Zynga 2015 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2015 Zynga annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

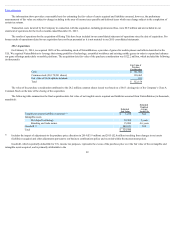

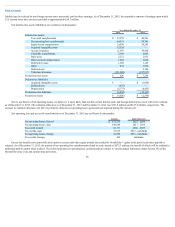

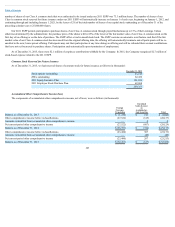

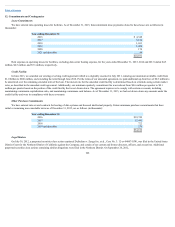

In connection with the 2015 employee bonus program, the company recognized $4.4 million of stock-based expense for the twelve months ended

December 31, 2015. This amount was accrued based on certain performance criteria and the passage of time and recognized as a liability based on the estimated

fair value as of the reporting date. Upon settlement, according to the conditions specified in the agreement, approximately 4.2 million shares would be issued for an

estimated total liability of $11.2 million based upon Company’s closing stock price as of December 31, 2015 of $2.68.

As of December 31, 2015, total unrecognized stock-based expense of $7.6 million and $20.6 million related to unvested stock options and restricted shares of

common stock, respectively, is expected to be recognized over a weighted-average recognition period of approximately 1.25 and 1.13 years, respectively.

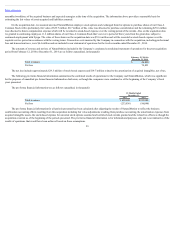

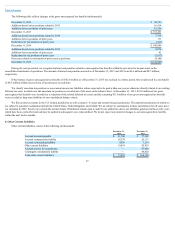

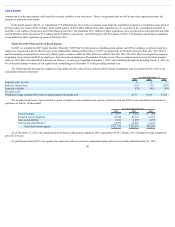

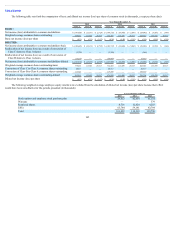

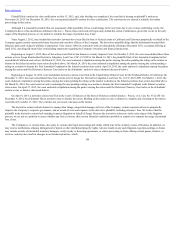

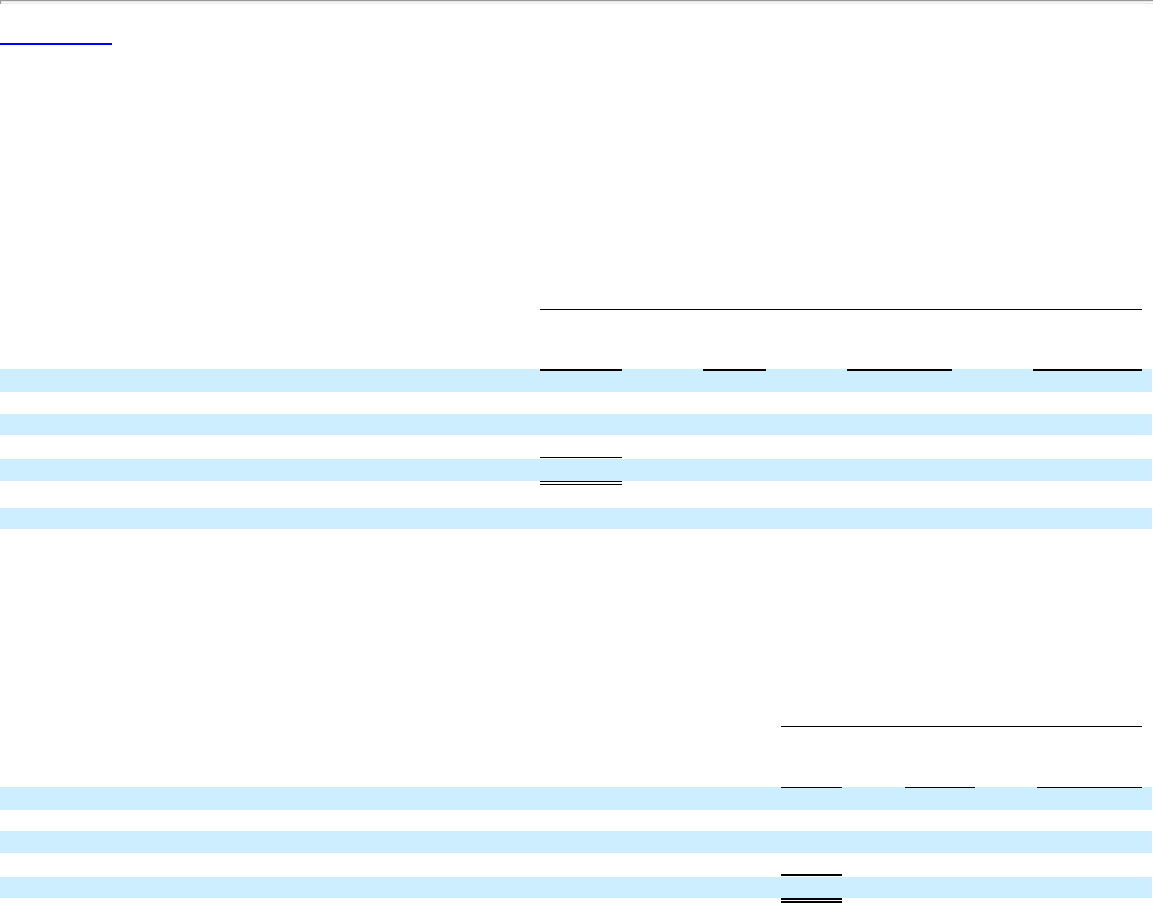

The following table shows stock option activity for the year ended December 31, 2015 (in thousands, except weighted-average exercise price and remaining

contractual term):

Outstanding Options

Stock Options

Weighted-

Average

Exercise

Price

Aggregate

Intrinsic Value of

Stock Options

Outstanding

Weighted-

Average

Contractual Term

(in years)

Balance as of December 31, 2014 39,460 $ 2.22 $ 47,347 6.74

Granted 305 2.99

Forfeited and cancelled (12,510) 3.37

Exercised (4,040) 0.42

Balance as of December 31, 2015 23,215 $ 1.93 $ 35,949 5.36

As of December 31, 2015

Exercisable options 20,076 $ 1.30 $ 33,252 5.01

Vested and expected to vest 22,825 $ 1.40 $ 35,834 5.31

The aggregate intrinsic value of options exercised during the years ended December 31, 2015, 2014, and 2013 was $9.1 million, $25.1 million, and $85.9

million, respectively. The total grant date fair value of options that vested during the years ended December 31, 2015, 2014, and 2013 was $10.2 million, $6.6

million, and $12.8 million, respectively.

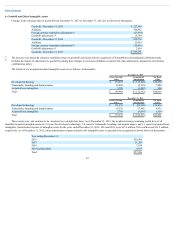

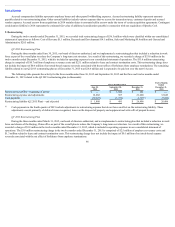

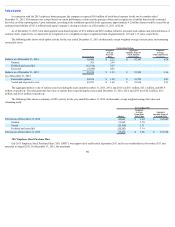

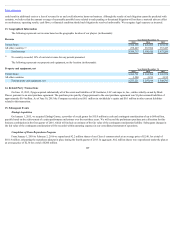

The following table shows a summary of ZSU activity for the year ended December 31, 2015 (in thousands, except weighted-average fair value and

remaining term):

Outstanding ZSUs

Shares

Weighted-

Average

Grant Date

Fair Value

Aggregate

Intrinsic Value of

Unvested ZSUs

Unvested as of December 31, 2014 69,883 $ 3.64 $ 185,889

Granted 51,962 2.70

Vested (29,106) 3.71

Forfeited and cancelled (30,303) 3.14

Unvested as of December 31, 2015 62,436 $ 3.06 $ 167,328

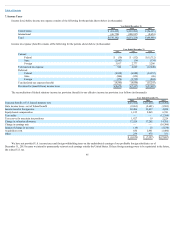

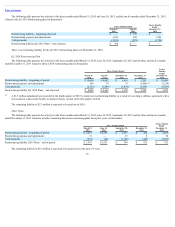

2011EmployeeStockPurchasePlan

Our 2011 Employee Stock Purchase Plan (“2011 ESPP”), was approved by our Board in September 2011 and by our stockholders in November 2011 and

amended in August 2012. On December 31, 2015, the maximum

102