Blackberry 1999 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 1999 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

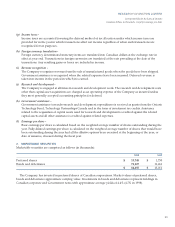

14. UNCERTAINTY DUE TO THE YEAR 2000 ISSUE

The Year 2000 issue arises because many computerized systems use two digits rather than four to identify a

year. Date sensitive systems may recognize the year 2000 as 1900 or some other date, resulting in errors when

information using year 2000 dates is processed. In addition, similar problems may arise in some systems which

use certain dates in 1999 to represent something other than a date. The effects of the Year 2000 issue may be

experienced before, on or after January 1, 2000 and if not addressed, the impact on operations and financial

reporting may range from minor errors to significant system failure which could affect the Company’s ability to

conduct normal business operations. However, it is not possible to be certain that all aspects of the Year 2000 issue

affecting the Company, including those related to the efforts of customers, suppliers, or other third parties, will

be fully resolved.

15. COMPARATIVE FIGURES

Certain of the prior year’s figures have been reclassified for consistency with the presentation adopted for the

current year.

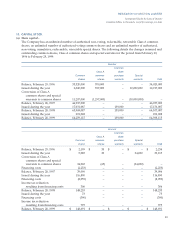

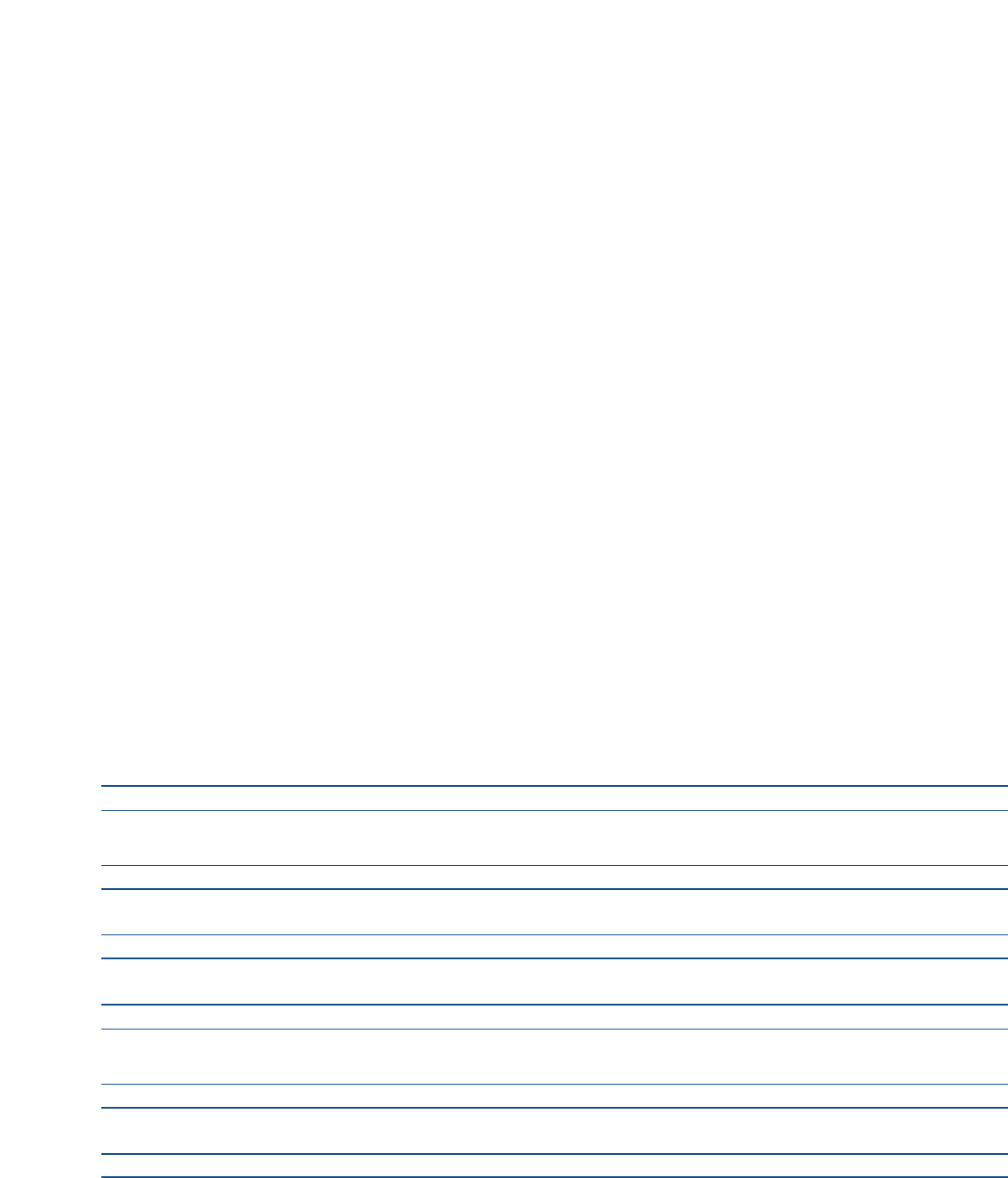

16. SUMMARY OF MATERIAL DIFFERENCES BETWEEN GENERALLY ACCEPTED ACCOUNTING PRINCIPLES (GAAP)

IN CANADA AND THE UNITED STATES

The financial statements of the Company have been prepared in accordance with accounting principles generally

accepted in Canada (“Canadian GAAP”) which conform in all material respects with accounting principles

generally accepted in the United States (“U.S. GAAP”) except as set forth below (in thousands, except for earnings

per share):

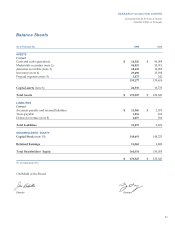

Balance Sheets -

1999 1998 1997

Total assets under Canadian GAAP $ 175,527 $ 153,347 $ 44,415

Adjustment - Deferred income taxes (a) 3,000 700 –

Total assets under U.S. GAAP $ 178,527 $ 154,047 $ 44,415

Total shareholders’ equity under Canadian GAAP $ 160,054 $ 150,055 $ 40,766

Adjustment - Deferred income taxes (a) 3,000 700 –

Total shareholders’ equity under U.S. GAAP $ 163,054 $ 150,755 $ 40,766

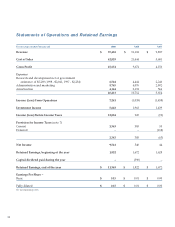

Statements of Operations -

1999 1998 1997

Net income under Canadian GAAP $ 9,541 $ 540 $ 44

Adjustment - Deferred income taxes (a) 500 – –

Net income under U.S. GAAP $ 10,041 $ 540 $ 44

Earnings per share under U.S. GAAP

Basic $ 0.16 $ 0.01 $ 0.00

Diluted $ 0.14 $ 0.01 $ 0.00

31

RESEARCH IN MOTION LIMITED

Incorporated Under the Laws of Ontario

Canadian dollars, in thousands, except for earnings per share