Western Digital 2010 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2010 Western Digital annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The growth opportunity in the hard drive market has been created

in large part by our ability to continually drive down average cost

per gigabyte, leading to attractive price points that have driven

mass market adoption of devices incorporating hard drive storage.

At the same time, we have gradually expanded gross margins

while growing revenues by continuously increasing efciencies and

reducing costs.

While remaining highly protable, we have continued to generate

signicant amounts of cash, further strengthening the industry’s

highest quality balance sheet. We generated $1.9 billion in cash

ow from operations during scal 2010. Our cash and cash

equivalent balance of $2.7 billion at the end of the scal year

exceeds our anticipated operating needs and provides us with

operational exibility, the ability to continue to invest in advanced

technology, expand our product breadth through the pursuit of

internal and external opportunities and protect against continued

macro economic uncertainty. We continue to prudently review and

evaluate all available avenues to increase shareholder value with

our strong balance sheet.

Over the course of scal 2010, we derived signicant return on

our continuing investments in technology, new products, and

improvements in our operations:

• We continued to lead the industry’s fastest growing segment—

2.5-inch drives—deploying industry-leading areal density

products at the 640 GB, 750 GB and 1 TB capacity points.

• We made our entry into the traditional enterprise market with

the introduction of our rst 2.5-inch SAS-interface hard drives

for server applications—part of our multi-year investment and

commitment to serve this important and heretofore unserved

market for WD.

• We brought to market our rst client-oriented solid-state drive

(SSD) to complement our existing portfolio of high reliability

embedded SSDs, and we are in development of our rst SSD

for high-end enterprise applications.

• In our branded products business, we broadened our

portfolio of WD storage devices, with the introduction of

My Book® Studio™ LX external hard drives for Apple® users,

and the My Book AV DVR Expander external drives which

allow users to store more of their favorite movies and TV shows

locally. We also extended our family of WD media players with

WD TV® Live™ Plus, featuring added services such as Netix®,

YouTube™, Flickr®, Pandora®, Live365® as well as MediaFly™

that enables consumers to stream their favorite shows and

personal content directly to their TVs. It was also the rst

network media player compatible with Windows® 7.

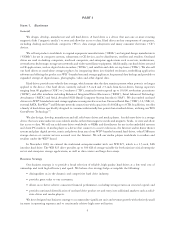

0.0

10.0

20.0

30.0

40.0

50.0

60.0

70.0

80.0

90.0

FY2006 FY2007 FY2008 FY2009 FY2010

2.5-INCH MOBILE DRIVE SHIPMENTS

5.4

Amounts in millions

12.3

36.6

55.3

80.1

Reecting our technology and product

leadership in this high-growth market, WD

increased mobile drive shipments 45% from

scal 2009.

$0

$200

$400

$600

$800

$1,000

$1,200

$1,400

$1,600

$1,800

$2,000

FY2006 FY2007 FY2008 FY2009 FY2010

BRANDED PRODUCTS REVENUE

$1,445

$1,403

$1,818

$292

Dollars in millions

$871

Our continued strategy to focus on the

industry’s high-growth sector of external

storage resulted in a 26% increase in

branded products revenue from scal 2009,

reecting continued industry leadership in

this market.

REVENUE DIVERSIFICATION*

Dollars in millions

$0

$1,000

$2,000

$3,000

$4,000

$5,000

$6,000

$7,000

$8,000

$9,000

$10,000

FY2006 FY2007 FY2008 FY2009 FY2010

71%

29%

57%

43%

44%

56%

38%

62%

36%

64%

Desktop Revenue

Non-Desktop Revenue

* Revenue percentages are based on sales of hard drives only.

Remaining focused on our goal to diversify

our product set beyond desktop computing,

hard drive revenue from non-desktop markets

expanded to 64% in scal 2010.

$0

$400

$800

$1,200

$1,600

$2,000

$2,400

FY2006 FY2007 FY2008 FY2009 FY2010

CASH and CASH EQUIVALENTS LESS DEBT

$1,312

$2,334

$507

Dollars in millions

$678 $595

WD ended scal 2010 with $2.3 billion of net

cash and cash equivalents, an increase of

$1 billion from scal 2009.