Xcel Energy 2000 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2000 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Certain employees also may be awarded restricted stock under Xcel Energy’s incentive plans. We hold restricted stock until restrictions lapse; 50 percent of

the stock vests one year from the date of the award and the other 50 percent vests two years from the date of the award. We reinvest dividends on the shares

we hold while restrictions are in place. Restrictions also apply to the additional shares acquired through dividend reinvestment. We granted 58,690 restricted

shares in 2000, 52,688 restricted shares in 1999 and 49,651 restricted shares in 1998. Compensation expense related to these awards was immaterial.

The NCE/NSP merger was a “change in control” under the NSP incentive plan, so all stock option and restricted stock awards under that plan became fully

vested and exercisable as of the merger date. The NCE/NSP merger did not constitute a change in control under the NCE incentive plans, so there was no accel-

erated vesting of stock options issued under them. When NCE and NSP merged, each outstanding NCE stock option was converted to 1.55 Xcel Energy options.

We apply Accounting Principles Board Opinion No. 25 in accounting for its stock-based compensation and, accordingly, no compensation cost is recognized

for the issuance of stock options as the exercise price of the options equals the fair-market value of our common stock at the date of grant. If we had used

the SFAS 123 method of accounting, earnings would have been reduced by approximately 2 cents per share for 2000 and approximately 1 cent per share

per year for 1999 and 1998.

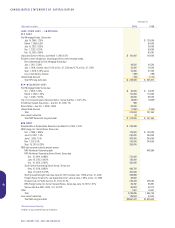

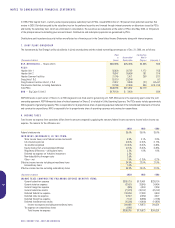

The fair value of each option grant is estimated on the date of grant using the Black-Scholes Option-Pricing Model with the following assumptions:

2000 1999 1998

Expected option life 3–5 years 5–10 years 5–10 years

Stock volatility 15% 15–21% 14–15%

Risk-free interest rate 5.3–6.5% 4.7–6.4% 5.1–5.6%

Dividend yield 5.4–7.5% 5.4% 5.2–5.4%

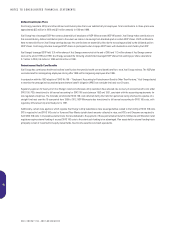

Dividend Restrictions

The Articles of Incorporation of both NSP-Minnesota and Xcel Energy place restrictions on the amount of common stock dividends they can pay when

preferred stock is outstanding. NSP-Minnesota has no outstanding preferred stock, so these restrictions would not apply. Xcel Energy has outstanding

preferred stock. It could have paid approximately $2.75 billion in additional common stock dividends before restrictions would apply.

In addition, NSP-Minnesota’s first mortgage indenture places certain restrictions on the amount of cash dividends it can pay to Xcel Energy, the holder of its common

stock. Even with these restrictions, NSP-Minnesota could have paid more than $800 million in additional cash dividends on common stock at Dec. 31, 2000.

Shareholder Rights

In 2000, Xcel Energy adopted a shareholder protection rights plan. This rights plan is subject to approval by the SEC. The plan is designed to protect shareholders’

interests in the event we are ever confronted with an unfair or inadequate acquisition proposal. Pursuant to this plan and assuming SEC approval, each share of

common stock has one right entitling the holder to purchase a share of Xcel Energy common stock under certain circumstances. The rights become exercisable if

any person or group acquires 15 percent or more of Xcel Energy’s common stock. Under certain circumstances, the holders of the rights will be entitled to purchase

either shares of Xcel Energy common stock or common stock of any acquirer of Xcel Energy at a reduced percentage of market value. The rights are scheduled to

expire in 2011.

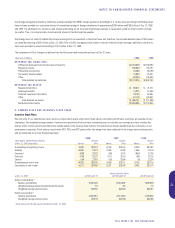

10. BENEFIT PLANS AND OTHER POSTRETIREMENT BENEFITS

Xcel Energy offers various benefit plans to its benefit employees. Approximately 45 percent of benefit employees are represented by several local labor

unions under several collective-bargaining agreements. At Dec. 31, 2000, NSP-Minnesota and NSP-Wisconsin had 2,598 union employees covered under a

collective-bargaining agreement, which expires at the end of 2004. PSCo had 1,969 union employees covered under a collective-bargaining agreement,

which expires in May 2003. SPS had 776 union employees covered under a collective-bargaining agreement, which expires in October 2002.

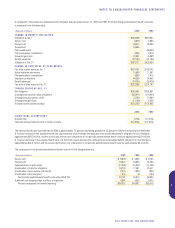

Pension Benefits

Xcel Energy has several noncontributory, defined benefit pension plans that cover almost all utility employees. Benefits are based on a combination of years

of service, the employee’s average pay and Social Security benefits.

Xcel Energy’s policy is to fully fund into an external trust the actuarially determined pension costs recognized for ratemaking and financial reporting purposes,

subject to the limitations of applicable employee benefit and tax laws. Plan assets principally consist of the common stock of public companies, corporate

bonds and U.S. government securities.

48

XCEL ENERGY INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS