Atmos Energy 2004 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2004 Atmos Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

LETTER TO SHAREHOLDERS 3

DEAR FELLOW SHAREHOLDER:

Our 2004 fiscal year will stand as one of the biggest years

in Atmos Energy’s history. Not only did we do well

financially, we virtually doubled in size to become the

largest pure-gas utility in America. However, size is

only important if it is accompanied by performance, and

Atmos Energy performed exceptionally well in 2004.

Consolidated net income rose to $86.2 million, or

$1.58 per diluted share, compared with $71.7 million,

or $1.54 per diluted share, in 2003. Our total return to

shareholders was an enviable 10.4 percent, including

cash dividends of$1.22 paid during fiscal 2004. Return

on average shareholders’ equity was 9.1 percent.

Based on these strong results and our positive

forecast for 2005, the Board of Directors increased the

annual indicated dividend rate by 2 cents to $1.24 per

share. The increase marked our 17th consecutive annual

dividend increase. When adjusted for mergers and

acquisitions, Atmos Energy has paid higher dividends every

year since its founding in 1983. Fewer than 2.5 percent

of American corporations can match

our dividend history.

TXU GAS ACQUISITION

Our 2004 results were exceeded only

by the leap we made in our regulated

operations. On October 1, 2004, we

completed our acquisition of the

natural gas distribution and pipeline operations of TXU

Gas Company. This acquisition added 1.5 million utility

customers in one of the more dynamic American growth

markets. It also placed us in an excellent position to

benefit in the future for the following reasons:

Immediate contribution to 2005 earnings. We expect that

the operations of our new Mid-Tex Division will con-

tribute from 5 cents to 10 cents to earnings per share in

2005. We are forecasting our earnings per diluted share

in fiscal 2005 to be between $1.65 and $1.75.

Above-average residential and commercial growth. Our

new division serves rapidly growing communities in

the Dallas-Fort Worth Metroplex and northern suburbs

of Austin. The division’s net growth in customers

is approximately 2 percent a year, almost double our

former growth rate.

Added value from new gas pipeline operations. The

intrastate pipeline we acquired as part of the TXU Gas

operations runs from one end of Texas to the other.

It interconnects at three of the state’s major hubs, or gas

transfer points, with dozens of other

intrastate and interstate gas pipelines.

The 6,162-mile pipeline system delivers

gas to the 550 cities served by the

new division. Owning this asset gives us

expansion opportunities to transport

more natural gas for others besides our

own utility operations.

EARNINGS REVIEW

$1.80

1.50

1.20

0.90

0.60

0.30

0.00 2000 2001 2002 2003 2004

Earnings per diluted share

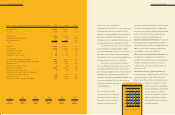

YEAR ENDED SEPTEMBER 30 (Dollars in thousands, except per share data) 2004 2003 Change

Operating revenues $ 2,920,037 $ 2,799,916 4.3%

Gross profit $ 562,191 $ 534,976 5.1%

Utility net income $63,096 $ 62,137 1.5%

Natural gas marketing net income (loss) 16,633 (970) 1814.7%

Other nonutility net income 6,498 10,521 -38.2%

Total $ 86,227 $ 71,688 20.3%

Total assets $2,869,883 $ 2,625,495 9.3%

Total capitalization $ 1,994,770 $ 1,720,017 16.0%

Net income per share – diluted $ 1.58 $ 1.54 2.6%

Cash dividends per share $1.22 $1.20 1.7%

Book value per share at end of year $ 18.05 $ 16.66 8.3%

Consolidated utility segment throughput (MMcf) 246,033 247,965 -0.8%

Consolidated natural gas marketing segment throughput (MMcf) 222,572 225,961 -1.5%

Heating degree days 3,271 3,473 -5.8%

Degree days as a percentage of normal 96% 101% -5.0%

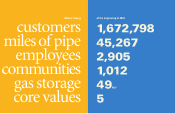

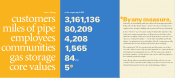

Meters in service at end of year 1,679,136 1,672,798 0.4%

Return on average shareholders’ equity 9.1% 9.9% -8.1%

Shareholders’ equity as a percentage of total capitalization

(including short-term debt) at end of year 56.7% 46.4% 22.2%

Shareholders of record 27,555 28,510 -3.3%

Weighted average shares outstanding – diluted (000s) 54,416 46,496 17.0%

3

Letter to

Shareholders

18

Operations

Review

22

Financial

Review

30

Atmos Energy

Officers

31

Board of

Directors

32

Corporate

Information

2 FINANCIAL HIGHLIGHTS