Aarons 2004 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2004 Aarons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

16

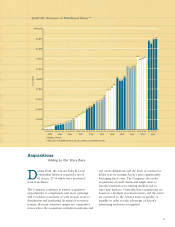

Revenues

The 19.7% increase in total revenues in 2003 from 2002

is primarily attributable to continued growth in our sales

and lease ownership division from both the opening and

acquisition of new Company-operated stores and improve-

ment in same store revenues. Revenues for our sales and

lease ownership division increased $137.5 million to $656.5

million in 2003 compared with $519.0 million in 2002, a

26.5% increase. This increase was attributable to a 10.1%

increase in same store revenues and the addition of 136

Company-operated stores since the beginning of 2002. Total

revenues were impacted by a decrease in rent-to-rent division

revenues, which decreased $11.4 million to $110.3 million

in 2003 from $121.7 million in 2002, a 9.3% decrease, due

primarily to a decline in same store revenues as well as a net

reduction of 15 stores since the beginning of 2002.

The 20.6% increase in rentals and fees revenues was

attributable to a $100.9 million increase from our sales and

lease ownership division related to the growth in same store

revenues and the increase in the number of stores described

above. The growth in our sales and lease ownership division

was offset by a $6.3 million decrease in rental revenues in

our rent-to-rent division. The decrease in rent-to-rent division

revenues is primarily the result of the decline in same store

revenues and the net reduction in stores described above.

Revenues from retail sales fell 5.4% due to a decrease of

$4.6 million in our rent-to-rent division caused by the decline

in same store revenues and the store closures described

above, partially offset by an increase of $0.7 million in our

sales and lease ownership division caused by the increase in

same store revenues and the increase in the number of stores

also described above. This increase in our sales and lease

ownership division was negatively impacted by the intro-

duction of an alternative shorter-term lease, which replaced

many retail sales.

The 35.3% increase in non-retail sales in 2003 reflects the

significant growth of our franchise operations.

The 20.4% increase in other revenues was primarily

attributable to franchise fees, royalty income, and other

related revenues from our franchise stores increasing $2.7

million, or 16.5%, to $19.3 million compared with $16.6

million to establish a rental merchandise allowance reserve.

We expect rental merchandise adjustments in the future

under this new method to be materially consistent with

adjustments under the former method. In addition, as dis-

cussed above, the revision of certain estimates related to our

accrual for group health self-insurance resulted in a reduction

in expenses of $1.4 million in 2004, partially offsetting the

merchandise allowance reserve expense.

The 29.5% increase in depreciation of rental merchandise

was driven by the growth of our sales and lease ownership

division described above. As a percentage of total rentals and

fees, depreciation of rental merchandise increased slightly

to 36.5% in 2004 from 35.3% in 2003. The increase as a

percentage of rentals and fees reflects increased depreciation

expense as a result of a larger number of short-term leases

in 2004 as described above under retail sales.

The decrease in interest expense as a percentage of total

revenues is primarily due to the growth of our sales and lease

ownership division related to increased same-store revenues

and store count described above.

The 48.9% increase in income tax expense between years

is primarily attributable to a comparable increase in pretax

income in addition to a slightly higher effective tax rate of

37.7% in 2004 compared to 37.0% in 2003 arising from

higher state income taxes.

Net Earnings

The 44.4% increase in net earnings was primarily due to

the maturing of Company-operated sales and lease ownership

stores opened and acquired over the past several years; an

11.6% increase in same store revenues; a 29.8% increase in

franchise fees, royalty income, and other related franchise

income; and the recognition of a $3.4 million after-tax

gain on the sale of Rainbow Rentals common stock. As

a percentage of total revenues, net earnings improved to

5.6% in 2004 from 4.8% in 2003.

Year Ended December 31, 2003 Versus Year Ended

December 31, 2002

The following table shows key selected financial data for

the years ended December 31, 2003 and 2002, and the

changes in dollars and as a percentage to 2003 from 2002.

Year Ended Year Ended Increase/ % Increase/

December 31, December 31, (Decrease) in Dollars (Decrease) to

(In Thousands) 2003 2002 to 2003 from 2002 2003 from 2002

REVENUES:

Rentals and Fees $553,773 $459,179 $ 94,594 20.6%

Retail Sales 68,786 72,698 (3,912) (5.4)

Non-Retail Sales 120,355 88,969 31,386 35.3

Other 23,883 19,842 4,041 20.4

766,797 640,688 126,109 19.7

COSTS AND EXPENSES:

Retail Cost of Sales 50,913 53,856 (2,943) (5.5)

Non-Retail Cost of Sales 111,714 82,407 29,307 35.6

Operating Expenses 344,884 293,346 51,538 17.6

Depreciation of Rental Merchandise 195,661 162,660 33,001 20.3

Interest 5,782 4,767 1,015 21.3

708,954 597,036 111,918 18.7

EARNINGS BEFORE INCOME TAXES 57,843 43,652 14,191 32.5

INCOME TAXES 21,417 16,212 5,205 32.1

NET EARNINGS $ 36,426 $ 27,440 $ 8,986 32.7%