Atmos Energy 1997 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 1997 Atmos Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Second, we want to increase the scope, scale and market share

of our non-utility operations. We see many opportunities for

extending the use of propane in service areas where it would

be difficult to install natural gas distribution systems. We also

are going to pursue opportunities to increase the customer

base of Woodward Marketing, a wholesale natural gas mar-

keting and gas services limited liability corporation in which

we own a 45 percent interest.

Third, we intend to develop a plan to participate in retail

energy services behind the meter. We also intend to survey

and evaluate customer preferences, now and for the future,

and develop specific strategies to deliver those services that

we choose to provide. Our strategy is to seek partners to

join us in providing retail energy services to customers.

These partners, we expect, will be experienced in retail

services and marketing and will recognize the value of our

connection to over 1 million customers and our brand equity.

Fourth, we are going to continue our acquisition strategy to

add new customers and service areas for both our natural

gas distribution and propane operations. We have an excel-

lent track record of acquiring LDC operations that provide

us with diversity in weather, regulation, economies and

markets. We have achieved synergies and benefits quickly,

while preserving brand equity.

What paths for growth

do not make sense for Atmos?

Our management team has invested considerable time

this year analyzing our strengths, core competencies and

distinctive assets. From these discussions came our focused

initiatives I have previously outlined. But it also was impor-

tant not just to identify initiatives we should pursue, but

also areas we should not pursue. We will not be investing

to create a national position in retail marketing. We will look,

however, for joint venture partners, as I explained earlier. We

are not interested in investing in the sector of natural gas pro-

duction, gathering, processing, or in international distribution

projects. We will not pursue electric acquisitions, although

we, along with Woodward, will look for an electric partner for

the Woodward L.L.C. We believe these kinds of projects

would dilute our energy and take away financial resources

from our main business focus.

What are the performance targets that

the company expects to achieve?

Our objective is to continue to provide total returns to our

shareholders that are in the top quartile when compared to

other LDCs of comparable size. We expect to do this through

growth in our customer base and in earnings annually.

When do you expect to see results

of this plan for growth?

We made a number of investments in 1997 from which we

expect to see benefits beginning in 1998 and extending into

1999 and beyond. The United Cities integration is in progress

and on schedule — their organization has been restructured

to match Atmos’ operating model. Our customer service ini-

tiative will be completed in September 1998, when all our

operating divisions are using the central call center. The man-

agement reorganization is complete, with a new leadership

team in place to build on our successful past with our focus

firmly on the future.

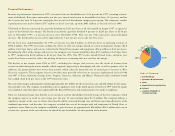

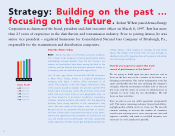

Total Assets

93 $786,739

94 $829,385

95 $900,948

96 $1,010,610

97 $1,088,311

Book Value

Per Share

93 $9.98

94 $10.33

95 $10.77

96 $11.27

97 $11.04

93 94 95 96 97

93 94 95 96 97

7