Xcel Energy 2000 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2000 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

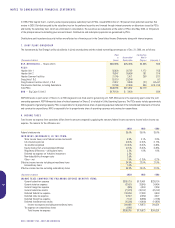

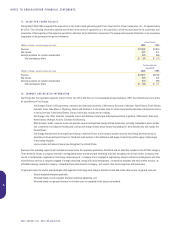

Letters of Credit

Xcel Energy and its subsidiaries use letters of credit, generally with terms of one year, to provide financial guarantees for certain operating obligations. In

addition, NRG uses letters of credit for nonregulated equity commitments, collateral for credit agreements, fuel purchase and operating commitments, and

bids on development projects. At Dec. 31, 2000, there were $113 million in letters of credit outstanding, including $58 million related to NRG commitments.

The contract amounts of these letters of credit approximate their fair value and are subject to fees determined in the marketplace.

14. COMMITMENTS AND CONTINGENT LIABILITIES

Legislative Resource Commitments

In 1994, NSP-Minnesota received Minnesota legislative approval for additional on-site temporary spent fuel storage facilities at its Prairie Island nuclear

power plant, provided NSP-Minnesota satisfies certain requirements. Seventeen dry cask containers were approved. As of Dec. 31, 2000, NSP-Minnesota had

loaded twelve casks. The Minnesota Legislature established several energy resource and other commitments for NSP-Minnesota to obtain the Prairie Island

temporary nuclear fuel storage facility approval. These commitments can be met by building, purchasing, or in the case of biomass, converting generation resources.

The 1994 legislation requires NSP-Minnesota to have 425 megawatts of wind resources contracted by Dec. 31, 2002. Of this commitment, approximately

80 megawatts remain to be contracted. During 1999, the MPUC ordered an additional 400 megawatts to be contracted by 2012, subject to least-cost deter-

minations. The 1994 legislation also requires NSP-Minnesota to contract for 125 megawatts of biomass-fueled energy, which has essentially been fulfilled.

Other commitments established by the Legislature include a discount for low-income electric customers, required conservation improvement expenditures

and various study and reporting requirements to a legislative electric energy task force. NSP-Minnesota has implemented programs to meet the legislative

commitments. NSP-Minnesota’s capital commitments include the known effects of the Prairie Island legislation. The impact of the legislation on future

power purchase commitments and other operating expenses is not yet determinable.

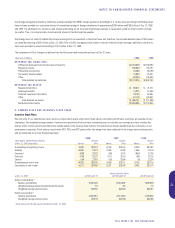

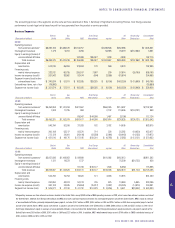

Capital Commitments

As discussed in Liquidity and Capital under Management’s Discussion and Analysis, the estimated cost, as of Dec. 31, 2000, of the capital expenditure programs

of Xcel Energy and its subsidiaries and other capital requirements is approximately $5.0 billion in 2001, $3.0 billion in 2002 and $3.3 billion in 2003.

The capital expenditure programs of Xcel Energy are subject to continuing review and modification. Actual utility construction expenditures may vary from

the estimates due to changes in electric and natural gas projected load growth, the desired reserve margin and the availability of purchased power, as well

as alternative plans for meeting Xcel Energy’s long-term energy needs. In addition, Xcel Energy’s ongoing evaluation of merger, acquisition and divestiture

opportunities to support corporate strategies, address restructuring requirements and comply with future requirements to install emission control equipment

may impact actual capital requirements.

Xcel Energy’s capital expenditures include approximately $3.1 billion in 2001 for NRG investments and asset acquisitions. NRG’s future capital requirements

may vary significantly. For 2001, NRG’s capital requirements reflect expected acquisitions of existing generation facilities, including the Conectiv fossil

assets, North Valmy, LS Power, Clark gas-fired assets, Reid Gardner coal-fired assets and the Bridgeport and New Haven Harbor coal-fired facilities.

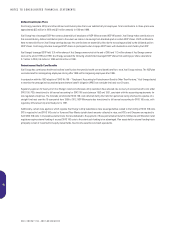

California Power Market

NRG operates in and sells to the wholesale power market in California. During the fourth quarter of 2000, the inability of certain California utilities to

recover rising energy costs through regulated prices charged to retail customers created financial difficulties. The California utilities have appealed to state

agencies and regulators for the opportunity to be reimbursed for costs incurred that are not currently recoverable through the existing rate structure.

Absent such relief, some of the utilities have indicated they may be unable to continue to service their debt and/or otherwise pay obligations, or would

consider discontinuing energy service to customers to avoid incurring costs that are not recoverable. Due to these circumstances, various bond rating

agencies have lowered the credit rating of the California utilities to below investment grade. California state agencies and regulators, along with federal

agencies such as the FERC have characterized the situation as a national emergency. Although changes may be necessary in the California utility regulatory

model to address the problem in the long run, in the short term the alternatives being discussed include financial support for distressed utilities to ensure

continued energy service to California customers. However, at this time it is unknown whether or when such financial support will be made available to

California utilities.

At Dec. 31, 2000, NRG had not yet collected approximately $105 million in revenues from distressed utilities and the independent system operator in

California, which are potentially at risk if financial relief or support is not provided. In addition, Xcel Energy’s wholesale trading operation has a receivable

from the California Independent System Operator for approximately $3 million. Although there is uncertainty as to the final resolution of this matter,

management believes that its revenue from California utilities and the independent system operator will ultimately be collected.

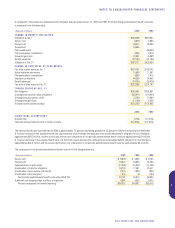

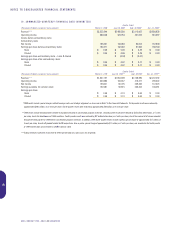

Tax Matters

PSR Investments, Inc. (PSRI), a subsidiary of PSCo, owns and manages permanent life insurance policies on certain past and present employees. The IRS

has issued a Notice of Proposed Adjustment proposing to disallow interest expense related to corporate-owned life insurance (COLI) policy loans taken in

56

XCEL ENERGY INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS