Abercrombie & Fitch 2000 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2000 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

A total of 102,000 restricted shares were granted in 2000,

with a total market value at grant date of $2.3 million. A total of

140,000 restricted shares were granted in both 1999 and 1998,

with a total market value at grant date of $5.4 million and $2.7

million, respectively. The restricted share grants generally vest

either on a graduated scale over four years or 100% at the end

of a fixed vesting period, principally five years. The market

value of restricted shares is being amortized as compensation

expense over the vesting period, generally four to five years.

Compensation expenses related to restricted share awards

amounted to $4.3 million, $5.2 million and $11.5 million in

2000, 1999 and 1998, respectively. Long-term liabilities at fiscal

year-end 1998 included $8.7 million of compensation expense

relating to restricted shares.

11. RETIREMENT BENEFITS The Company participates in

a qualified defined contribution retirement plan and a non-

qualified supplemental retirement plan. Participation in the

qualified plan is available to all associates who have completed

1,000 or more hours of service with the Company during certain

12-month periods and attained the age of 21. Participation in the

nonqualified plan is subject to service and compensation require-

ments. The Company’s contributions to these plans are based

on a percentage of associates’ eligible annual compensation.

The cost of these plans was $3.0 million in 2000, $2.6 million

in 1999 and $2.0 million in 1998.

12. CONTINGENCIES The Company is involved in a number of

legal proceedings. Although it is not possible to predict with any

certainty the eventual outcome of any legal proceedings, it is the

opinion of management that the ultimate resolution of these

matters will not have a material impact on the Company’s results

of operations, cash flows or financial position.

13. PREFERRED STOCK PURCHASE RIGHTS On July 16, 1998,

A&F’s Board of Directors declared a dividend of .50 of a Series A

Participating Cumulative Preferred Stock Purchase Right (Right)

for each outstanding share of Class A Common Stock, par value

$.01 per share (Common Stock), of A&F. The dividend was paid

to shareholders of record on July 28, 1998. Shares of Common

Stock issued after July 28, 1998 and prior to the Distribution

Date described below will be issued with .50 Right attached.

29

Abercrombie &Fitch

28

Under certain conditions, each whole Right may be exercised to

purchase one one-thousandth of a share of Series A Participating

Cumulative Preferred Stock at an initial price of $250. The

Rights initially will be attached to the shares of Common Stock.

The Rights will separate from the Common Stock and a

Distribution Date will occur upon the earlier of 10 business days

after a public announcement that a person or group has acquired

beneficial ownership of 20% or more of A&F’s outstanding shares

of Common Stock and become an “Acquiring Person” (Share

Acquisition Date) or 10 business days (or such later date as the

Board shall determine before any person has become an

Acquiring Person) after commencement of a tender or exchange

offer which would result in a person or group beneficially

owning 20% or more of A&F’s outstanding Common Stock.

The Rights are not exercisable until the Distribution Date.

In the event that any person becomes an Acquiring Person,

each holder of a Right (other than the Acquiring Person and

certain affiliated persons) will be entitled to purchase, upon

exercise of the Right, shares of Common Stock having a market

value two times the exercise price of the Right. At any time

after any person becomes an Acquiring Person (but before any

person becomes the beneficial owner of 50% or more of the out-

standing shares), A&F’s Board of Directors may exchange all or

part of the Rights (other than Rights beneficially owned by an

Acquiring Person and certain affiliated persons) for shares of

Common Stock at an exchange ratio of one share of Common

Stock per Right. In the event that, at any time following the Share

Acquisition Date, A&F is acquired in a merger or other business

combination transaction in which A&F is not the surviving

corporation, the Common Stock is exchanged for other securi-

ties or assets or 50% or more of A&F’s assets or earning power is

sold or transferred, the holder of a Right will be entitled to buy,

for the exercise price of the Rights, the number of shares of

Common Stock of the acquiring company which at the time

of such transaction will have a market value of two times the

exercise price of the Right.

The Rights, which do not have any voting rights, expire on

July 16, 2008, and may be redeemed by A&F at a price of $.01

per whole Right at any time before a person becomes an

Acquiring Person.

Rights holders have no rights as a shareholder of A&F, includ-

ing the right to vote and to receive dividends.

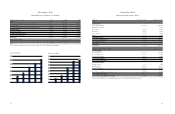

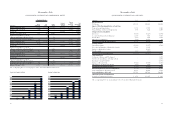

14. QUARTERLY FINANCIAL DATA (UNAUDITED)

Summarized quarterly financial results for 2000 and 1999

follow (thousands except per share amounts):

2000 Quarter First (1) Second (1) Third (1) Fourth

Net sales $205,006 $229,031 $364,122 $439,445

Gross income 75,403 87,765 143,283 202,924

Net income 16,163 21,163 43,592 77,215

Net income per basic share $.16 $.21 $.44 $.78

Net income per diluted share $.16 $.21 $.43 $.76

1999 Quarter First (1) Second (1) Third (1) Fourth (1)

Net sales $186,427 $196,227 $284,510 $363,694

Gross income 69,368 77,346 118,600 185,069

Net income 14,963 18,858 39,059 76,724

Net income per basic share $.14 $.18 $.38 $.75

Net income per diluted share $.14 $.17 $.36 $.73

MARKET PRICE INFORMATION The following is a summary

of A&F’s sales price as reported on the New York Stock

Exchange (“ANF”) for the 2000 and 1999 fiscal years:

Sales Price

High Low

2000 Fiscal Year

4th Quarter $31.31 $14.75

3rd Quarter $26.56 $15.31

2nd Quarter $16.69 $ 8.00

1st Quarter $24.50 $10.06

1999 Fiscal Year

4th Quarter $32.56 $19.56

3rd Quarter $43.25 $21.00

2nd Quarter $49.69 $36.50

1st Quarter $50.75 $35.25

Per share amounts have been restated to reflect the two-for-one

stock split on A&F’s Class A Common Stock, distributed on

June 15, 1999 to shareholders of record at the close of business

on May 25, 1999.

A&F has not paid dividends on its shares of Class A Common

Stock in the past and does not presently plan to pay dividends

on the shares. It is presently anticipated that earnings will be

retained and reinvested to support the growth of the Company’s

business. The payment of any future dividends on shares will

be determined by the A&F Board of Directors in light of condi-

tions then existing, including earnings, financial condition and

capital requirements, restrictions in financing agreements,

business conditions and other factors.

On February 3, 2001, there were approximately 7,000 share-

holders of record. However, when including active associates who

participate in A&F’s stock purchase plan, associates who own

shares through A&F sponsored retirement plans and others

holding shares in broker accounts under street name, A&F

estimates the shareholder base at approximately 65,000.

Abercrombie &Fitch

(1) Net sales and gross income for 1999 and the first three quarters of 2000 reflect the reclassi-

fication of shipping and handling revenues and costs and employee discounts (see Note 3).