Aetna 2009 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2009 Aetna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Our Medicare MBRs were 87.1% for 2009, 85.6% for 2008 and 86.8% for 2007. We had no significant development

of prior period health care cost estimates that affected results of operations in 2009, 2008 or 2007. The increase in our

Medicare MBR in 2009 reflects a percentage increase in our per member premiums that was outpaced by the

percentage increase in per member health care costs. The decrease in our Medicare MBR in 2008 reflected a

percentage increase in our per member premiums that outpaced the percentage increase in per member health care

costs.

Other Sources of Revenue

Fees and other revenue for 2009 increased $215 million compared to 2008 reflecting growth in ASC membership as

described in the table below, partially offset by lower fee yields and revised product and service mix. The $271 million

increase in 2008 compared to 2007, reflected revenue from our acquisitions of Schaller Anderson Incorporated and

Goodhealth Worldwide (Bermuda) Limited as well as growth in ASC membership.

Net investment income for 2009 increased $51 million compared to 2008 primarily reflecting higher average asset

levels and higher yields on alternative investments. Net investment income for 2008 decreased $30 million compared

to 2007, primarily reflecting lower income from alternative investments.

Net realized capital gains (losses) for 2009 and 2007 were not significant. Net realized capital losses in 2008 were due

primarily to OTTI of debt securities (refer to our discussion of Investments – Net Realized Capital Gains and Losses on

page 12 for additional information) and net losses on the sale of debt securities.

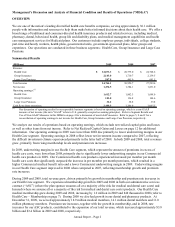

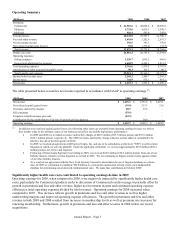

Membership

Health Care’ s membership at December 31, 2009 and 2008 was as follows:

(Thousands) Insured ASC Total Insured ASC Total

Medical:

Commercial 5,614 11,821 17,435 5,595 10,893 16,488

Medicare 433 - 433 366 - 366

Medicaid 310 736 1,046 207 640 847

Total Medical Membership 6,357 12,557 18,914 6,168 11,533 17,701

Consumer-Directed Health Plans

(1)

1,868 1,431

Dental:

Commercial 4,998 7,304 12,302 5,012 7,494 12,506

Medicare and Medicaid 260 432 692 229 374 603

Network Access

(2)

- 1,067 1,067 - 1,015 1,015

Total Dental Membership 5,258 8,803 14,061 5,241 8,883 14,124

Pharmacy:

Commercial 9,728 9,846

Medicare PDP (stand-alone) 346 375

Medicare Advantage PDP 240 195

Medicaid 30 25

Total Pharmacy Benefit Management Services 10,344 10,441

Mail Order

(3)

669 657

Total Pharmacy Membership 11,013 11,098

2009 2008

(1) Represents members in consumer-directed health plans included in Commercial medical membership above.

(2) Represents members in products that allow these members access to our dental provider network for a nominal fee.

(3) Represents members who purchased medications through our mail order pharmacy operations during the fourth quarter of 2009 and

2008, respectively, and are included in pharmacy membership above.

Total medical membership at December 31, 2009 increased compared to December 31, 2008. The increase in medical

membership was primarily due to growth in Commercial membership, driven by growth within existing plan sponsors

and new customers, net of lapses, and Medicaid membership attributable to a new Insured contract.

Total dental membership at December 31, 2009 decreased compared to 2008 primarily due to the loss of a large

Government plan sponsor.

Annual Report – Page 7