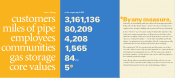

Atmos Energy 2004 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2004 Atmos Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

OPERATIONS REVIEW 21

employee, compared to the industry peer group’s average

of 546 customers.

Our control of operating expenses is even more

remarkable, considering that we have operated primarily

in rural and smaller communities across 12 states. The

structure of our operations has made it more difficult to

achieve efficiencies, compared with a company serving

a large customer base in a metropolitan area or limited

geographical area.

CUSTOMER SATISFACTION

Customer service excellence is one of our major goals.

The most recent independent survey of our customers’

attitudes, conducted in the fall of 2004, found an overall

satisfaction rating among residential and commercial

customers of 94 percent. Compared with other utility

service providers, Atmos Energy ranked among the

industry’s leaders in overall satisfaction.

NONUTILITY OPERATIONS

Our nonutility operations during 2004 achieved major

improvements in margins and in reduced exposure to

risks from volatile gas commodity prices. Our natural gas

marketing business expanded into the Mobile Bay area

of Alabama. In Kansas, nonutility gas storage facilities

were transferred to our Colorado-Kansas Division for

utility operations.

A major development was the acquisition of

the natural gas pipeline and storage assets of TXU Gas.

Although regulated, these assets will be managed

under our nonutility operations.

The 6,162-mile pipeline extends across Texas to

transport natural gas to third parties. It has extensive

connections in nine major gas-producing basins and three

interconnection hubs to other major producing areas

and many interstate pipelines. Five underground gas storage

reservoirs contain 39 Bcf of working storage, including

one salt-dome facility with higher delivery capabilities.

We believe this pipeline and storage system is

well situated to transport larger volumes of natural gas.

Its operations create additional gas marketing and

other opportunities for our nonutility businesses.

FISCAL 2005 FORECAST

We anticipate our earnings will increase at 3 percent to

6 percent a year, on average, during the next five years. We

also expect to continue paying higher annual dividends.

In fiscal 2005, we expect to earn between $1.65

and $1.75 per diluted share and to pay an indicated

dividend rate of $1.24 per share. Our capital expenditures

are expected to approximate $340 million to $350

million, with about 60 percent of that total being spent

on projects in our new Mid-Tex Division.

remain abundant in North America, gas production has

not kept pace with the steady rise in demand.

During the 2004–2005 heating season, residential

heating bills will likely increase 10 percent to 15 percent

above bills of the previous heating season, according to the

federal Energy Information Administration. Tight sup-

plies also are causing greater volatility in natural gas prices.

To help protect our customers, we offer budget

billing plans, assistance for low-income customers and

information about lowering energy costs. We also

have advocated vigorously for federal energy legislation

to offer incentives for more natural gas production

and for increased energy assistance to aid indigent and

low-income customers.

CONTROLLING KEY EXPENSES

To control our purchased gas costs, we use a combination

of gas storage, fixed physical contracts and fixed financial

contracts. We have fixed the price for about 50 percent of

our expected 2004–2005 winter gas supply requirements.

Of the total amount hedged, about

45 percent is a combination of our

underground storage assets and con-

tracted pipeline storage; this storage

provides a natural hedge for our gas

supply purchases. The other 55 per-

cent of the quantity hedged is through

financial contracts.

Hedging is good financial management because it

protects our capital and cash flow. It also cushions the

effects of higher gas prices on our customers’ winter bills,

on our receivables and, ultimately, on our collections.

Despite rising natural gas prices, we have contin-

ued to keep our utility bad-debt expense low. Our

collection efforts, coupled with credit qualification before

reconnecting customers and expanded customer

payment options, helped us maintain our allowance for

doubtful accounts in 2004 at just 0.29 percent of

residential and commercial revenues, which is consider-

ably lower than our historical accrual rate.

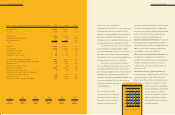

OPERATING EFFICIENCY

Atmos Energy has earned a reputation for being one of

the most efficient natural gas utilities in the country.

We continue to be an industry leader in two key indicators:

operation and maintenance expense per customer and

customers served per employee.

We benchmark our performance each year against

our industry peer group. Since 1997,

we have reduced operating costs and

expenses by about $57 per customer,

or 31 percent. For fiscal 2004, our O&M-

per-customer expense was $126,

compared to our peer group’s average

of $193, which is 53 percent higher

than ours. We served 566 customers per

O&M EXPENSES

$140

$130

$120

$110

$100

Operation and maintenance

expense per customer

2000 2001 2002 2003 2004

20 OPERATIONS REVIEW