Aarons 2004 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2004 Aarons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

12

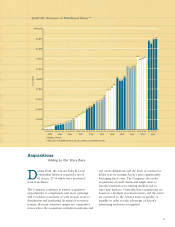

Selected Financial Information

Year Ended Year Ended Year Ended Year Ended Year Ended

(Dollar Amounts in Thousands, December 31, December 31, December 31, December 31, December 31,

Except Per Share) 2004 2003 2002 2001 2000

OPERATING RESULTS

Revenues:

Rentals & Fees $694,293 $553,773 $459,179 $403,385 $359,880

Retail Sales 56,259 68,786 72,698 60,481 62,417

Non-Retail Sales 160,774 120,355 88,969 66,212 65,498

Other 35,154 23,883 19,842 16,603 15,125

946,480 766,797 640,688 546,681 502,920

Costs & Expenses:

Retail Cost of Sales 39,380 50,913 53,856 43,987 44,156

Non-Retail Cost of Sales 149,207 111,714 82,407 61,999 60,996

Operating Expenses 414,518 344,884 293,346 276,682 227,587

Depreciation of Rental Merchandise 253,456 195,661 162,660 137,900 120,650

Interest 5,413 5,782 4,767 6,258 5,625

861,974 708,954 597,036 526,826 459,014

Earnings Before Income Taxes 84,506 57,843 43,652 19,855 43,906

Income Taxes 31,890 21,417 16,212 7,519 16,645

Net Earnings $ 52,616 $ 36,426 $ 27,440 $ 12,336 $ 27,261

Earnings Per Share $ 1.06 $ .74 $ .58 $ .28 $ .61

Earnings Per Share Assuming Dilution 1.04 .73 .57 .27 .61

Dividends Per Share:

Common $ .039 $ .022 $ .018 $ .018 $ .018

Class A .039 .022 .018 .018 .018

FINANCIAL POSITION

Rental Merchandise, Net $425,567 $343,013 $317,287 $258,932 $267,713

Property, Plant & Equipment, Net 111,118 99,584 87,094 77,282 63,174

Total Assets 700,288 559,884 487,468 403,881 387,657

Interest-Bearing Debt 116,655 79,570 73,265 77,713 104,769

Shareholders’ Equity 375,178 320,186 280,545 219,967 208,538

AT YEAR END

Stores Open:

Company-Operated 674 560 482 439 361

Franchised 357 287 232 209 193

Rental Agreements in Effect 582,000 464,800 369,000 314,600 281,000

Number of Employees 6,400 5,400 4,800 4,200 3,900

The Company adopted Statement of Financial Accounting Standards No. 142, Goodwill and Other Intangible Assets, on

January 1, 2002. If the Company had applied the non-amortization provisions of Statement 142 for all periods presented, net

earnings and diluted net earnings per share would have increased by approximately $688,000 ($.013 per share) and $431,000

($.009 per share) for the years ended December 31, 2001 and 2000, respectively.