Abercrombie & Fitch 2000 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2000 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

27

Abercrombie &Fitch

26

8. LONG-TERM DEBT The Company entered into a $150

million syndicated unsecured credit agreement (the “Agreement”),

on April 30, 1998 (the “Effective Date”). Borrowings outstanding

under the Agreement are due April 30, 2003. The Agreement has

several borrowing options, including interest rates that are based

on the bank agent’s “Alternate Base Rate,” a LIBO Rate or a rate

submitted under a bidding process. Facility fees payable under the

Agreement are based on the Company’s ratio (the “leverage

ratio”) of the sum of total debt plus 800% of forward minimum

rent commitments to trailing four-quarters EBITDAR and

currently accrues at .225% of the committed amount per annum.

The Agreement contains limitations on debt, liens, restricted

payments (including dividends), mergers and acquisitions, sale-

leaseback transactions, investments, acquisitions, hedging

transactions and transactions with affiliates. It also contains

financial covenants requiring a minimum ratio of EBITDAR to

interest expense and minimum rent and a maximum leverage

ratio. No amounts were outstanding under the Agreement at

February 3, 2001 and January 29, 2000.

9. RELATED PARTY TRANSACTIONS Prior to the Exchange

Offer, transactions between the Company and The Limited and

its subsidiaries and affiliates principally consisted of the following:

Merchandise purchases

Real estate management and leasing

Capital expenditures

Inbound and outbound transportation

Corporate services

Subsequent to the Exchange Offer, A&F negotiated arms-

length terms with the merchandise and service suppliers that

are Limited subsidiaries. A&F and The Limited also entered into

various service agreements for terms ranging from one to three

years. A&F hired associates with the appropriate expertise or

contracted with outside parties to replace those services which

expired in May 1999. Service agreements were also entered into

for the continued use by the Company of its distribution and

home office space and transportation and logistic services. The

agreement for use of distribution space terminates in April 2001.

The agreement for use of home office space expires in May

2001. The agreement for transportation and logistics services will

also expire in May 2001, although most services have already been

transitioned to the Company. The cost of these services gener-

ally is equal to The Limited’s cost in providing the relevant

services plus 5% of such costs.

For the periods prior to the Exchange Offer, A&F and The

Limited entered into intercompany agreements that established

the provision of certain services. The prices charged to the

Company for services provided under these agreements may

have been higher or lower than prices that would have been

charged by third parties. It is not practicable, therefore, to

estimate what these costs would have been if The Limited had

not provided these services and the Company was required to pur-

chase these services from outsiders or develop internal expertise.

Management believes the charges and allocations described

above are fair and reasonable.

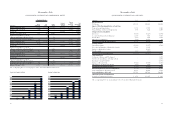

The following table summarizes the related party transac-

tions between the Company and The Limited and its subsidiaries,

for fiscal year 1998. The amounts below reflect activity through

the completion of the Exchange Offer.

(Thousands) 1998

Mast and Gryphon purchases $20,176

Capital expenditures 3,199

Inbound and outbound transportation 2,280

Corporate charges 2,671

Store leases and other occupancy, net 561

Distribution center, IT and home

office expenses 2,217

Centrally managed benefits 1,524

Interest charges, net 4

$32,632

The Company does not anticipate that costs incurred to

replace the services currently provided by The Limited will have

a material adverse impact on its financial condition.

Shahid & Company, Inc. has provided advertising and design

services for the Company since 1995. Sam N. Shahid Jr., who

serves on A&F’s Board of Directors, has been President and

Creative Director of Shahid & Company, Inc. since 1993. Fees

paid to Shahid & Company, Inc. for services provided during

fiscal years 2000, 1999 and 1998 were approximately $1.7 million,

$1.4 million and $1.2 million, respectively.

Abercrombie &Fitch

On August 28, 2000, A&F loaned $4.5 million to its Chairman

of the Board, a major shareholder of A&F, pursuant to the terms

of a replacement promissory note, which provides that such

amount is due and payable on May 18, 2001 together with

interest at the rate of 6.5% per annum. This note constitutes a

replacement of, and substitute for, the promissory notes dated

March 1, 2000 and May 19, 2000 in the amounts of $1.5 million

and $3.0 million, respectively, which were cancelled.

10. STOCK OPTIONS AND RESTRICTED SHARES Under A&F’s

stock plans, associates and non-associate directors may be

granted up to a total of 16.3 million restricted shares and options

to purchase A&F’s common stock at the market price on the date

of grant. In 2000, associates of the Company were granted

approximately 1.4 million options, with vesting periods from four

to five years. A total of 30,000 options were granted to non-

associate directors in 2000, all of which vest over four years.

All options have a maximum term of ten years.

The Company adopted the disclosure requirements of SFAS No.

123, “Accounting for Stock-Based Compensation,” in 1996, but

elected to continue to measure compensation expense in accor-

dance with APB Opinion No. 25, “Accounting for Stock Issued to

Employees.” Accordingly, no compensation expense for stock

options has been recognized. If compensation expense had been

determined based on the estimated fair value of options granted in

2000, 1999 and 1998, consistent with the methodology in SFAS No.

123, the pro forma effect on net income and net income per

diluted share would have been a reduction of approximately $20.0

million or $.20 per share in 2000, $18.5 million or $.17 per share

in 1999 and $6.1 million or $.06 per share in 1998. The weighted-

average fair value of all options granted during fiscal 2000, 1999 and

1998 was $8.90, $23.34 and $9.89, respectively. The fair value of

each option was estimated using the Black-Scholes option-pricing

model with the following weighted-average assumptions for 2000,

1999 and 1998: no expected dividends; price volatility of 50% in

2000, 45% in 1999 and 40% in 1998; risk-free interest rates of

6.2%, 6.0% and 5.5% in 2000, 1999 and 1998, respectively; assumed

forfeiture rates of 10%; and expected lives of 5 years in 2000, 6.5

years in 1999 and 5 years in 1998.

The pro forma effect on net income for 2000, 1999 and 1998

is not representative of the pro forma effect on net income

in future years because it takes into consideration pro forma

compensation expense related only to those grants made sub-

sequent to the Offering.

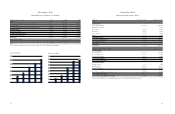

Options Outstanding at February 3, 2001

Options Outstanding Options Exercisable

Weighted

Average Weighted Weighted

Range of Remaining Average Average

Exercise Number Contractual Exercise Number Exercisable

Prices Outstanding Life Price Exercisable Price

$8-$23 5,004,000 7.2 $13.17 1,496,000 $10.82

$23-$38 2,821,000 7.8 $25.85 590,000 $26.36

$38-$52 5,169,000 8.4 $43.55 78,000 $40.70

$8-$52 12,994,000 7.8 $28.01 2,164,000 $16.13

A summary of option activity for 1998, 1999 and 2000 follows:

Stock Option Activity

Number of Weighted Average

Shares Option Price

1998

Outstanding at beginning of year 3,768,000 $ 8.91

Granted 3,970,000 22.47

Exercised (60,000) 8.99

Canceled (110,000) 19.40

Outstanding at end of year 7,568,000 $15.87

Options exercisable at year-end 388,000 $ 8.99

1999

Outstanding at beginning of year 7,568,000 $15.87

Granted 5,794,000 42.90

Exercised (337,000) 9.39

Canceled (216,000) 25.25

Outstanding at end of year 12,809,000 $28.03

Options exercisable at year-end 556,000 $ 9.85

2000

Outstanding at beginning of year 12,809,000 $28.03

Granted 1,414,000 17.25

Exercised (193,000) 14.57

Canceled (1,036,000) 16.06

Outstanding at end of year 12,994,000 $28.01

Options exercisable at year-end 2,164,000 $16.13