Abercrombie & Fitch 1999 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 1999 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

25

Abercrombie &Fitch Co.

24

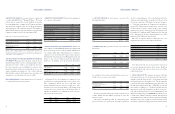

EARNINGS PER SHARE Net income per share is computed in

accordance with SFAS No. 128, “Earnings Per Share.” Net income

per basic share is computed based on the weighted average num-

ber of outstanding shares of common stock. Net income per diluted

share includes the weighted average effect of dilutive stock options

and restricted shares. The common stock issued to The Limited (43

million Class B shares) in connection with the incorporation of the

Company is assumed to have been outstanding for 1997.

Weighted Average Shares Outstanding (thousands):

1999 1998 1997

Shares of common stock issued 103,300 103,300 102,100

Treasury shares (429) (216) (78)

Basic shares 102,871 103,084 102,022

Dilutive effect of options and

restricted shares 4,770 3,118 934

Diluted shares 107,641 106,202 102,956

Options to purchase 5,690,000 and 456,000 shares of Class A Common Stock were out-

standing at year-end 1999 and 1997 but were not included in the computation of net

income per diluted share because the options’ exercise prices were greater than the aver-

age market price of the underlying shares.

USE OF ESTIMATES IN THE PREPARATION OF FINANCIAL

STATEMENTS The preparation of financial statements in con-

formity with generally accepted accounting principles requires

management to make estimates and assumptions that affect

the reported amounts of assets and liabilities as of the date of the

financial statements and the reported amounts of revenues and

expenses during the reporting period. Since actual results may

differ from those estimates, the Company revises its estimates and

assumptions as new information becomes available.

RECLASSIFICATIONS Certain amounts have been reclassified

to conform with current year presentation.

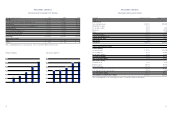

3. PROPERTY AND EQUIPMENT Property and equipment, at

cost, consisted of (thousands):

1999 1998

Land $114,007 –

Furniture, fixtures and equipment 158,753 $126,091

Beneficial leaseholds 7,349 7,349

Leasehold improvements 19,572 16,450

Construction in progress 26,100 2,728

Total $225,781 $152,618

Less: accumulated depreciation and amortization 79,378 63,060

Property and equipment, net $146,403 $089,558

4. LEASED FACILITIES AND COMMITMENTS Annual store

rent is comprised of a fixed minimum amount, plus contingent rent

based on a percentage of sales exceeding a stipulated amount. Store

lease terms generally require additional payments covering taxes,

common area costs and certain other expenses. Rent expense for

1998 and 1997 included charges from The Limited and its sub-

sidiaries for space under formal agreements that approximate

market rates. A summary of rent expense follows (thousands):

1999 1998 1997

Store rent:

Fixed minimum $51,086 $42,774 $34,402

Contingent 8,246 6,382 2,138

Total store rent $59,332 $49,156 $36,540

Buildings, equipment and other 2,574 1,814 1,400

Total rent expense $61,906 $50,970 $37,940

At January 29, 2000, the Company was committed to non-

cancelable leases with remaining terms of one to fifteen years.

These commitments include store leases with initial terms

ranging primarily from ten to fifteen years and offices and a

distribution center leased from an affiliate of The Limited with

a term of three years from the date of the Exchange Offer. A

summary of minimum rent commitments under noncance-

lable leases follows (thousands):

2000 $62,765 2003 $ 62,377

2001 $63,991 2004 $61,706

2002 $63,646 Thereafter 205,857

Abercrombie &Fitch Co.

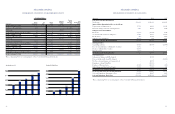

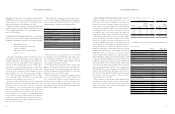

5. ACCRUED EXPENSES Accrued expenses consisted of the

following (thousands):

1999 1998

Rent and landlord charges $15,282 $13,368

Estimated cost to complete store construction 14,840 4,393

Compensation and benefits 11,588 9,800

Deferred revenue 8,482 –

Catalogue and advertising costs 7,005 8,701

Taxes, other than income 4,507 3,634

Other 23,669 23,986

Total $85,373 $63,882

6. INCOME TAXES The provision for income taxes consisted of

(thousands):

1999 1998 1997

Currently payable:

Federal $ 84,335 $65,778 $29,040

State 20,251 14,809 6,450

$104,586 $80,587 $35,490

Deferred:

Federal (3,885) (10,038) (2,620)

State (971) (2,509) (650)

$ (4,856) $(12,547) $ (3,270)

Total provision $ 99,730 $68,040 $32,220

A reconciliation between the statutory Federal income tax rate

and the effective income tax rate follows:

1999 1998 1997

Federal income tax rate 35.0% 35.0% 35.0%

State income tax, net of Federal

income tax effect 4.6% 4.7% 4.7%

Other items, net 0.4% 0.3% 0.3%

Total 40.0% 40.0% 40.0%

Income taxes payable included net current deferred tax assets

of $14.2 million and $9.5 million at January 29, 2000 and

January 30, 1999.

Subsequent to the Exchange Offer, the Company began fil-

ing its tax returns on a separate basis and made tax payments

directly to taxing authorities. Prior to the Exchange Offer, the

Company was included in the consolidated federal and certain

state income tax groups of The Limited for income tax purpos-

es. Under this arrangement, the Company was responsible for

and paid The Limited its proportionate share of income taxes,

calculated upon its separate taxable income at the estimated

annual effective tax rate. Amounts paid to The Limited totaled

$9.1 million, $27.4 million and $27.6 million in 1999, 1998 and

1997. Amounts paid directly to taxing authorities were $81.1

million and $31.7 million in 1999 and 1998.

The effect of temporary differences which gives rise to net

deferred income tax assets was as follows (thousands):

1999 1998

Deferred compensation $ 9,333 $ 9,228

Property and equipment 1,478 1,849

Rent 2,565 2,341

Accrued expenses 10,230 4,008

Inventory 1,650 2,093

Other, net – 882

Total deferred income taxes $25,256 $20,401

No valuation allowance has been provided for deferred tax

assets because management believes that it is more likely than

not that the full amount of the net deferred tax assets will be

realized in the future.

7. LONG-TERM DEBT The Company entered into a $150 mil-

lion syndicated unsecured credit agreement (the “Agreement”),

on April 30, 1998 (the “Effective Date”). Borrowings outstanding

under the Agreement are due April 30, 2003. The Agreement has

several borrowing options, including interest rates that are based on

the bank agent’s “Alternate Base Rate”, a LIBO Rate or a rate sub-

mitted under a bidding process. Facility fees payable under the

Agreement are based on the Company’s ratio (the “leverage ratio”)

of the sum of total debt plus 800% of forward minimum rent com-

mitments to trailing four-quarters EBITDAR and currently accrues

at .275% of the committed amount per annum. The Agreement

contains limitations on debt, liens, restricted payments (including

dividends), mergers and acquisitions, sale-leaseback transactions,

investments, acquisitions, hedging transactions and transactions