Blackberry 1999 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 1999 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

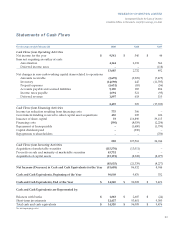

AMORTIZATION

In keeping with the expansion of RIM’s capital spending and associated

build-up of depreciable assets given the record growth in all facets of RIM’s

business, amortization expense increased to $4.1 million in fiscal 1999 from

$2.2 million last year.

Capital asset expenditures totalled $13.2 million for fiscal 1999, increasing

significantly from capital additions of $8.3 million last year. Significant

additions included computer workstations to accommodate growth of the

Company’s employee base, technological infrastructure, production tooling,

and R&D and production test equipment. In addition, significant

expenditures were incurred at the manufacturing facility to increase unit

capacity and to streamline the production process to increase efficiency.

INVESTMENT INCOME

The significant rise in investment income to $5.6 million reflected the

Company’s higher average cash balances throughout the year. Investment

income was $2.0 million in fiscal 1998. The Company will continue to invest

treasury funds in high grade instruments.

INCOME TAXES

The Company’s R&D activities have given rise to income tax loss carry-

forwards and investment tax credits (ITCs). In addition, the Company can

claim further tax deductions for past financing costs related to the issuance

of shares. RIM used loss carry-forwards to reduce its provision for income

taxes to $3.3 million in fiscal 1999. In addition, the company further used

ITCs and allocable financing costs to reduce the amount of income

taxes payable.

As at February 28, 1999, the Company had remaining tax loss

carry-forwards, allocable financing costs, and ITCs sufficient to shelter

approximately $21.4 million of federal taxable income and approximately

$18.6 million of provincial taxable income. As RIM intends to invest further

in R&D, tax incentives arising from such investment, together with the

utilization of remaining tax loss carry-forwards and allocable financing costs,

will continue to reduce the Company’s income tax liability.

NET INCOME

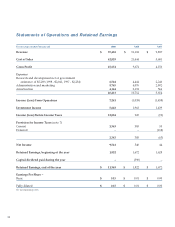

Net income was $9.5 million, or 14% of revenue, versus $0.5 million, or

2% of fiscal 1998 revenue. The improvement was attributable to increases

in revenue and gross margin, as well as investment income. Both basic

and fully diluted earnings per share for the year were $0.15, up from

$0.01 last year.

17

RESEARCH IN MOTION LIMITED

Incorporated Under the Laws of Ontario

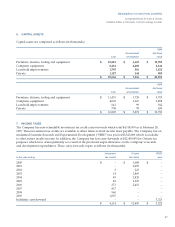

Selling, Marketing

and Administration

(CDN $ million)

0

2

4

6

8

10

1.4

1.5

2.8

4.0

96 97 98 99

9.7

95

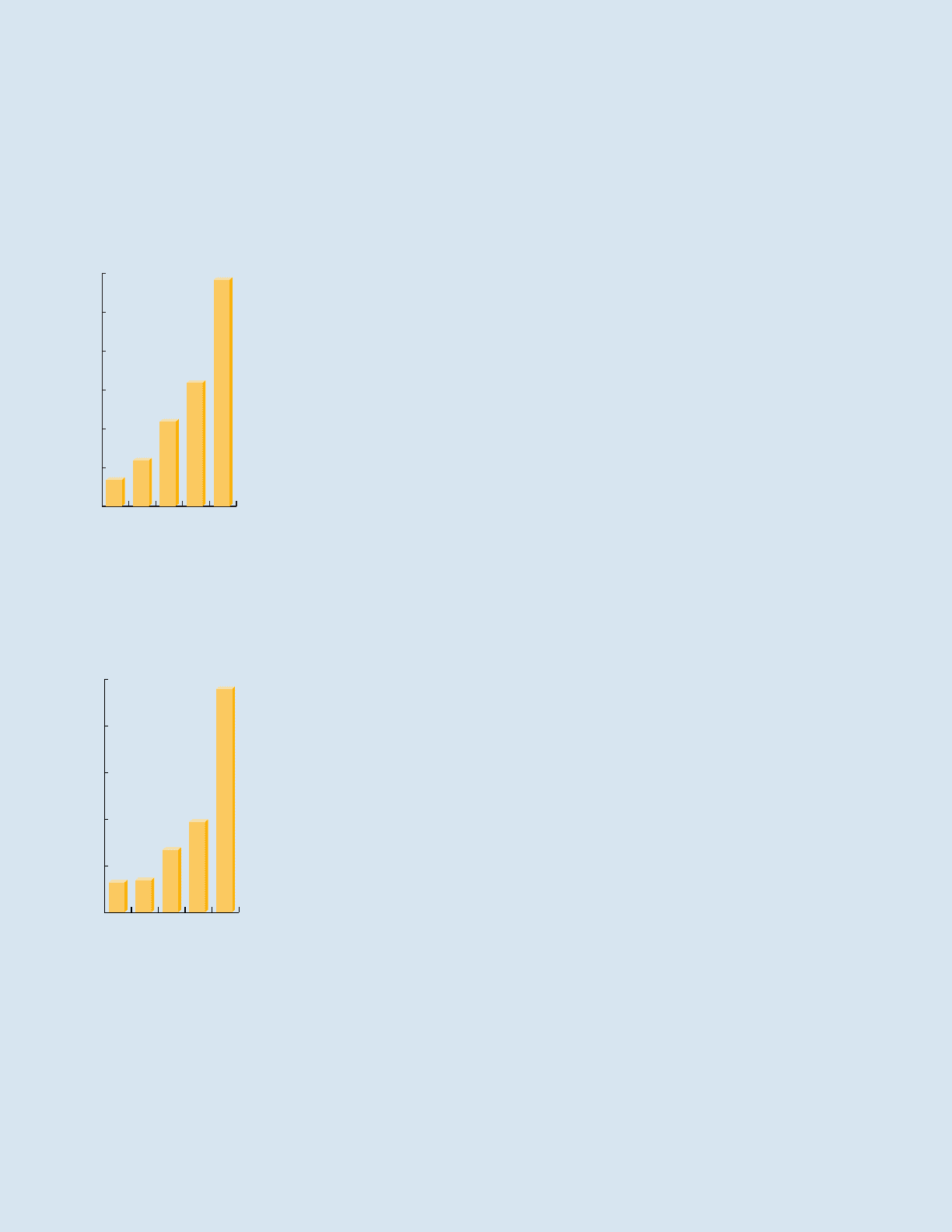

Gross Research

and Development

(CDN $ million)

0

2

4

6

8

10

12

1.5

2.5

4.5

6.5

96 97 98 99

11.8

95