Wendy's 2009 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2009 Wendy's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

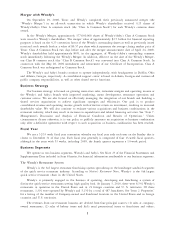

Selected Financial Data

(In Thousands) (Unaudited)

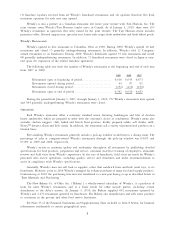

Reconciliation of EBITDA to Adjusted EBITDA

(In Thousands) (Unaudited)

1 The unaudited pro-forma financial statements are based upon the historical consolidated financial statements of Wendy’s/Arby’s Group, Inc. (formerly Triarc Companies,

Inc.) and Wendy’s International, Inc. and have been prepared to illustrate the effect of the merger in which Wendy’s became a wholly-owned subsidiary of Wendy’s/Arby’s

Group, Inc. The pro-forma results of operations are prepared on an “as if” basis which assumes that the merger with Wendy’s occurred at the beginning of 2008 and

includes the effect of the final purchase price allocation.

Disclosure Regarding Non-GAAP Financial Measures

Earnings before interest, taxes, depreciation and amortization (EBITDA) and pro-forma EBITDA are used by the Company as a performance measure for benchmarking

against the Company’s peers and competitors. The Company believes EBITDA and pro-forma EBITDA are useful to investors because they are frequently used by securities

analysts, investors and other interested parties to evaluate companies in the restaurant industry. The Company also uses adjusted EBITDA and pro-forma adjusted EBITDA,

which excludes integration-related expenses included within general and administrative expense, start-up expenses for the Wendy’s purchasing co-op, facilities relocation

and corporate restructuring expenses, pension withdrawal expense included within cost of sales, the one-time benefit from vacation policy standardization and 2008

Wendy’s special committee charges, as an internal measure of business operating performance. The Company believes adjusted EBITDA provides a meaningful perspective of

the underlying operating performance of the Company’s current business. EBITDA, adjusted EBITDA, pro-forma EBITDA, and pro-forma adjusted EBITDA are not recognized

terms under Generally Accepted Accounting Principles (GAAP). Because all companies do not calculate EBITDA or similarly titled financial measures in the same way, those

measures as used by other companies may not be consistent with the way the Company calculates EBITDA or similarly titled financial measures and should not be considered

as alternative measures of operating profit (loss) or net income (loss).

The Company’s presentation of EBITDA, adjusted EBITDA, pro-forma EBITDA, pro-forma adjusted EBITDA and other non-GAAP measures is not intended to replace the

presentation of the Company’s financial results in accordance with GAAP.

Wendy’s/Arby’s Group, Inc. and Subsidiaries

2009 Pro-forma1 2008

53 weeks 52 weeks

Revenues:

Sales $ 3,198,348 $3,279,504

Franchise revenues 382,487 383,137

$ 3,580,835 $3,662,641

EBITDA $ 384,359 $ 274,414

Depreciation and amortization (190,251) (186,601)

Goodwill impairment — (460,075)

Impairment of other long-lived assets (82,132) (20,592)

Operating profit (loss) 111,976 (392,854)

Interest expense (126,708) (100,412)

Investment (expense) income, net (3,008) 15,560

Other than temporary losses on investments (3,916) (112,741)

Other income (expense), net 1,523 (714)

Loss from continuing operations before income taxes (20,133) (591,161)

Benefit from income taxes 23,649 96,918

Income (loss) from continuing operations 3,516 (494,243)

Income from discontinued operations, net of income taxes 1,546 2,217

Net income (loss) $ 5,062 $ (492,026)

2009 Pro-forma1 2008

53 weeks 52 weeks

EBITDA $384,359 $274,414

Plus:

Integration costs in general and administrative (G&A) 16,598 1,857

Wendy’s purchasing co-op start-up costs in G&A 15,500 —

Facilities relocation and corporate restructuring 11,024 6,435

Pension withdrawal expense in cost of sales 4,975 —

Special committee charges — 84,231

Benefit from vacation policy standardization in G&A (3,339) —

Benefit from vacation policy standardization in cost of sales (3,925) —

Adjusted EBITDA $425,192 $366,937

Adjusted EBITDA Growth % 15.9%