Access America 2004 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2004 Access America annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Review of Operations

18

Review of Operations for the year 2004

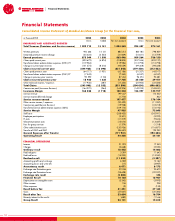

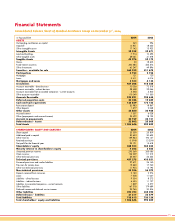

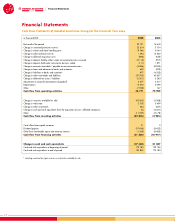

Annual Closing December 31st, 2004: consolidated accounts

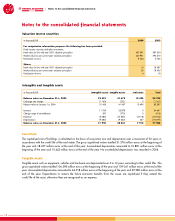

Turnover (Premium and Service Revenue)

Mondial Assistance Group's strong growth in turnover

of 10.5% (turnover written gross, both insurance premiums

and service fees) to 1,099.7 million euros throughout the

twelve-month period ended on December 31st, 2004,

was strongly influenced by more favorable conditions for the

two main lines of business, travel insurance and automobile

assistance.

Travel insurance turnover was boosted by 9% and reached a

share of 46% of total turnover. This development was due to

the comeback of the tourism sector to normal, at least prior to

the Tsunami in Asia on December 26, and the notably strong

growth in Australia.

In an environment of almost stagnant new vehicle sales (world

automobile market +3% in 2004), the need for sophisticated

automobile assistance led to a growth of turnover of 19% and

a share of 43% of total turnover.

The third line of business, healthcare services, which was

launched in 2003, was further developed and increased its

turnover by 50%.

Geographically speaking, turnover development was particu-

larly strong in certain markets. From a regional perspective,

growth was registered throughout all regions. The Asia-Pacific

region contributed to overall turnover growth with an increa-

se of 24% with respect to 2003, the Americas with +10%,

Europe (excluding France) with +13% and France with an

increase of more than 7%.

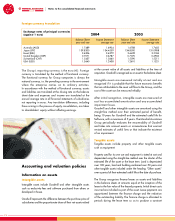

Fluctuation of currency exchange rates impacted the Group’s

turnover also in 2004, resulting in a net decrease of 7.9 million

euros (stemming from fluctuations of the US dollar, the

Brazilian real and the British pound), compared to a

hypothetical situation at constant exchange rates of 2003.

Claims and Expenses

The claims ratio (including claims administration costs, net of

re-insurance) in the insurance business improved to 61.6%

(2003: 63.2%), while the claims reserves were up by 13.5%

to 126.3 million euros.

The impact of the Tsunami disaster on December 26, 2004 led

to claims in Mondial Assistance Group’s retention of 2.7 million

euros (estimated gross claims before reinsurance amounted to

7.0 million euros) for the financial year 2004.

Compared to 2003, Mondial Assistance Group’s reported

global commission ratio (gross of reinsurance) slightly increased

to 17.2% (both for insurance as well as for service activities).

General expenses increased by 5.7% to 409 million euros

(2003: 388 million euros). The operating entities succeeded in

efficiently retaining control of the expenses despite the strong

growth of turnover. Thanks to the strong premium increase,

the favorable development of the claims, commissions

and expenses led to an improved combined ratio of 95.8%

(previous year: 97.5%; -1.7 points).

Investments and financial results

On December 31st, 2004 the Group's financial investments

amounted to 467.2 million euros (2003: 418.6 million euros).

The cash and cash equivalents could be successfully reduced

to 136 million euros (2003: 173 million euros; - 21.5%),

but are considered still relatively high. In 2004, almost

all shares in the portfolio were sold in order to further reduce

the investment risk.

Ordinary investment income increased to 18.4 million euros

(2003: 14.0 million euros) as interest rates in the markets

recovered slightly and due to the higher investment portfolio

on fixed interest securities and short term deposits. The sale of

Mondial Assistance Group's participation in a French subsi-

diary is the main reason for a decrease of the realized result.

In addition, the US dollar was further devalued against the

euro. In total, the described effects reduced the financial result

to 10.1 million euros (2003: 16.9 million euros).