Atmos Energy 2004 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2004 Atmos Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Dedicated and experienced employees. Our new division

already was a well-run natural gas system. Its 1,344 gas

professionals who transferred to Atmos Energy are work-

ing to integrate the operations as soon as possible and

are contributing their “knowledge capital” to benefit our

entire system.

Prompt recovery of new capital investment. Texas law

permits a utility to make annual adjustments for additions

to net plant, using its most recent return on investment,

depreciation rate and tax rates. The law lets us recover our

capital invest-

ment in new

pipelines and

other facilities

much faster

without having

to file a general

rate case. As we invest in our expanding Texas markets,

we will be able to earn a return on our investment faster

than in most of our other jurisdictions.

About 90 percent of earnings from regulated operations.

Adding the TXU Gas properties has increased the propor-

tion of our assets regulated by state commissions. Many

investors see this increase as positive because, although it

does not guarantee our profitability, it increases our

opportunity for consistent, long-term earnings growth.

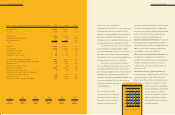

SUCCESSFUL FINANCINGS

Atmos Energy paid approximately $1.905 billion in cash

for the TXU Gas operations. To finance the acquisition,

we sold 9.9 million shares of common stock through

a public offering in July. Because of strong interest, the

offering raised approximately $235.7 million in net

proceeds, with the purchasers mainly being retail holders.

In October 2004, we made another public offering,

selling 16.1 million common shares to raise approximately

$382.5 million in net proceeds before other offering costs.

The purchasers

were mainly

large institu-

tional holders.

In a separate

offering at the

same time, we

also sold four series of senior unsecured notes to raise net

proceeds of approximately $1.39 billion.

We are gratified by the success of all three

offerings. We believe the prices that investors bid indicate

the market’s confidence in our ability to integrate and

operate the TXU Gas operations successfully. Within the

next three to five years, we expect to apply some of the

additional cash flow from the new operations to return

to a 50 percent to 55 percent debt-to-capitalization

ratio, as we have done consistently after completing our

nine previous major acquisitions.

LETTER TO SHAREHOLDERS 5

COMPLEMENTARY NONUTILITY OPERATIONS

Our nonutility operations achieved impressive results in

fiscal 2004, building on initiatives begun in 2003 to

reduce the risk from volatile natural gas prices. The con-

tribution to net income from our nonutility operations

in 2004 was 27 percent. We expect these contributions to

remain strong during the next five years.

One ofthe keys to our nonutility growth will

be managing the pipeline and storage assets acquired with

TXU Gas. Although these assets remain regulated, we

expect to operate them to deliver more volumes to whole-

sale customers. We also are working on optimizing our

nonutility natural gas marketing and storage operations.

During 2004, for example, we made changes in the

way we procure the billions of cubic feet of natural gas

for our utility system to take better advantage of our

nonutility operations’ expertise.

CONCENTRATION ON PERFORMANCE

Our goal has been to provide an attractive rate of return

through both capital appreciation and dividends. We

expect earnings per share to grow between 3 percent and

6 percent a year and our dividend yield to remain an

attractive 4 percent to 5 percent.

We expect to provide investors with a total annual

return between 8 percent and 11 percent. We have done

this consistently in the past and expect to continue to do

so in the future. We have accomplished this through an

intense focus on improving efficiency and managing costs,

mitigating the effects of weather on our utility operations

and fostering productive relationships with the regulators

in our operating jurisdictions.

We also have been successful because of our focus

on the basics. While many in the industry are claiming

a return to the basics, we can confidently say we never

left the basics. We always have been dedicated to natural

gas distribution as our core business.

KEEPING RATES CURRENT

In 2004, we added $16.2 million in net revenues through

rate increases. During the next five years, we expect to

receive approximately $15 million to $20 million in average

annual rate increases. One of our goals is to monitor our

rates of return in all jurisdictions to keep our actual

returns as close as possible to our allowed rates of return.

In states that have warmer winters, we have sought

to adjust our rates using a weather normalization adjust-

ment. We now have WNA or higher base rates in our eight

largest states. Only about 17 percent of our margins

are exposed to weather in the 2004–2005 heating season.

We have proposed other rate adjustments to offset

the effects of declining natural gas consumption. Nationally,

gas consumption has been going down about 2 percent a

year during the past decade. We also have sought to recoup

higher collection expenses and to recover bad debt expense

incurred during winter cutoff moratoriums.

Excellence in customer service stands

as a key part of our corporate vision–

we call it our Spirit of Service.

SM

4 LETTER TO SHAREHOLDERS