Windstream 2008 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2008 Windstream annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

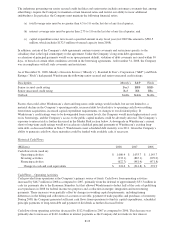

Proceeds received from borrowings in 2007, net of issuance costs, totaled $848.9 million, while repayments of

borrowings were $811.0 million. During 2007, the Company issued $500.0 million in senior unsecured notes due 2019.

These proceeds were used to retire $500.0 million in principal borrowings under Tranche B of the senior secured credit

facilities, which was refinanced through this transaction to lower the interest rate on the remainder of Tranche B and

modify the pre-payment provisions. The remaining borrowings totaling $350.0 million in 2007 were from the

Company’s revolving line of credit, which was used in part to fund the acquisition of CTC. The remaining repayments

during 2007 included the payoff of $37.5 million of debt obligations assumed from CTC, payments to reduce amounts

outstanding under the revolving line of credit of $250.0 million and scheduled principal payments on the Company’s

outstanding borrowings. As a result, net amounts due under the revolving credit agreement increased $100.0 million

during 2007.

Proceeds received from borrowings in 2006, net of issuance costs, totaled $3,156.1 million, while repayments of

borrowings were $871.4 million. In conjunction with the spin off from Alltel, the Company incurred $2.4 billion of

borrowings under its senior secured credit agreement. In conjunction with the merger with Valor, the Company issued

$800.0 million of subsidiary debt due 2013. The proceeds from these offerings were used in part to pay the special

dividend to Alltel, to repay $780.6 million of debt assumed from Valor, to repay $80.8 million of debt previously

issued by the Company’s wireline operating subsidiaries, and to make other scheduled principal payments on

outstanding borrowings.

Off-Balance Sheet Arrangements

We do not use securitization of trade receivables, affiliation with special purpose entities, variable interest entities or

synthetic leases to finance our operations. Additionally, we have not entered into any arrangement requiring us to

guarantee payment of third party debt or to fund losses of an unconsolidated special purpose entity. During March

2007, the Company sold certain customer receivables for approximately $1.9 million that had previously been deemed

uncollectible to a third party collection agency without recourse. The Company may enter into similar transactions in

the future in the normal course of business.

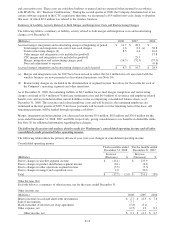

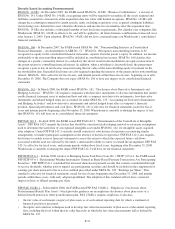

Contractual Obligations and Commitments

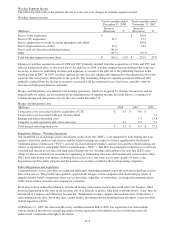

Set forth below is a summary of our material contractual obligations and commitments as of December 31, 2008:

Payments due by Period

(Millions)

Less than

1 Year

1-3

Years

3-5

Years

More than

5 years Total

Long-term debt, including current maturities (a) $ 24.3 $ 477.8 $ 2,160.5 $ 2,746.0 $ 5,408.6

Interest payments on long-term debt obligations (b) 396.1 781.3 723.4 788.7 2,689.5

Operating leases 24.3 34.2 6.3 0.1 64.9

Purchase obligations (c) 42.0 24.0 0.2 - 66.2

Other long-term liabilities and commitments (d) (e) (f) (g) 112.2 182.7 95.2 1,391.9 1,782.0

Total Contractual obligations and commitments $ 598.9 $ 1,500.0 $ 2,985.6 $ 4,926.7 $ 10,011.2

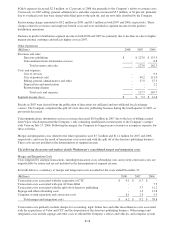

Notes:

(a) Excludes $26.1 million of unamortized discounts (net of premiums) included in long-term debt at December 31,

2008.

(b) Variable rates on tranches A and B of the senior secured credit facilities are calculated in relation to LIBOR,

which was 4.55 percent at December 31, 2008.

(c) Purchase obligations include open purchase orders not yet receipted and amounts payable under noncancellable

contracts. The portion attributable to noncancellable contracts primarily represents agreements for network

capacity and software licensing.

(d) Other long-term liabilities primarily consist of deferred tax liabilities, pension and other postretirement benefit

obligations and interest rate swaps.

(e) Excludes $7.4 million of reserves for uncertain tax positions, including interest and penalties, that were included

in other liabilities at December 31, 2008 for which the Company is unable to make a reasonably reliable estimate

as to when cash settlements with taxing authorities will occur.

(f) Includes $40.5 million and $15.4 million in current portion of interest rate swaps and postretirement benefit

obligations, respectively that were included in current portion of interest rate swaps and other current liabilities at

December 31, 2008.

F-25