Abercrombie & Fitch 1999 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 1999 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

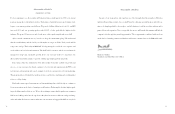

2120

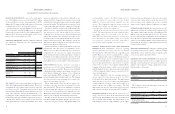

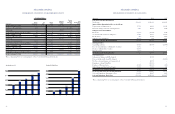

Abercrombie &Fitch Co. Abercrombie &Fitch Co.

(Thousands)1999 1998 1997

Cash Flows from Operating Activities

Net Income $149,604 $102,062 $ 48,322

Impact of Other Operating Activities on Cash Flows

Depreciation and Amortization 27,721 20,946 16,342

Non Cash Charge for Deferred Compensation 5,212 11,497 6,219

Change in Assets and Liabilities

Inventories (31,270) (10,065) 1,016

Accounts Payable and Accrued Expenses 15,446 37,530 22,309

Income Taxes (131) 10,758 4,606

Other Assets and Liabilities (12,773) 355 1,381

Net Cash Provided by Operating Activities 153,809 173,083 100,195

Investing Activities

Capital Expenditures (83,824) (41,876) (29,486)

Proceeds from Maturities of Marketable Securities 11,332 ––

Purchase of Marketable Securities (56,933) ––

Note Receivable (1,500) ––

Net Cash Used for Investing Activities (130,925) (41,876) (29,486)

Financing Activities

Settlement of Balance with The Limited –23,785 –

Decrease in Receivable from The Limited –– (29,202)

Net Proceeds from Issuance of Common Stock –25,875 –

Repayment of Long-Term Debt –(50,000) –

Purchase of Treasury Stock (50,856) (11,240) (929)

Other Changes in Shareholders’ Equity 12,316 1,270 144

Net Cash Used for Financing Activities (38,540) (10,310) (29,987)

Net Increase/(Decrease) in Cash and Equivalents (15,656) 120,897 40,722

Cash and Equivalents, Beginning of Year 163,564 42,667 1,945

Cash and Equivalents, End of Year $147,908 $163,564 $ 42,667

CONSOLIDATED STATEMENTS OF CASH FLOWS

The accompanying Notes are an integral part of these Consolidated Financial Statements.

CONSOLIDATED STATEMENTS OF SHAREHOLDERS’ EQUITY

Common Stock

Treasury

Retained Stock, Total

Shares Par Paid-In Earnings at Average Shareholders’

(Thousands)Outstanding Value Capital (Deficit) Cost Equity

Balance, February 1, 1997 102,100 $1,022 $117,469 $(107,253) – $ 11,238

Purchase of Treasury Stock (100) – – – $ (929) (929)

Net Income – – – 48,322 – 48,322

Stock Options, Restricted Stock and Other 18 – (8) – 152 144

Balance, January 31, 1998 102,018 $1,022 $117,461 $ (58,931) $ (777) $ 58,775

Purchase of Treasury Stock (490) – – – (11,240) (11,240)

Net Income – – – 102,062 – 102,062

Issuance of Common Stock 1,200 11 25,870 – – 25,881

Stock Options, Restricted Stock and Other 86 – 295 – 10,332 10,627

Balance, January 30, 1999 102,814 $1,033 $143,626 $ 43,131 $ (1,685) $ 186,105

Purchase of Treasury Stock (1,510) – – – (50,856) (50,856)

Net Income – – – 149,604 – 149,604

Stock Options, Restricted Stock and Other 700 – 3,679 – 22,562 26,241

Balance, January 29, 2000 102,004 $1,033 $147,305 $ 192,735 $(29,979) $ 311,094

The accompanying Notes are an integral part of these Consolidated Financial Statements.

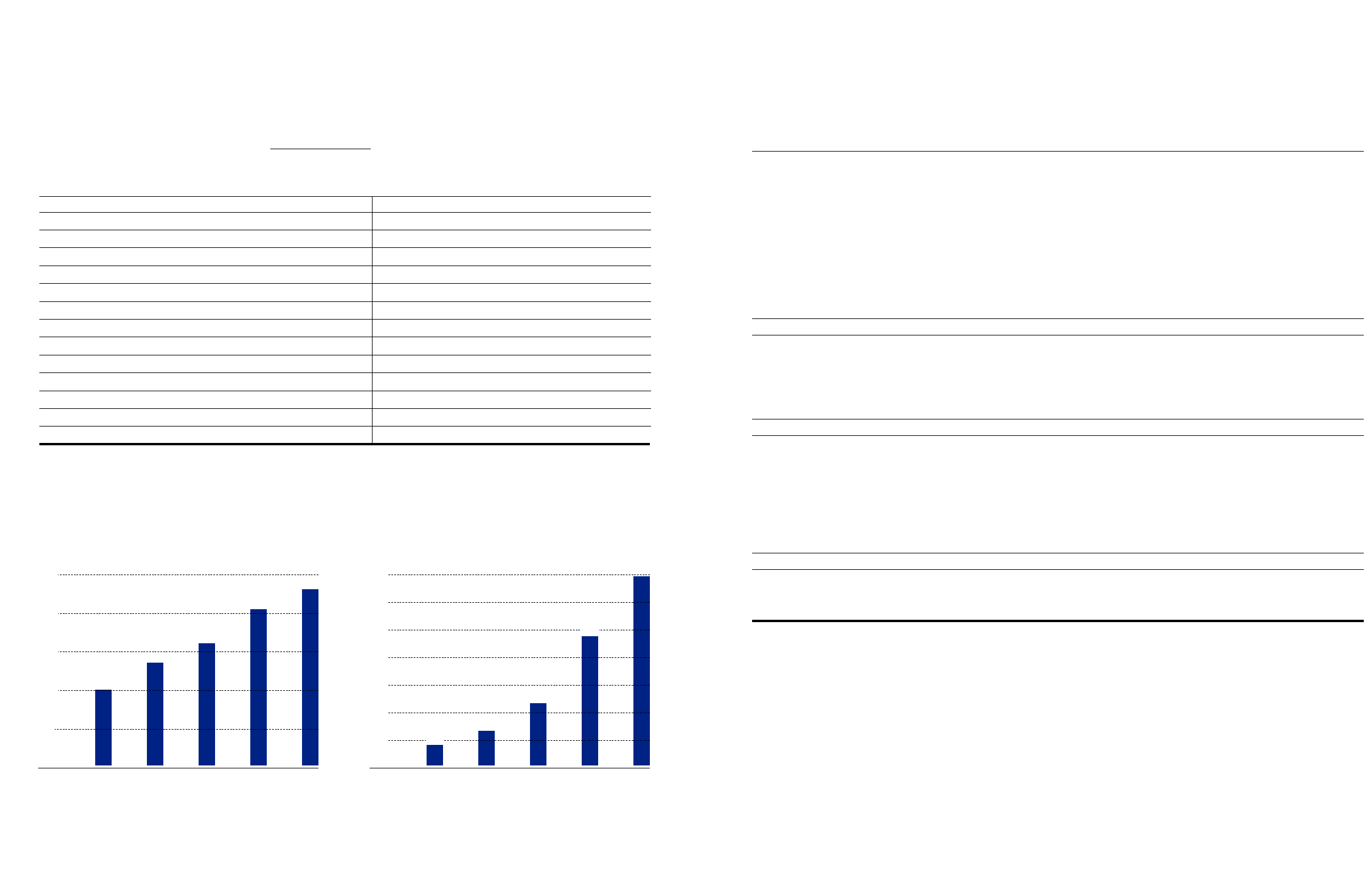

Operating Income (%)

95 96 97 98 99

10.1%

13.7%

16.1%

20.5%

23.2%

25.0%

20.0%

15.0%

10.0%

5.0%

Earning Per Diluted Share

95 96 97 98 99

$1.40

$1.20

$1.00

$0.80

$0.60

$0.40

$0.20 $0.17

$0.27

$0.47

$0.96

$1.39