Abercrombie & Fitch 2000 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2000 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

and occupancy costs, expressed as a percentage of net sales.

For the year, the gross income rate decreased to 41.2% in 2000

from 43.7% in 1999. The decrease was attributable to lower

merchandise margins, primarily due to lower IMU caused by

both a change in sales mix and the planned strategy of offering

lower opening price points in key product classifications.

In 1999, the gross income rate increased to 43.7% from 41.2%

in 1998. Merchandise margins, expressed as a percentage of

net sales, increased due to slightly higher IMU across most

merchandise categories. In addition, buying and occupancy

costs, expressed as a percentage of net sales, declined slightly

due to leverage achieved from comparable store sales increases.

The Company also improved the gross income rate through

reduced freight costs and enhanced store inventory control

procedures which reduced shrink cost.

GENERAL, ADMINISTRATIVE AND STORE OPERATING

EXPENSES General, administrative and store operating expenses,

expressed as a percentage of net sales, were 17.9% in the fourth

quarter of 2000 and 16.4% in the comparable period in 1999.

The increase in the percentage was primarily due to the inabil-

ity to leverage fixed expenses as a result of the decrease in

comparable store sales. The increase was also due to planned

one-time expenses related to the Company’s move to a new

home office and distribution center. The increases were offset

by tightly controlled headcount additions, travel expenses, store

payroll hours, outside services and compensation expense related

to management bonuses.

General, administrative and store operating expenses,

expressed as a percentage of net sales, were 16.4% in the fourth

quarter of 1999 as compared to 15.4% for the same period in

1998. The increase in the percentage was primarily due to a

change in the accounting for gift certificates and gift cards.

This was partially offset by lower compensation expenses related

to management bonuses and restricted share grants awarded to

key executives of the Company. Additionally, the Company did

not incur expenses related to service agreements with The

Limited, Inc. that expired prior to the fourth quarter of 1999

and emphasized tighter expense control in travel, relocation

and legal expenses.

General, administrative and store operating expenses for the

year, expressed as a percentage of net sales, were 20.7%, 20.2%

Net sales for the fourth quarter of 1999 increased 21% to $363.7

million from $300.1 million in 1998. The increase was primarily

due to the addition of new stores and a comparable store sales

increase of 3%. Comparable store increases were driven by men’s

pants and knits while the women’s knit business was very strong.

The Company’s catalogue, the A&F Quarterly and the Company’s

web site accounted for 3.8% of net sales in the fourth quarter of

1999 as compared to 2.2% in 1998.

Net sales for the 2000 fiscal year increased 20% to $1.24 billion

from $1.03 billion in 1999. The sales increase was attributable to

the addition of 104 stores offset by a 7% comparable store sales

decrease. The decline in comparable store sales, based on a 53 week

fiscal year for both 2000 and 1999, was across both the men’s and

women’s businesses. During the year, the assortment in each busi-

ness was repositioned to be more balanced and less focused on

graphics and included items at key opening price points. The

Company’s catalogue, the A&F Quarterly and the Company’s web

sites represented 3.8% of 2000 net sales compared to 2.9% last year.

Net sales for the 1999 fiscal year increased 28% to $1.03 billion

from $805.2 million in 1998. Sales growth resulted from a com-

parable store sales increase of 10% and the addition of 54 new

stores. Comparable store sales increases were driven by both men’s

and women’s knits and pants. Net retail sales per gross square foot

for the Company increased 6%, principally from an increase in the

number of transactions per store. The Company’s catalogue, the

A&F Quarterly and the Company’s web site represented 2.9% of

1999 net sales compared to 2.0% of 1998 net sales.

GROSS INCOME For the fourth quarter of 2000, gross income,

expressed as a percentage of net sales, decreased to 46.2% from

50.9% for the same period in 1999. The decrease was attributable

to lower merchandise margins (representing gross income before

the deduction of buying and occupancy costs) due to lower initial

markups (IMU) and higher markdowns. The IMU was affected

by both a change in sales mix and the planned strategy of offering

lower opening price points in key product classifications.

Gross income, expressed as a percentage of net sales, increased

to 50.9% for the fourth quarter of 1999 from 48.3% for the same

period in 1998. The increase was attributable to higher mer-

chandise margins, resulting from higher IMU, and improved

control of store inventory shrinkage and merchandise freight

costs. The Company also achieved some leverage in buying

RESULTS OF OPERATIONS Net sales for the fourth quarter of

the 2000 fiscal year were $439.4 million, an increase of 21% from

$363.7 million for the fourth quarter a year ago. Operating

income was $124.1 million compared to $125.3 million last year.

Net income per diluted share was $.76, up 4% from $.73 last year.

Net sales for the 2000 fiscal year increased 20% to $1.24 billion

from $1.03 billion last year. Operating income for the year

increased 5% to $253.7 million from $242.1 million in 1999.

Net income per diluted share was $1.55 compared to $1.39 a year

ago, an increase of 12%.

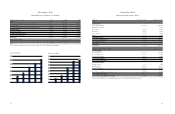

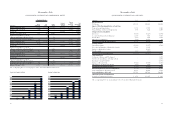

FINANCIAL SUMMARY The following summarized financial

data compares the 2000 fiscal year to the comparable periods

for 1999 and 1998:

% Change

2000- 1999-

2000 1999 1998 1999 1998

Net sales (millions) $1,237.6 $1,030.9 $805.2 20% 28%

Increase (decrease) in comparable

store sales (7%) 10% 35%

Retail sales increase attributable

to new and remodeled stores,

magazine, catalogue and web site 27% 18% 22%

Retail sales per average

gross square foot $0,474 $0,505 $0,476 (6%) 6%

Retail sales per average store

(thousands) $3,944 $4,487 $4,484 (12%) –

Average store size at year-end

(gross square feet) 8,047 8,695 9,140 (7%) (5%)

Gross square feet at year-end

(thousands) 2,849 2,174 1,791 31% 21%

Number of stores:

Beginning of year 250 196 156

Opened 104 54 41

Closed (–)– (1)

End of year 354 250 196

NET SALES Fourth quarter 2000 net sales increased 21% to

$439.4 million from $363.7 million in 1999. The increase was due

to the addition of new stores offset by a 9% decline in comparable

store sales. The decline in comparable store sales, based on a 14

week quarter for both 2000 and 1999, was primarily due to com-

parable store sales decreases in the men’s graphic tees and pants

departments. Comparable store sales were positive in the

women’s business for the quarter based on strong increases in the

sweaters, denim and outerwear departments. The Company’s

catalogue, the A&F Quarterly (a catalogue/magazine) and the

Company’s web sites accounted for 5.0% of net sales in the

fourth quarter of 2000 as compared to 3.8% in 1999.

15

Abercrombie &Fitch

14

MANAGEMENT’S DISCUSSION AND ANALYSIS

Abercrombie &Fitch

and 20.4% in 2000, 1999 and 1998, respectively. The rate has

increased in 2000 primarily due to the inability to leverage fixed

expenses as a result of the decrease in comparable store sales.

The increase was partially offset by the Company’s continued

focus on discretionary expense controls. The 1999 improvement

was due to the control of expenses and favorable leveraging of

expenses due to higher comparable store sales.

OPERATING INCOME Operating income, expressed as a per-

centage of net sales, was 28.2% and 20.5% for the fourth quarter

and fiscal year of 2000, respectively, compared to 34.5% and

23.5% for the same periods in 1999. The decline in operating

income as a percentage of sales in these periods is primarily a

result of lower gross income percentages. Higher general, admin-

istrative and store operating expenses also added to the decrease

in the operating income percentage of net sales.

Operating income, expressed as a percentage of net sales,

was 34.5% and 23.5% for the fourth quarter and fiscal year of

1999, respectively, compared to 32.9% and 20.7% for the same

periods in 1998. The improvement was the result of higher

gross income coupled with lower general, administrative and

store operating expenses, expressed as a percentage of net sales.

Sales volume and gross income increased at a faster rate than

general, administrative and store operating expenses due to the

Company’s emphasis on cost controls.

INTEREST INCOME/EXPENSE Net interest income was $2.5

million in the fourth quarter of 2000 and $7.8 million for all of 2000

compared with net interest income of $2.5 million and $7.3 mil-

lion for the corresponding periods last year. Net interest income

in 2000 and 1999 was primarily from short-term investments.

FINANCIAL CONDITION The Company’s continuing growth

in net income provides evidence of financial strength and flexi-

bility. A more detailed discussion of liquidity, capital resources

and capital requirements follows.