAAP, for any stock option with an exercise price that is less than the market price on the date

of grant, the difference between the exercise price and the market price on the date of grant is recorded as

compensation expense (“intrinsic value based method”). The Company grants stock options at the fair market

value of the shares on the day preceding the date of the grant of the options. Consequently, no compensation

expense is recognized. This method is consistent with U.S. GAAP, APB Opinion 25, Accounting for Stock Issued

to Employees

32