Barnes and Noble 2010 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2010 Barnes and Noble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

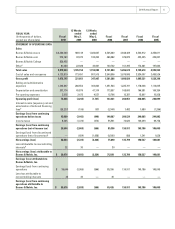

a Includes primarily third-party sales of Sterling Publishing Co., Inc., a wholly-owned subsidiary of the Company, and B. Dalton store sales.

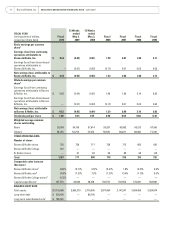

b Amounts for fiscal 2010, the transition period, the 13 weeks ended May 3, 2008, fiscal 2008, 2007, 2006 and 2005 are net of interest income of $452, $211,

$1,369, $1,518, $9,169, $5,292 and $6,615, respectively.

c Represents the results of Calendar Club for all periods presented.

d Noncontrolling interest represents the 50% outside interest in Begin Smart LLC.

e On February 1, 2009, the Company adopted ASC 260-10-45, Determining Whether Instruments Granted in Share-Based Payment Transactions Are

Participating Securities, whereby the Company’s unvested restricted shares and shares issuable under the Company’s deferred compensation plan are

considered participating securities. The Company has retroactively applied the provisions of ASC 260-10-45 to the financial information included for the

13 weeks ended May 3, 2008 and fiscal years 2008, 2007, 2006 and 2005.

f Comparable store sales increase (decrease) is calculated on a 52-week basis (with the exception of those presented for the 13 weeks ended May 2,

2009 and May 3, 2008), and includes sales from stores that have been open for at least 15 months and does not include closed or relocated stores.

g Comparable online sales increase (decrease) have been adjusted from prior year results to conform with the fiscal 2010 presentation.

h Comparable store sales increase (decrease) is calculated since Acquisition and includes sales from stores that have been open for at least 15 months

and does not include closed or relocated stores.

i Excludes Calendar Club capital expenditures of $308, $1,988, $2,551, $3,333, and $4,469, for the 13 weeks ended May 3, 2008, fiscal 2008, 2007, 2006, and

2005, respectively.

j See Note 4 to the Notes to Consolidated Financial Statements.

2010 Annual Report 7