Blackberry 1999 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 1999 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

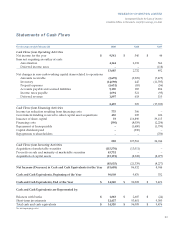

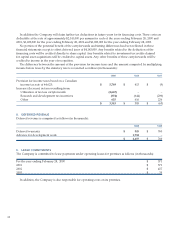

LIQUIDITY AND CAPITAL RESOURCES

The Company’s operating cash flow continued to exhibit improvement in fiscal 1999. Operations generated cash

of $2.5 million, up from $0.3 million a year earlier, despite the fact that non-cash working capital items used

$11.2 million from cash reserves versus $2.4 million in fiscal 1998. This was primarily due to increased working

capital needs, such as inventory procurement, required to support RIM’s aggressive revenue expansion. As well,

prepaid expenses increased by $5.6 million to $5.9 million as RIM prepaid BellSouth and Cantel for blocks of network

usage for the BlackBerry service.

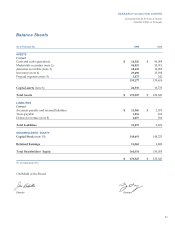

As in the prior year, RIM ended the year with a strong balance sheet. Cash and marketable securities totalled

$99 million, or approximately $1.54 per share, and represented more than half of total assets of $176 million.

YEAR 2000 COMPLIANCE

The Company has completed a review of systems, suppliers, processes and procedures to assess its vulnerability to

Year 2000 issues. All mission-critical systems, such as the Company’s manufacturing equipment, financial systems,

email systems, telephone and voice mail systems and all corporate file servers have been assessed and all related

remedial actions and testing are targeted for completion by mid-1999. The Company expects to complete its review,

remediation and testing of other Year 2000 systems by this time as well. An assessment of the readiness of third

parties, such as customers, suppliers and others is ongoing. It is not possible to be certain that all aspects of the Year

2000 issue affecting the Company, including but not limited to, those related to the efforts of customers, suppliers, or

other third parties, will be fully resolved. Contingency plans will be developed as required based on the results of

the testing program. RIM believes that it has adopted a reasonable and prudent strategy for dealing with the Year

2000 issue. Based on the progress of the Year 2000 program to date, the Company has determined its exposure to

Year 2000 risk in its mission critical systems will be low to moderate and the Company believes that it will not

experience a material adverse affect on its business as a result of Year 2000 issues. Based on the review carried out

to date, the costs of Year 2000 programs are not anticipated to be material and will be expensed as incurred as part

of the Company’s normal operating and capital budgets.

FORWARD-LOOKING STATEMENTS

Certain statements in this management’s discussion and analysis constitute “forward-looking statements” within

the meaning of the United States Private Securities Litigation Reform Act of 1995. These include statements about

management’s expectations, beliefs, intentions or strategies for the future, which are indicated by words such as

“anticipate, intend, believe, estimate, forecast and expect” and similar words. All forward-looking statements reflect

management’s current views with respect to future events and are subject to certain risks and uncertainties and

assumptions that have been made. Important factors that could cause actual results, performance or achievements

to be materially different from those expressed or implied by these forward-looking statements include:

18

Management’s Discussion and Analysis (continued)