Abercrombie & Fitch 2000 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2000 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

17

authorized stock repurchase programs. A&F is authorized to

repurchase up to an additional 2,450,000 shares under the current

repurchase program.

In 1998, financing activities consisted primarily of the repay-

ment of $50 million long-term debt to The Limited. This

occurred through the issuance of 1.2 million shares of Class A

Common Stock to The Limited with the remaining balance

paid with cash from operations. Additionally, settlement of the

intercompany balance between the Company and The Limited

occurred on May 19, 1998. During 1998, A&F also repurchased

490 thousand shares of Class A Common Stock.

CAPITAL EXPENDITURES Capital expenditures, primarily for

new and remodeled stores and the construction of a new office

and distribution center, totaled $153.5 million, $73.4 million

and $37.5 million for 2000, 1999 and 1998, respectively.

Additionally, the noncash accrual for construction in progress

totaled $9.5 million, $10.4 million and $4.4 million in 2000,

1999 and 1998, respectively. Expenditures related to the new

office and distribution center accounted for $92.3 million of

total capital expenditures in 2000, of which $12.9 million was

noncash accrual for construction in progress.

The Company anticipates spending $105 to $115 million in

2001 for capital expenditures, of which $85 to $95 million will be

for new stores, remodeling and/or expansion of existing stores and

related improvements. The balance of capital expenditures will

chiefly be related to the construction of the new home office

and distribution center. The distribution center was completed

in February 2001 and the home office was completed in April

2001. The Company intends to add approximately 825,000 gross

square feet in 2001, which will represent a 29% increase over year-

end 2000. It is anticipated the increase will result from the

addition of approximately 50 new Abercrombie & Fitch stores,

60 abercrombie stores and 20 Hollister Co. stores.

The Company estimates that the average cost for leasehold

improvements and furniture and fixtures for Abercrombie & Fitch

stores opened in 2001 will approximate $600,000 per store, after

giving effect to landlord allowances. In addition, inventory pur-

chases are expected to average approximately $300,000 per store.

The Company estimates that the average cost for leasehold

improvements and furniture and fixtures for abercrombie stores

opened in 2001 will approximate $500,000 per store, after giving

effect to landlord allowances. In addition, inventory purchases are

expected to average approximately $150,000 per store.

The Company is in the early stages of developing Hollister Co.

As a result, current average costs for leasehold improvements, fur-

niture and fixtures and inventory purchases are not representative

of future costs.

The Company expects that substantially all future capital

expenditures will be funded with cash from operations. In addi-

tion, the Company has available a $150 million credit agreement

to support operations.

RELATIONSHIP WITH THE LIMITED Effective May 19, 1998,

The Limited, Inc. (“The Limited”) completed a tax-free exchange

offer to establish A&F as an independent company. Subsequent

to the exchange offer (see Note 1 to the Consolidated Financial

Statements), A&F and The Limited entered into various service

agreements for terms ranging from one to three years. A&F hired

associates with the appropriate expertise or contracted with out-

side parties to replace those services which expired in May 1999.

Service agreements were also entered into for the continued

use by the Company of its distribution and home office space and

transportation and logistic services. The distribution space agree-

ment terminates in April 2001. The home office space service

agreement expires in May 2001. The agreement for trans-

portation and logistic services will also expire in May 2001,

although most of these services have already been transitioned

to the Company. The cost of these services generally is equal

to The Limited’s cost in providing the relevant services plus

5% of such costs.

The Company does not anticipate that costs incurred to

replace the services provided by The Limited will have a mate-

rial adverse impact on its financial condition.

RECENTLY ISSUED ACCOUNTING PRONOUNCEMENTS

Statement of Financial Accounting Standards (“SFAS”) No. 133,

“Accounting for Derivative Instruments and Hedging Activities,”

subsequently amended and clarified by SFAS No. 138, is effec-

tive for the Company’s 2001 fiscal year. It requires that derivative

instruments be recorded at fair value and that changes in their

fair value be recognized in current earnings unless specific hedg-

ing criteria are met. The adoption of this standard had no impact

on the Company’s financial position or results of operations.

Abercrombie &Fitch

16

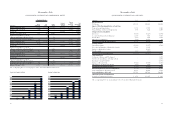

LIQUIDITY AND CAPITAL RESOURCES Cash provided by

operating activities provides the resources to support operations,

including seasonal requirements and capital expenditures. A sum-

mary of the Company’s working capital position and capitalization

follows (thousands):

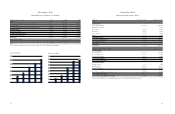

2000 1999 1998

Working capital $149,000 $162,351 $ 95,890

Capitalization:

Shareholders’ equity $422,700 $311,094 $186,105

The Company considers the following to be measures of

liquidity and capital resources:

2000 1999 1998

Current ratio (current assets divided

by current liabilities) 1.96 2.18 1.78

Cash flow to capital investment

(net cash provided by operating

activities divided by capital expenditures) 99% 208% 451%

Net cash provided by operating activities totaled $151.2 million,

$152.8 million and $169.0 million for 2000, 1999 and 1998, respec-

tively. Cash was provided primarily by current year net income

adjusted for depreciation and amortization, and increased accounts

payable and accrued expenses needed to support the growth in

inventories. Cash was used primarily to fund inventory pur-

chases required to support the addition of new stores and the

investment in new women’s categories, including underwear,

gymwear and fragrances. The inventory increase is also due to

the timing of spring deliveries as a result of the 2000 fiscal year

having 53 weeks. Additionally, cash used for income taxes

increased due to the timing of income tax payments.

The Company’s operations are seasonal in nature and typically

peak during the back-to-school and Christmas selling periods.

Accordingly, cash requirements for inventory expenditures are

highest during these periods.

Cash outflows for investing activities were primarily for capital

expenditures related to new and remodeled stores (net of con-

struction allowances) and the construction costs of the new office

and distribution center. In 2000 and 1999, investing activities

also included maturities and purchases of marketable securities.

Financing activities during 2000 and 1999 consisted primarily

of the repurchase of 3,550,000 shares and 1,510,000 shares, respec-

tively, of A&F’s Class A Common Stock pursuant to previously

Abercrombie &Fitch

IMPACT OF INFLATION The Company’s results of opera-

tions and financial condition are presented based upon historical

cost. While it is difficult to accurately measure the impact of

inflation due to the imprecise nature of the estimates required,

the Company believes that the effects of inflation, if any, on its

results of operations and financial condition have been minor.

SAFE HARBOR STATEMENT UNDER THE PRIVATE SECU-

RITIES LITIGATION REFORM ACT OF 1995 A&F cautions

that any forward-looking statements (as that term is defined in

the Private Securities Litigation Reform Act of 1995) contained

in this Report or made by management of A&F involve risks and

uncertainties and are subject to change based on various impor-

tant factors. The following factors, among others, in some cases

have affected and in the future could affect the Company’s

financial performance and actual results and could cause actual

results for 2001 and beyond to differ materially from those

expressed or implied in any of the forward-looking statements

included in this Form 10-K or otherwise made by management:

changes in consumer spending patterns, consumer preferences

and overall economic conditions, the impact of competition and

pricing, changes in weather patterns, political stability, currency

and exchange risks and changes in existing or potential duties,

tariffs or quotas, availability of suitable store locations at appro-

priate terms, ability to develop new merchandise and ability to

hire and train associates.