Barnes and Noble 2010 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2010 Barnes and Noble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

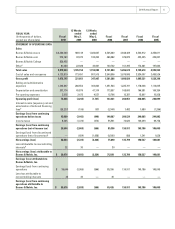

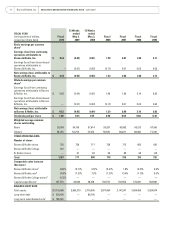

The following table sets forth, for the periods indicated, the percentage relationship that certain items bear to total sales of

the Company:

13 Weeks Ended

Fiscal Year Fiscal 2010 May 2, 2009 May 3, 2008 Fiscal 2008 Fiscal 2007

Sales 100.0% 100.0% 100.0% 100.0% 100.0%

Cost of sales and occupancy 71.1 70.0 69.9 69.1 69.6

Gross margin 28.9 30.0 30.1 30.9 30.4

Selling and administrative expenses 24.0 25.9 26.3 24.4 23.2

Depreciation and amortization 3.6 4.2 3.6 3.4 3.2

Pre-opening expenses 0.1 0.2 0.4 0.2 0.2

Operating margin (loss) 1.3 (0.3) (0.2) 2.8 3.8

Interest income, net and amortization of deferred

financing fees 0.5 — 0.1 — 0.1

Earnings (loss) from continuing operations before taxes 0.8 (0.3) (0.1) 2.8 4.0

Income taxes 0.1 (0.1) — 1.1 1.4

Earnings (loss) from continuing operations

(net of income tax) 0.6% (0.2)% —% 1.7% 2.6%

BUSINESS OVERVIEW

Over the past two years, the Company’s financial perfor-

mance has been adversely impacted by a number of factors,

including the economic downturn, increased competition

and the expanding digital market.

The Company’s core business is the operation of Barnes &

Noble retail stores, from which it derives the majority of its

sales and net income. Comparable store sales have declined

in recent years due to lower consumer traffic as a result of

the factors noted above. Even as the economy improves,

the Company expects these trends to continue as consumer

spending patterns shift toward internet retailers and digital

content. The Company faces increasing competition from

the expanding market for electronic books, or “eBooks,”

eBook readers and digital distribution of content.

Despite these challenges, the Company believes it has

attractive opportunities for future development.

The Company plans to leverage its unique assets, iconic

brands and reach to become a leader in the distribution of

digital content, as well as increase the online distribution

of physical books. In 2009, the Company entered the eBook

market with its acquisition of Fictionwise, a leader in the

eBook marketplace, and the popularity of its eBook site

continues to grow. In addition, the Company launched the

NOOK™ eReader, which has become its single best-selling

product.

As digital and electronic sales become a larger part of its

business, the Company believes its footprint of more than

1,300 stores will continue to be a major competitive asset.

The Company plans to integrate its traditional retail, trade

book and college bookstores businesses with its electronic

and internet offerings, using retail stores in attractive

geographic markets to promote and sell digital devices and

content. Customers can see, feel and experiment with the

NOOK™ in the Company’s stores.

Although the stores will be just a part of the offering,

they will remain a key driver of sales and cash flow as the

Company expands its multi-channel relationships with

its customers. The Company does not expect to open retail

stores in new geographic markets or expand the total num-

ber of retail stores in the near future.

Although the Company believes cash on hand, cash flows

from operating activities, funds available from its senior

credit facility and short term vendor financing provide the

Company with adequate liquidity and capital resources for

seasonal working capital requirements, the Company may

raise additional capital to support the growth of online and

digital businesses.

2010 Annual Report 13