Aarons 2004 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2004 Aarons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

15

Revenues

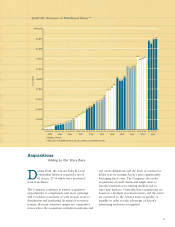

The 23.4% increase in total revenues in 2004 from 2003

is primarily attributable to continued growth in our sales

and lease ownership division, from both the opening and

acquisition of new Company-operated stores and improve-

ment in same store revenues. Revenues for our sales and

lease ownership division increased $174.6 million to $831.1

million in 2004 compared with $656.5 million in 2003, a

26.6% increase. This increase was attributable to an 11.6%

increase in same store revenues and the addition of 204

Company-operated stores since the beginning of 2003.

The 25.4% increase in rentals and fees revenues was

attributable to a $139.8 million increase from our sales and

lease ownership division related to the growth in same store

revenues and the increase in the number of stores described

above. Rental revenues in our rent-to-rent division increased

by $0.7 million to $76.0 million in 2004 from $75.3 million

in 2003.

Revenues from retail sales fell 18.2% due to a decline of

$11.6 million in our sales and lease ownership division, which

reflects a decreased focus on retail sales in certain stores and

the impact of the introduction of an alternative shorter-term

lease, which we believe replaced many retail sales.

The 33.6% increase in non-retail sales in 2004 reflects

the significant growth of our franchise operations.

The 47.2% increase in other revenues is primarily

attributable to recognition of a $5.5 million pretax gain

on the sale of our holdings of Rainbow Rentals common

stock in connection with that company’s merger with Rent-

A-Center, Inc., and franchise fees, royalty income, and other

related revenues from our franchise operations increasing

$5.8 million, or 29.8%, to $25.1 million in 2004 compared

with $19.3 million for 2003. Of this increase, royalty income

from franchisees increased $3.8 million to $17.8 million in

2004 compared to $14.0 million in 2003, with increased

franchise and financing fee revenues comprising the majority

of the remainder. This franchisee-related revenue growth

reflects the net addition of 125 franchised stores since the

beginning of 2003 and improving operating revenues at

maturing franchised stores.

Cost of Sales

The 22.7% decrease in retail cost of sales is primarily

a result of a decrease in retail sales in our sales and lease

ownership division for the same reasons discussed under

retail sales revenue above. Retail cost of sales as a percentage

of retail sales decreased to 70.0% in 2004 from 74.0% in

2003 due to the 2004 discontinuation of certain low-margin

retail sales.

Cost of sales from non-retail sales increased 33.6%,

primarily due to the growth of our franchise operations

as described above, corresponding to the similar increase

in non-retail sales. As a percentage of non-retail sales,

non-retail cost of sales remained steady at 92.8% in

both 2004 and 2003.

Expenses

The 20.2% increase in 2004 operating expenses was due

primarily to the growth of our sales and lease ownership

division described above. As a percentage of total revenues,

operating expenses improved to 43.8% for 2004 from 45.0%

for 2003, with the decrease driven by the maturing of new

Company-operated sales and lease ownership stores added

over the past several years and an 11.6% increase in same

store revenues.

As explained in our discussion of critical accounting

policies above, effective September 30, 2004, we began

recording rental merchandise carrying value adjustments

on the allowance method rather than the direct write-off

method. In connection with the change of methods, we

recorded a catch-up adjustment of approximately $2.5

Year Ended Year Ended Increase/ % Increase/

December 31, December 31, (Decrease) in Dollars (Decrease) to

(In Thousands) 2004 2003 to 2004 from 2003 2004 from 2003

REVENUES:

Rentals and Fees $694,293 $553,773 $140,520 25.4%

Retail Sales 56,259 68,786 (12,527) (18.2)

Non-Retail Sales 160,774 120,355 40,419 33.6

Other 35,154 23,883 11,271 47.2

946,480 766,797 179,683 23.4

COSTS AND EXPENSES:

Retail Cost of Sales 39,380 50,913 (11,533) (22.7)

Non-Retail Cost of Sales 149,207 111,714 37,493 33.6

Operating Expenses 414,518 344,884 69,634 20.2

Depreciation of Rental Merchandise 253,456 195,661 57,795 29.5

Interest 5,413 5,782 (369) (6.4)

861,974 708,954 153,020 21.6

EARNINGS BEFORE INCOME TAXES 84,506 57,843 26,663 46.1

INCOME TAXES 31,890 21,417 10,473 48.9

NET EARNINGS $ 52,616 $ 36,426 $ 16,190 44.4%

Results of Operations

Year Ended December 31, 2004 Versus Year Ended December 31, 2003

The following table shows key selected financial data for the years ended December 31, 2004 and 2003, and the changes in

dollars and as a percentage to 2004 from 2003.