Zynga 2015 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2015 Zynga annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

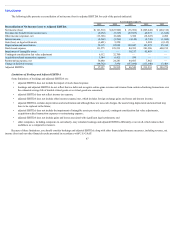

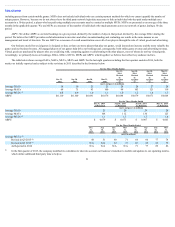

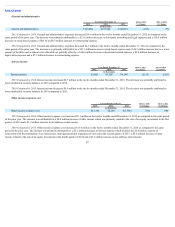

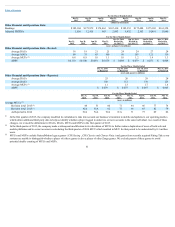

unique payers and excludes bookings from certain payment methods for which we cannot quantify the number of unique payers. Also excluded are bookings

from advertising, NaturalMotion legacy games ( CSR Racing , CSR Classics and Clumsy Ninja ) and games from recently acquired Rising Tide .

MUPs exclude payers of NaturalMotion legacy games and games from recently acquired Rising Tide as our systems are unable to distinguish whether a

player of these games is also a player of other Zynga games. We exclude payers of these games to avoid potential double counting of MUPs.

Monthly unique payer bookings per MUP is calculated by dividing average monthly unique payer bookings by average MUPs. This calculation excludes

MUP data for NaturalMotion legacy games and games from recently acquired Rising Tide.

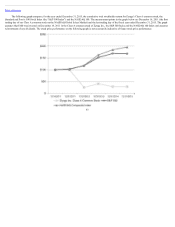

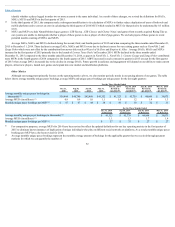

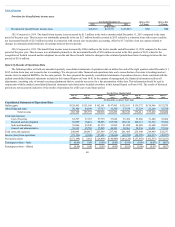

Average monthly unique payer bookings grew during the first and second quarters of 2015 and declined in the third and fourth quarters of 2015 and when

comparing the three months ended December 31, 2015 to December 31, 2014. Growth in average monthly unique payer bookings in the first and second quarter of

2015 was due to the bookings contribution from Wizard of Oz Slots (launched in November 2014) and Empires & Allies (launched in May 2015). Declines in

average monthly unique payer bookings in the third and fourth quarters of 2015 and when comparing the three months ended December 31, 2015 to December 31,

2014 were due to the decline in bookings and users in our existing web and multiplatform games, such as FarmVille 2 , Zynga Poker and Hit It Rich! Slots and

older mobile titles such as FarmVille 2: Country Escape which were not offset by the contribution from newer titles. Monthly unique payer bookings per MUP

increased to $47 in the third and fourth quarters of 2015 due to MUP decreasing faster than unique payer bookings for those periods.

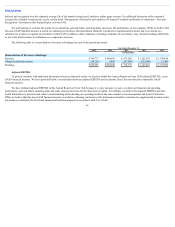

Although we monitor our unique payer metrics, we focus on monetization, including through in-game advertising, of all of our players and not just those

who are payers. Accordingly, we strive to enhance content and our players’ game experience to increase our bookings and ABPU, which is a measure of overall

monetization across all of our players through the sale of virtual goods and advertising.

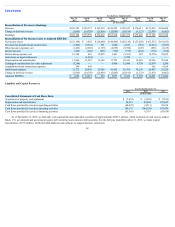

Recent Developments

• GameLaunches. We launched several new games in 2015, including Words on Tour , Empires & Allies , Mountain Goat Mountain and Black

Diamond Casino on mobile platforms and FarmVille: Harvest Swap and Princess Bride Slots on mobile and web platforms. We also launched a

localized version of Words With Friends in six new languages, including Spanish, French, German and Italian.

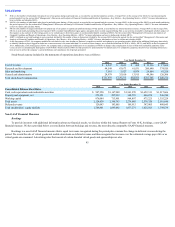

• MobileGrowth.In 2015, we delivered a 35% increase in mobile bookings year over year and a 61% increase in mobile revenue year over year. This

increase was driven by the continued success of our Slots franchise, including Hit it Rich! Slots, Wizard of Oz Slots and the launch of new mobile titles

in 2015, including Empires & Allies .

• ChangesinExecutiveTeam. On April 8, 2015, Don Mattrick resigned as Chief Executive Officer. The Board appointed Mark Pincus, Zynga’s

Founder and Chairman of the Board, as Zynga’s Chief Executive Officer. Mr. Pincus had previously served as Zynga’s Chief Executive Officer from

April 2007 to July 2013. In addition, he served as Chief Product Officer from April 2007 to April 2014 and has served as Chairman of the Board since

April 2007.

On April 19, 2015, Clive Downie resigned as Chief Operating Officer.

On November 3, 2015, Chief Financial Officer David Lee resigned as CFO. Zynga has initiated a search for a replacement CFO and until a new CFO

is appointed, Michelle Quejado, Zynga’s Chief Accounting Officer, is serving as interim CFO.

• 2015Restructuring.In the first quarter of 2015, we implemented a restructuring plan which included a reduction in workforce and the closure of the

Beijing, China office. In total, we recorded a charge of $3.8 million in the twelve months ended December 31, 2015 related to this plan.

53

(3)

(4)