Alpine 2008 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2008 Alpine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

15

offset shifts in new car demand toward smaller models, leading to a decline in sales.

As a result, sales of this segment decreased 4.9% compared with the previous fiscal year.

Overall, for consolidated performance during the fiscal year under review, net sales decreased

4.9% to ¥252,072 million (US$2,515.9 million), operating income fell 30.6% to ¥7,012 million

(US$70.0 million), and net income decreased 38.0% to ¥3,554 million (US$35.5 million). Net

income per share was ¥50.95 (US$0.51).

The number of consolidated subsidiaries changed to 27 companies, with 8 companies in

Japan and 19 overseas. The number of companies accounted for by the equity method at the

end of the fiscal year remained 1.

Investment

Capital expenditures increased 8.3% to ¥13,673 million (US$136.5 million). By segment,

investment in the Audio Products business totaled ¥8,068 million (US$80.5 million), and that in

the Information and Communication Equipment business amounted to ¥5,452 million (US$54.4

million).

R&D expenses decreased 3.3% to ¥29,337 million (US$292.8 million). R&D expenses

amounted to 11.6% of net sales, up 0.2 percentage points.

Cash Flows

For the fiscal year under review, cash and cash equivalents at the end of the period totaled

¥30,159 million (US$301.0 million), a decrease of ¥7,348 million (US$73.3 million), or 19.6%,

compared with the previous fiscal year-end.

Cash flows from operating activities

Net cash provided by operating activities amounted to ¥9,963 million (US$99.4 million), a

decrease of 39.2%. This was mainly the result of inflows provided by net income before taxes

and other adjustments of ¥6,345 million (US$63.3 million), depreciation and amortization of

¥10,655 million (US$106.3 million) and decrease in notes and accounts receivable of ¥5,779

million (US$57.7 million), decrease in notes and accounts payable of ¥1,624 million (US$16.2

million), and income taxes paid of ¥5,275 million (US$52.6 million) from the payment of income

and other taxes.

Cash flows from investing activities

Net cash used in investing activities was ¥14,101 million (US$140.7 million), up 18.6%

compared with the previous fiscal year. Principal components were payments for the

acquisition of tangible and intangible fixed assets of ¥11,029 million (US$110.1 million) and

¥2,945 million (US$29.4 million), respectively.

Cash flows from financing activities

Net cash used in financing activities totaled ¥2,290 million (US$22.9 million), up 48.6%. The

principal component was cash dividends paid of ¥1,744 million (US$17.4 million).

Financial Position

Total assets at the end of the year decreased 7.4% to ¥167,785 million (US$1,674.7 million),

primarily due to a decrease in cash and cash equivalents, notes and accounts receivable, and

investment in securities. As a result of the decrease in unrealized holding gains on securities

and foreign currency translation adjustment, total net assets shrank 3.8% to ¥116,265 million

(US$1,160.4 million). The equity ratio rose 2.7 percentage points to 68.5%.

Return on equity was 3.0%, a decrease of 1.9 of a percentage point. Return on assets was

2.0%, a decrease of 1.2 of a percentage point.

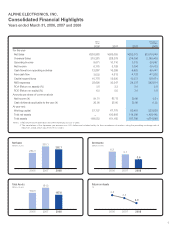

(Millions of yen)

2004

3,032

2005

10,491

2006

12,472

3,021

2007

12,887

3,229

2008

16,399

4,512

Cash Flows from Operating Activity

Free Cash Flow

(%)

2004

3.8

2005

9.4

2006

9.4

4.9

2007

6.2

5.3

2008

5.0

3.3

Return on Equity

Ruturn on Assets

(¥)

2004

17.5

2005 2006

20.0 20.0

2007 2008

25.0