Wendy's 2009 Annual Report Download

Download and view the complete annual report

Please find the complete 2009 Wendy's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2009 ANNUAL REPOR T

Hamburgers made-to-order

with fresh, never frozen beef

Chicken sandwiches

Chili

Salads

Baked potatoes

FrostyTM desserts

French fries

Boneless wings

Roast beef sandwiches,

slow-roasted in-house daily

and freshly sliced to order

Roastburger® sandwiches

Market Fresh® Deli sandwiches

Chicken sandwiches

Toasted subs

Thick and creamy shakes

Curly fries

Sidekickers® sides

Table of contents

-

Page 1

2009 ANNUAL REPORT Hamburgers made-to-order with fresh, never frozen beef Chicken sandwiches Chili Salads Baked potatoes FrostyTM desserts French fries Boneless wings Roast beef sandwiches, slow-roasted in-house daily and freshly sliced to order Roastburger ® sandwiches Market Fresh® Deli ... -

Page 2

... expansion of our everyday value strategy, increasing our national media presence, revamping our product pipeline, enhancing customer service and investing up to $100 million in a three-year capital program to remodel our companyowned restaurants. • ct Wendy's/crby's Group, we will continue to... -

Page 3

2009 Highlights Stock Price Per Share at Shares Outstanding: Market Capitalization: At Wendy's ®, customer focus has fueled growth and led to unique, innovative menu offerings like Garden Sensations ® salads, the Super Value Menu ®, our FrostyTM, Boneless Wings, Chicken Go Wraps and a line-up ... -

Page 4

... $5.01 combo meals with three new sandwiches: Roast Beef Patty Melt, Roast Chicken Ranch and Roast Beef Gyro • Introduced new everyday $1 Value Menu • Opened first Silver LEED certified eco-friendly restaurant 3,718 Company Restaurants 1,169 Franchise Restaurants 2,549 Systemwide Sales... -

Page 5

...'s purchasing co-op, facilities relocation and corporate restructuring expenses, pension withdrawal expense included within cost of sales, the one-time benefit from vacation policy standardization and 2008 Wendy's special committee charges, as an internal measure of business operating performance... -

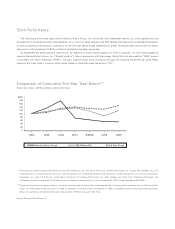

Page 6

...a specified Peer Group* of other companies with restaurant operations for the five-year period ended December 31, 2009. The stockholder returns set forth below assumes an initial investment of $100 and that all dividends have been reinvested. On September 29, 2008, Wendy's International, Inc. became... -

Page 7

... 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE FISCAL YEAR ENDED JANUARY 3, 2010 â...ª OR TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE TRANSITION PERIOD FROM TO . COMMISSION FILE NUMBER 1-2207 WENDY'S/ARBY'S GROUP, INC. (Exact Name of... -

Page 8

... the merger with Wendy's International, Inc. ("Wendy's"), the corporate name of Triarc Companies, Inc. ("Triarc") was changed to Wendy's/Arby's Group, Inc. ("Wendy's/Arby's" or, together with its subsidiaries, the "Company" or "we"). This Annual Report on Form 10-K and oral statements made from time... -

Page 9

...changed from Triarc Companies, Inc. ("Triarc") to Wendy's/Arby's Group, Inc. Our principal executive offices are located at 1155 Perimeter Center West, Atlanta, Georgia 30338, and our telephone number is (678) 514-4100. We make our annual reports on Form 10-K, quarterly reports on Form 10-Q, current... -

Page 10

... company responsibilities, as well as other shared service functions. Business Strategy Our business strategy is focused on growing same-store sales, restaurant margins and operating income at the Wendy's and Arby's brands with improved marketing, menu development, restaurant operations and customer... -

Page 11

... Arby's system. At January 3, 2010, the Bakery supplied 692 restaurants operated by Wendy's and 2,476 restaurants operated by franchisees. The Bakery also manufactures and sells some products to customers in the grocery and other food service businesses. See Note 25 of the Financial Statements and... -

Page 12

...contracts, assets and certain Wendy's purchasing employees to QSCC in the first quarter of 2010. Pursuant to the terms of the Co-op Agreement, Wendy's is required to pay $15.5 million to QSCC over an 18 month period in order to provide funding for start-up costs, operating expenses and cash reserves... -

Page 13

...safety, and operational requirements. Wendy's has the right to terminate franchise agreements if franchisees fail to comply with quality standards. Acquisitions and Dispositions of Wendy's Restaurants Wendy's has from time to time acquired the interests of and sold Wendy's restaurants to franchisees... -

Page 14

...of 4% of sales, as defined in the agreement, from the operation of the restaurant. The agreement also typically requires that the franchisee pay Wendy's a technical assistance fee. In the United States, the standard technical assistance fee required under a newly executed Unit Franchise Agreement is... -

Page 15

...Item 2. Properties" for a listing of the number of Company-owned and franchised locations in the United States and in foreign countries. The revenues from the Arby's restaurant business are derived from three principal sources: (1) sales at company-owned restaurants; (2) franchise royalties received... -

Page 16

...in Item 8 herein, for financial information attributable to certain geographical areas. Raw Materials and Purchasing As of January 3, 2010, 3 independent meat processors (5 total production facilities) supplied all of Arby's beef for roasting in the United States. Franchise operators are required to... -

Page 17

... on-site consulting services to franchisees. ARG has the right to terminate franchise agreements if franchisees fail to comply with quality standards. Acquisitions and Dispositions of Arby's Restaurants Arby's has from time to time acquired the interests of and sold Arby's restaurants to franchisees... -

Page 18

... franchise agreements, the average royalty rate paid by U.S. ARG franchisees was approximately 3.6% in each of 2009, 2008 and 2007. Franchised restaurants are required to be operated under uniform operating standards and specifications relating to the selection, quality and preparation of menu items... -

Page 19

... for local advertising until their restaurants have been in operation for 36 months. General Governmental Regulations Various state laws and the Federal Trade Commission regulate Wendy's and Arby's franchising activities. The Federal Trade Commission requires that franchisors make extensive... -

Page 20

...which they no longer have any operations, or properties that we or our subsidiaries have sold to third parties, but for which we or our subsidiaries remain liable or contingently liable for any related environmental costs. Our company-owned Wendy's and Arby's restaurants have not been the subject of... -

Page 21

..., financial condition, cash requirements and such other factors as the board of directors may deem relevant from time to time. Because we are a holding company, our ability to declare and pay dividends is dependent upon cash, cash equivalents and short-term investments on hand and cash flows from... -

Page 22

... Executive Officer, and Peter May, our Vice Chairman and former President and Chief Operating Officer, beneficially own shares of our outstanding common stock that collectively constitute approximately 22% of our total voting power. Messrs. Peltz and May may, from time to time, acquire beneficial... -

Page 23

... our control. Our restaurant businesses derive earnings from sales at company-owned restaurants, franchise royalties received from franchised restaurants and franchise fees from franchise restaurant operators for each new unit opened. Growth in our restaurant revenues and earnings is significantly... -

Page 24

... the operating results of franchisees. As of January 3, 2010, approximately 79% of the Wendy's system and 69% of the Arby's system were franchise restaurants. We receive revenue in the form of royalties, which are generally based on a percentage of sales at franchised restaurants, rent and fees from... -

Page 25

... food-away-from-home spending could hurt our revenues, results of operations, business and financial condition. In addition, if company-owned and franchised restaurants are unable to adapt to changes in consumer preferences and trends, company-owned and franchised restaurants may lose customers... -

Page 26

... have introduced lower cost, value meal menu options. Our revenues and those of our franchisees may be hurt by this product and price competition. Moreover, new companies, including operators outside the quick service restaurant industry, may enter our market areas and target our customer base. For... -

Page 27

...landlord may increase the rent over the term of the lease and any renewals thereof. Most leases require us to pay all of the costs of insurance, taxes, maintenance and utilities. We generally cannot cancel these leases. If an existing or future restaurant is not profitable, and we decide to close it... -

Page 28

...the restaurant is located. State and local government authorities may enact laws, rules or regulations that impact restaurant operations and the cost of conducting those operations. For example, recent efforts to require the listing of specified nutritional information on menus and menu boards could... -

Page 29

... covenants contained in debt agreements, which event of default could result in all of our subsidiaries' debt becoming immediately due and payable; • reducing the availability of our cash flow to fund working capital, capital expenditures, acquisitions and other general corporate purposes, and... -

Page 30

... other cash needs, Wendy's/Arby's Restaurants will require a significant amount of cash, which may not be available to it. The ability of Wendy's/Arby's Restaurants to make payments on, or repay or refinance, its debt, including the Senior Notes, and to fund planned capital expenditures, dividends... -

Page 31

..., cause delays in introducing new menu items or investment products or require us to enter into royalty or licensing agreements. As a result, any such claim could harm our business and cause a decline in our results of operations and financial condition. Wendy's plans to expand its breakfast... -

Page 32

... 50%) longlived assets will be sold or otherwise disposed of significantly before the end of their previously estimated useful life; and • a significant drop in our stock price. Based upon future economic and capital market conditions, as well as the operating performance of our reporting units... -

Page 33

... agreements Wendy's has the option to purchase the real estate. Certain leases require the payment of additional rent equal to a percentage, generally less than 6%, of annual sales in excess of specified amounts. Wendy's also owned land and buildings for, or leased, 220 Wendy's restaurant locations... -

Page 34

The location of company-owned and franchised restaurants as of January 3, 2010 is set forth below. Wendy's Company Franchise Arby's Company Franchise State Alabama ...Alaska ...Arizona ...Arkansas ...California ...Colorado ...Connecticut ...Delaware ...Florida ...Georgia ...Hawaii...Idaho ...... -

Page 35

... acquired by RTM and such affiliates. ARG estimates that it will spend approximately $1.15 million per year of capital expenditures over a seven-year period (which commenced in 2008) to bring the restaurants into compliance under the settlement agreement, in addition to paying certain legal fees... -

Page 36

... Wendy's Merger effective September 29, 2008, Wendy's/Arby's stockholders approved a charter amendment to convert each share of the then existing Triarc Class B common stock into one share of Wendy's/Arby's Common Stock. The prices for the fourth quarter of 2008 are for the September 29 trading day... -

Page 37

...Wendy's and ARG to pay cash dividends or make any loans or advances as well as to make payments for the management services and under the tax sharing agreement to us is also dependent upon their ability to achieve sufficient cash flows after satisfying their cash requirements, including debt service... -

Page 38

... Financial Data. January 3, 2010 Year Ended (1) December 28, December 30, December 31, 2008(2) 2007(2) 2006(2) (In Millions, except per share amounts) January 1, 2006(2) Sales ...$3,198.3 Franchise revenues ...382.5 Asset management and related fees ...- Revenues ...3,580.8 Operating profit (loss... -

Page 39

...the amount an employee must pay to acquire the stock. There was no effect from the adoption of this new accounting methodology on the financial statements for all periods presented prior to the accounting change. (d) As of December 29, 2008, the Company adopted new accounting guidance related to non... -

Page 40

... the Company receives on new franchise agreements and (3) facilities relocation and corporate restructuring charges of $13.5; $67.5 charged to loss from continuing operations representing the aforementioned $58.9 charged to operating loss and a $35.8 loss on early extinguishments of debt upon a debt... -

Page 41

... changed to Wendy's/Arby's Group, Inc. The references to the "Company" or "we" for periods prior to September 29, 2008 refer to Triarc and its subsidiaries. Because the Wendy's Merger did not occur until the first day of our 2008 fourth quarter, only the fourth quarter results of operations of Wendy... -

Page 42

... the execution of the following strategies: • Grow same-store sales at Wendy's and Arby's by introducing innovative new menu items, enhancing the customer experience with operational excellence, and improving affordability with everyday value menu items; • Continue to improve Wendy's Company... -

Page 43

... companies. Key Business Measures We track our results of operations and manage our business using the following key business measures: • Same-Store Sales We report Arby's North America Restaurants same-store sales commencing after a store has been open for fifteen continuous months. Wendy... -

Page 44

... number of publicly-traded companies. In addition, the Equities Account sold securities short and invested in market put options in order to lessen the impact of significant market downturns. In June 2009, we and the Management Company entered into a withdrawal agreement (the "Withdrawal Agreement... -

Page 45

... acquisition, corporate finance and/or similar transaction that is consummated at any time during the period commencing on the date the New Services Agreement was executed and ending six months following the expiration of its term, we will negotiate a success fee to be paid to the Management Company... -

Page 46

... funding for start-up costs, operating expenses and cash reserves. Future operations will be funded by all members of QSCC, including Wendy's and its franchisees. The required payments by Wendy's under the Co-op Agreement were expensed in the fourth quarter of 2009 and included in "General and... -

Page 47

Results of Operations 2009 Amount Change 2008 Amount Change (In Millions) 2007 Amount Revenues: Sales ...Franchise revenues ...Asset management and related fees ...Costs and expenses: Cost of sales ...Cost of services...General and administrative ...Depreciation and amortization ...Goodwill ... -

Page 48

... 30, 2007...Opened...Closed...Net purchased from (sold by) franchisees ...Restaurant count at December 28, 2008 ...Opened...Closed...Net purchased from (sold by) franchisees ...Restaurant count at January 3, 2010...Total Wendy's/Arby's restaurant count at January 3, 2010 ... Company-owned average... -

Page 49

...and Executive Overview-Our Business." In addition, the 2009 Arby's same-store sales were negatively impacted by a decrease in the number of national advertising campaigns; however, certain aggressive Arby's value promotions partially mitigated this negative impact. Franchise Revenues Change 2009 (In... -

Page 50

...in 2008 and (2) a decrease in costs associated with our corporate aircraft as a result of the termination of the time share agreements and the establishment of a new aircraft lease agreement with the Principals and the Management Company, and the sale of one of the aircraft in 2009. Our 2008 general... -

Page 51

... properties ...Arby's restaurants, primarily properties ...Asset management ...General corporate ... $104.2 $23.8 (5.0) 4.3 - (4.9) 2.8 (1.1) $102.0 $22.1 The 2009 and 2008 increases were primarily related to the increase in long-lived assets as a result of the Wendy's Merger. The 2009 increase... -

Page 52

...gains from the sale of cost method investments. The Withdrawal Fee relates to the fee paid to the Management Company for the Equities Sale as discussed in "Introduction and Executive Overview-Equities Account." The change in our recognized net gains in 2008 is primarily related to: (1) $22.4 million... -

Page 53

... to the Equities Sale in June 2009. Losses in 2009 related to cost method investments were not as significant due to improved market conditions as compared to 2008. The 2008 increase in losses on available-for sale securities and $1.8 million of the increase in losses on cost method investments was... -

Page 54

... includes the introduction of new premium products, will have a favorable impact on sales. In addition, we anticipate that Arby's increasing emphasis on everyday value menu items will have a favorable impact on sales. For 2010, the net impact of new store openings and closings is not expected to... -

Page 55

...'s restaurant margins of the emphasis on everyday value menu items will be significantly offset by a reduction in other discounted product promotional activity. General and Administrative We expect that our general and administrative expenses will decrease in 2010 primarily as a result of the 2009... -

Page 56

... • The costs of any potential business acquisitions or financing activities. Based upon current levels of operations, we expect that cash flows from operations and available cash will provide sufficient liquidity to meet operating cash requirements for the next twelve months. Working Capital and... -

Page 57

... changes to the terms of any debt obligations since December 28, 2008. See Note 8 of the Consolidated Financial Statements contained in Item 8 of this document for more information related to our long-term debt obligations. Senior Notes On June 23, 2009, our subsidiary Wendy's/Arby's Restaurants... -

Page 58

... of such debt, and permitted Wendy's/Arby's Restaurants to dividend to Wendy's/Arby's the net cash proceeds of the Senior Notes issuance less $132.5 million used to prepay the Amended Term Loan and pay accrued interest thereon and certain other payments, (2) modified certain total leverage financial... -

Page 59

... those lease agreements. The Company does not believe that such non-compliance will have a material adverse effect on its consolidated financial position or results of operations. Credit Ratings Wendy's/Arby's Group, Inc. and its subsidiaries with specific debt issuances (Wendy's/Arby's Restaurants... -

Page 60

... the expected payments under our outstanding contractual obligations at January 3, 2010: 2010 2011-2012 Fiscal Years 2013-2014 After 2014 (In Millions) Total Long-term debt (a) ...Sale-leaseback obligations (b) ...Capitalized lease obligations (b) ...Operating leases (c) ...Purchase obligations... -

Page 61

... taxable year in 2008 ending on the date of the Wendy's Merger. Also as a result of the Wendy's Merger, for U.S. Federal tax purposes there was an ownership change which places a limit on the amount of a company's net operating losses that can be deducted annually. The Internal Revenue Service (the... -

Page 62

...3, 2010 (In Millions) Lease guarantees and contingent rent on leases (1) ...Loan guarantees (2) ...Letters of credit (3) ... $108.6 $ 25.8 $ 34.7 (1) Wendy's is contingently liable for certain leases and other obligations primarily from Company-owned restaurant locations now operated by franchises... -

Page 63

... our consolidated financial statements: • Goodwill impairment: The Company operates in two business segments consisting of restaurant brands: (1) Wendy's restaurant operations and (2) Arby's restaurant operations. Each segment includes Company-owned restaurants and franchise reporting units which... -

Page 64

...sales of Company-owned and franchised restaurants and the resulting cash flows. Arby's restaurants impairment losses reflect impairment charges resulting from the deterioration in operating performance of certain Company-owned restaurants in 2009, 2008 and 2007. Wendy's restaurants impairment losses... -

Page 65

... a result of the deteriorating financial condition of some of our franchisees. For the year ended January 3, 2010, we recorded $8.2 million in provision for doubtful accounts of which $7.4 million related to the Arby's franchises. • Accounting for leases: We operate restaurants that are located on... -

Page 66

...the restaurant opening date. There is a period under certain lease agreements referred to as a rent holiday ("Rent Holiday") that generally begins on the possession date and ends on the rent commencement date. During the Rent Holiday period, no cash rent payments are typically due under the terms of... -

Page 67

... to interest rate changes is to limit the impact on our earnings and cash flows. Our policy is to maintain a target, over time and subject to market conditions, of between 50% and 75% of "Long-term debt" as fixed rate debt. As of January 3, 2010 our long-term debt, including current portion and... -

Page 68

...the purchasing cooperative in January 2010. Equity Market Risk Our objective in managing our exposure to changes in the market value of our investments is to balance the risk of the impact of these changes on our earnings and cash flows with our expectations for long-term investment returns. Foreign... -

Page 69

...of a limited number of publicly-traded companies. In addition, the Equities Account sold securities short and invested in market put options in order to lessen the impact of significant market downturns. In June 2009, we and the Management Company entered into the Withdrawal Agreement which provided... -

Page 70

... 3, 2010 our investments were classified in the following general types or categories (in millions): Type At Cost At Fair Value (a) Carrying Value Amount Percent Cash equivalents ...Current and non-current restricted cash equivalents ...Investment related receivables ...Investment accounted for... -

Page 71

...): Year End 2009 Carrying Value Interest Rate Risk Equity Price Risk Foreign Currency Risk Cash equivalents ...Current and non-current restricted cash equivalents ...Available-for-sale equity security ...Interest Rate Swaps ...Equity investment ...Cost investments...DFR Notes...Long-term debt... -

Page 72

... capitalized lease and sale-leaseback obligations, represents the potential impact an increase in interest rates of one percentage point has on our results of operations related to our $251.5 million of variable-rate long-term debt outstanding as of January 3, 2010. Our variable-rate long-term debt... -

Page 73

... CONSOLIDATED FINANCIAL STATEMENTS Page Glossary of Defined Terms ...Report of Independent Registered Public Accounting Firm ...Consolidated Balance Sheets as of January 3, 2010 and December 28, 2008 ...Consolidated Statements of Operations for the years ended January 3, 2010, December 28, 2008 and... -

Page 74

... and Corporate Restructuring Retirement Benefit Plans Advertising Costs and Funds Long-Term Debt Guarantees and Other Commitments and Contingencies Long-Term Debt Transactions with Related Parties Long-Term Debt Summary of Significant Accounting Policies Summary of Significant Accounting Policies... -

Page 75

... ...Legacy Assets ...Liquidation Services Agreement...LIBOR ...Management Company...Management Company Employees ...New Services Agreement ...Other Than Temporary Losses ...Package Options ...Payment Obligations ...Preferred Stock...Principals...Profit Interests ...QSCC ...Rent Holiday ...RSAs... -

Page 76

... of Significant Accounting Policies Summary of Significant Accounting Policies Summary of Significant Accounting Policies Summary of Significant Accounting Policies Summary of Significant Accounting Policies Share-Based Compensation Retirement Benefit Plans Long-Term Debt Investments Investments 69 -

Page 77

... "Company") as of January 3, 2010 and December 28, 2008, and the related consolidated statements of operations, stockholders' equity, and cash flows for each of the three years in the period ended January 3, 2010. Our audits also included the financial statement schedule listed in the Index at Item... -

Page 78

Item 8. Financial Statements and Supplementary Data Wendy's/Arby's Group, Inc. and Subsidiaries CONSOLIDATED BALANCE SHEETS (In Thousands) January 3, 2010 December 28, 2008 Assets Current assets: Cash and cash equivalents ...Restricted cash equivalents...Accounts and notes receivable ...... -

Page 79

Wendy's/Arby's Group, Inc. and Subsidiaries CONSOLIDATED STATEMENTS OF OPERATIONS (In Thousands Except Per Share Amounts) January 3, 2010 Year Ended December 28, 2008 December 30, 2007 Revenues: Sales ...Franchise revenues...Asset management and related fees ...Costs and expenses: Cost of sales... -

Page 80

... Loss Capital Deficit Total Balance at December 28, 2008 ...$47,042 $2,753,141 $(357,541) Comprehensive income: Net income ...- - 5,062 Change in unrealized gain on available-for-sale securities ...- - - Foreign currency translation adjustment...- - - Comprehensive income ...- - - Cash dividends... -

Page 81

...common stock . 6,410 (6,410) - - Value of Wendy's stock options converted into Wendy's/Arby's Group, Inc. options ...- - 18,495 - Common stock issuance related to merger of Triarc Companies, Inc. and Wendy's International Inc...37,678 - 2,438,519 - Common stock issued upon exercises of stock options... -

Page 82

... Common Common Paid-in Pension for-Sale Cash Flow Translation Capital Earnings in Treasury Securities Stock Stock Loss Hedges Adjustment Total Balance at December 31, 2006 ...$2,955 Cumulative effect of change in accounting for uncertainty in income taxes ...- Balance as adjusted at December 31... -

Page 83

...deferred financing costs ...Share-based compensation provision ...Distributions received from joint venture ...Non-cash rent expense ...Accretion of long-term debt ...Provision for doubtful accounts ...Operating investment adjustments, net (see below) ...Deferred income tax benefit, net ...Equity in... -

Page 84

Wendy's/Arby's Group, Inc. and Subsidiaries CONSOLIDATED STATEMENTS OF CASH FLOWS-CONTINUED (In Thousands) January 3, 2010 Year Ended December 28, 2008 December 30, 2007 Detail of cash flows related to investments: Operating investment adjustments, net: Other than temporary losses on ... -

Page 85

... merger (the "Wendy's Merger") with Wendy's International, Inc. ("Wendy's") and our corporate name Triarc Companies, Inc. ("Triarc") was changed to Wendy's/Arby's Group, Inc. Wendy's/Arby's is the parent company of its wholly-owned subsidiary holding company, Wendy's/Arby's Restaurants, LLC ("Wendy... -

Page 86

... of restaurant food items, kids' meal toys and paper supplies. Investments Investments include marketable equity securities with readily determinable fair values. The Company's marketable equity securities are classified and accounted for as "available-for-sale" and are reported at fair market value... -

Page 87

... fair value less cost to sell of an asset to be disposed. Asset groups are primarily comprised of our individual restaurant properties. Goodwill The Company operates in two business segments consisting of two restaurant brands: (1) Wendy's restaurant operations and (2) Arby's restaurant operations... -

Page 88

... hedging instruments is included in results of operations. Share-based compensation The Company measures the cost of employee services received in exchange for an award of equity instruments, including grants of employee stock options and restricted stock, based on the fair value of the award at the... -

Page 89

... the related commitments to open new franchised restaurants. Rental income from locations owned by the Company and leased to franchisees is recognized on a straight-line basis over the respective operating lease terms. Asset management and related fees, earned prior to the Deerfield Sale, consisted... -

Page 90

Wendy's/Arby's Group, Inc. and Subsidiaries NOTES TO CONSOLIDATED FINANCIAL STATEMENTS-CONTINUED (In Thousands Except Per Share Amounts) Company recognized non-cash management fee revenue related to its restricted stock and stock options in DFR based on their then current fair values which were ... -

Page 91

...financial statements. (2) Acquisitions and Dispositions Merger with Wendy's International, Inc. On September 29, 2008, we completed the Wendy's Merger in an all-stock transaction in which Wendy's shareholders received a fixed ratio of 4.25 shares of Wendy's/Arby's Class A Common Stock for each share... -

Page 92

... ...Changes to fair values of assets and liabilities and deferred income tax liability related to the merger: (Increase)/decrease in: Current assets Accounts and notes receivable ...Prepaid expenses and other current assets ...Investments Properties ...Other intangible assets Trademark ...Franchise... -

Page 93

... 2007: 2008 As Reported As Adjusted 2007 As Reported As Adjusted Revenues: Sales...Franchise revenues ...Asset management and related fees ...Total revenues ...Operating (loss) profit ...Net (loss) income ...Basic and diluted (loss) income per share: Common Stock ...Class B Common Stock ... $1,662... -

Page 94

...of DFR Stock Purchasers, but not the Company, acquired additional shares at various prices in open-market transactions. The Company, through the date of the Deerfield Sale, was the investment manager of DFR and, subsequent to the Deerfield Sale, maintains one seat on its Board of Directors. Prior to... -

Page 95

... the year ended December 28, 2008 related to our investment in the 206 common shares of DFR discussed above which were accounted for under the equity method through the Determination Date. (3) DFR Notes On December 21, 2007 the Company received, as a part of the proceeds in the Deerfield Sale, $47... -

Page 96

... 28, 2008, respectively, are included in non-current "Notes receivable." (4) Income (Loss) Per Share Basic income per share for 2009 is computed by dividing net income by the weighted average number of common shares outstanding. Prior to the Wendy's Merger, the Company had Class B common stock which... -

Page 97

... Stock on September 29, 2008. (5) Balance Sheet Detail Cash and cash equivalents Year End 2009 2008 Cash ...Cash equivalents ... $353,283 238,436 $591,719 $53,324 36,766 $90,090 Restricted cash equivalents Current Trust for termination costs for former Wendy's executives ...Other ...Year End 2009... -

Page 98

...-CONTINUED (In Thousands Except Per Share Amounts) Non-current Trust for termination costs for former Wendy's executives ...Collateral supporting letters of credit securing payments due under leases...Accounts managed by the Management Company... Year End 2009 2008 $5,352 890 - $6,242 $ 6,462... -

Page 99

...CONSOLIDATED FINANCIAL STATEMENTS-CONTINUED (In Thousands Except Per Share Amounts) Properties Year End 2009 2008 Owned: Land ...Buildings and improvements (a) ...Office, restaurant and transportation equipment ...Leasehold improvements (a) ...Leased (b): Capitalized leases...Sale-leaseback assets... -

Page 100

.... Long-Term The following is a summary of the carrying value of non-current investments: Year End 2009 Carrying Value Cost (a) Year End 2008 Unrealized Holding Fair Gains Losses Value Carrying Value Restricted investments held in the Equities Account: Available-for-sale marketable equity securities... -

Page 101

... equity investment in DFR for less than one quarter in 2008, we have not presented any data for that year. The company's actual ownership in DFR Common Stock was 0.3% in 2007. The summary financial information is taken from balance sheets which do not distinguish between current and long-term assets... -

Page 102

...is activity related to our portion of TimWen included in our Consolidated Balance Sheets and Consolidated Statements of Operations as of and for the year ended January 3, 2010 and the quarter ended December 28, 2008. 2009 2008 Balance at beginning of period...Purchase price adjustments ...Equity in... -

Page 103

Wendy's/Arby's Group, Inc. and Subsidiaries NOTES TO CONSOLIDATED FINANCIAL STATEMENTS-CONTINUED (In Thousands Except Per Share Amounts) Year ended January 3, 2010 Quarter ended December 28, 2008 Income statement information: Revenues...Income before income taxes and net income ...Investment in ... -

Page 104

...for each business segment: Arby's Restaurant Segment 2009 Wendy's Restaurant Segment Arby's Restaurant Segment 2008 Wendy's Restaurant Segment Total Total Balance at beginning of year: Goodwill ...Accumulated impairment losses...Changes in goodwill: Wendy's Merger ...Other restaurant acquisitions... -

Page 105

... been recorded as a reduction in the cost basis of the related intangible asset. (b) Includes $2,375 of amortization of asset management contracts until their disposal with the Deerfield Sale. (8) Long-Term Debt Long-term debt consisted of the following: Year End 2009 2008 10.00% Senior Notes, due... -

Page 106

... of debt thereunder, and permitted Wendy's/Arby's Restaurants to dividend to Wendy's/Arby's the net cash proceeds of the Senior Notes issuance less $132,500 used to prepay the Amended Term Loan and pay accrued interest thereon and certain other payments, (2) modified certain total leverage financial... -

Page 107

...$10,812 as of January 3, 2010. A significant number of the underlying leases in the Arby's restaurants segment for sale-leaseback obligations and capitalized lease obligations, as well as the operating leases, require or required periodic financial reporting of certain subsidiary entities within ARG... -

Page 108

...interest rate risk relating to Arby's Term Loan had been designated as effective cash flow hedges at inception and on an ongoing quarterly basis through their expiration dates. There was no ineffectiveness from these hedges through their expiration in 2008. Accordingly, gains and losses from changes... -

Page 109

... items were recognized by the Company related to its derivative activity during each of the years presented below: 2009 2008 2007 Interest expense (income): Interest Rate Swaps...Term Loan Swap Agreements...Investment expense (income), net: Put and call option combinations on equity securities... -

Page 110

...of fair values is required were as follows: Year End 2009 Carrying Amount Fair Value Carrying Amount 2008 Fair Value Financial assets: Cash and cash equivalents (a) ...Restricted cash equivalents (a): Current...Non-current ...Short-term investment (b) ...DFR Notes receivable (c) ...Non-current Cost... -

Page 111

... Per Share Amounts) (d) These consist of investments in certain non-current cost investments. The fair values of these investments were based entirely on statements of account received from investment managers or investees which are principally based on quoted market or broker/dealer prices. To... -

Page 112

Wendy's/Arby's Group, Inc. and Subsidiaries NOTES TO CONSOLIDATED FINANCIAL STATEMENTS-CONTINUED (In Thousands Except Per Share Amounts) The following table presents the fair values for those assets and liabilities measured at fair value during 2009 on a non-recurring basis. Total losses include ... -

Page 113

... year in 2008 ending on the date of the Wendy's Merger. Also as a result of the Wendy's Merger, for U.S. Federal tax purposes there was an ownership change at Wendy's/Arby's which places a limit on the amount of a Company's net operating losses that can be deducted annually. As of January 3, 2010... -

Page 114

... FINANCIAL STATEMENTS-CONTINUED (In Thousands Except Per Share Amounts) Additionally, the Company has carryforwards other than Federal net operating losses and related valuation allowances principally consisting of: (1) As of January 3, 2010, $199,057 capital loss resulting from Wendy's sale... -

Page 115

... contingent tax benefit related to two related party deferred compensation trusts. The Internal Revenue Service ("IRS") is conducting an examination of the Company's 2010 and 2009 U.S. Federal income tax years as part of the Compliance Assurance Process ("CAP"). As part of CAP, tax years are... -

Page 116

... Per Share Amounts) Uncertain Tax Positions A reconciliation of the beginning and ending amount of unrecognized tax benefits is as follows: 2009 2008 2007 Beginning balance...Additions: Wendy's unrecognized tax benefits at the Wendy's Merger date...Tax positions related to the current year ...Tax... -

Page 117

... of net assets of the Company's restaurant business segment which were restricted as to transfer to Wendy's/Arby's in the form of cash dividends, loans or advances under the covenants of the Credit Agreement. (13) Share-Based Compensation The Company maintains several equity plans (the "Equity Plans... -

Page 118

... to the date of the Wendy's Merger (including those under the Wendy's Plans) are now exercisable for one share of Common Stock (three shares of Common Stock for Package Options). Summary information regarding Wendy's/Arby's outstanding stock options, including changes therein, is as follows: Package... -

Page 119

... of January 3, 2010, there was $7,691 of total unrecognized compensation cost related to nonvested share-based compensation grants which would be recognized over a weighted-average period of 1.75 years. The Company's currently outstanding stock options have maximum contractual terms of ten years and... -

Page 120

...payments were required from the employees to acquire the Profit Interests. The scheduled vesting of the Profit Interests varied by employee either vesting ratably in each of the three years ended August 20, 2007, 2008 and 2009 or 100% on August 20, 2007 and the related unrecognized compensation cost... -

Page 121

... in our Arby's restaurant segment for 2008 and 2007 represent additional costs principally related to the now completed Company combination of its existing restaurant operations with those of the RTM Restaurant Group ("RTM") following the acquisition of RTM in 2005. The general corporate charges for... -

Page 122

...' executives and employees and (4) a loss of $835 on properties and other assets at the Company's former New York headquarters, principally reflecting assets for which the appraised value was less than book value, sold during 2007 to the Management Company, all as part of the Corporate Restructuring... -

Page 123

...and corporate restructuring accrual are as follows: 2009 Balance December 28, 2008 Balance January 3, 2010 Total Expected to be Incurred Total Incurred to Date Provisions Payments Wendy's restaurant segment: Cash obligations: Severance costs...Total Wendy's restaurant segment ...Arby's restaurant... -

Page 124

... losses by business segment: 2009 2008 2007 Arby's restaurants segment: Impairment of Company-owned restaurants: Properties ...Intangible assets ...Wendy's restaurants segment: Impairment of Company-owned restaurants: Properties ...Intangible assets ...Asset management segment ...General corporate... -

Page 125

... fair values of impaired assets discussed above for the Wendy's and Arby's restaurants segments and the asset management segment are generally estimated based on the present values of the associated cash flows and on market value with respect to land. (16) Investment (Expense) Income, Net 2009 2008... -

Page 126

... date used by the Company in determining amounts related to its defined benefit plans is its current fiscal year end based on the rollforward of an actuarial report. The balance of the accumulated benefit obligations and the fair value of these two plans' assets at January 3, 2010 was $3,920 and... -

Page 127

... (20) Lease Commitments The Company leases real property, leasehold interests, and restaurant, transportation, and office equipment. Some leases which relate to restaurant operations provide for contingent rentals based on sales volume. Certain leases also provide for payments of other costs such as... -

Page 128

...for closed locations. The Company leases properties it owns to third parties. Properties leased to third parties under operating leases as of January 3, 2010 and December 28, 2008 include: 2009 2008 Land ...Buildings and improvements ...Office, restaurant and transportation equipment ...Accumulated... -

Page 129

...Future purchases by the Company under these beverage purchase requirements are estimated to be approximately $28,614 per year over the next five years. Based on current preferred prices and the current ratio of sales at Company-owned restaurants to franchised restaurants, the total remaining Company... -

Page 130

... 2007 and received a refund for the applicable taxes withheld with the respective payroll tax return filings in 2008. Distributions to co-investment shareholders As part of its overall retention efforts, the Company provided certain of its Former Executives and current and former employees, the... -

Page 131

Wendy's/Arby's Group, Inc. and Subsidiaries NOTES TO CONSOLIDATED FINANCIAL STATEMENTS-CONTINUED (In Thousands Except Per Share Amounts) Information pertaining to the remaining co-investment is as follows: 280 BT Ownership percentages at January 3, 2010: Company ...Former officers of the Company ... -

Page 132

... Wendy's common stock, which were included in the Equities Account, were sold to the Management Company at the closing market value as of the day we decided to sell the shares. The sale resulted in a loss of $38. Executive use of corporate aircraft In August 2007, the Company entered into time share... -

Page 133

... in full. Sale of assets related to Corporate Restructuring In July 2007, as part of the Corporate Restructuring, the Company sold substantially all of the properties and other assets it owned and used at its former New York headquarters to the Management Company for an aggregate purchase price of... -

Page 134

... acquisition, corporate finance and/or similar transaction that is consummated at any time during the period commencing on the date the New Services Agreement was executed and ending six months following the expiration of its term, we will negotiate a success fee to be paid to the Management Company... -

Page 135

... to be paid in equal annual installments over a five year period to be donated to the Dave Thomas Foundation for Adoption, a related party. Payments of $200 were made in 2009 and 2008. The amount pledged was recorded in "General and administrative" in 2008. Wendy's executive officers On September 29... -

Page 136

... funding for start-up costs, operating expenses and cash reserves. Future operations will be funded by all members of QSCC, including Wendy's and its franchisees. The required payments by Wendy's under the Co-op Agreement were expensed in the fourth quarter of 2009 and included in "General and... -

Page 137

... Sale, we managed and internally reported our operations as two business segments: (1) the operation and franchising of Arby's restaurants and (2) asset management ("Asset Management"). We evaluate segment performance and allocate resources based on each segment's operating profit (loss). The Wendy... -

Page 138

.... The following is a summary of the Company's segment information: Wendy's restaurants Arby's restaurants Corporate Total 2009 Revenues: Sales ...Franchise revenues ... Depreciation and amortization ...Operating profit (loss) ...Interest expense ...Investment expense, net ...Other than temporary... -

Page 139

... FINANCIAL STATEMENTS-CONTINUED (In Thousands Except Per Share Amounts) 2007 Revenues: Sales ...Franchise revenues ...Asset management and related fees... Arby's restaurants Asset management Corporate Total Depreciation and amortization ...Operating profit (loss)...Interest expense...Investment... -

Page 140

...72,990 (a) The corporate capital expenditures in 2009 are primarily related to the establishment of our shared services center. Revenues and long-lived asset information by geographic area are as follows: U.S Canada Other International Total 2009 Revenues: Wendy's restaurants ...Arby's restaurants... -

Page 141

... consolidated quarterly financial information beginning with the date of the Wendy's Merger on September 29, 2008. March 29 (b) 2009 Quarter Ended June 28 (b) September 27 (b) January 3, 2010 (b) Revenues...Cost of sales ...Operating profit (loss)...(Loss) income from continuing operations...Income... -

Page 142

... public accounting firm, Deloitte & Touche LLP, has issued an attestation report dated March 3, 2010, on our internal control over financial reporting. Changes in Internal Control Over Financial Reporting On September 29, 2008, we acquired Wendy's. As part of the integration activities, Wendy's/Arby... -

Page 143

...the preparation of financial statements and other information presented in this Annual Report on Form 10-K. We expect further integration of Wendy's processes and systems during 2010. There were no other changes in our internal control over financial reporting made during the quarter that materially... -

Page 144

... of Independent Registered Public Accounting Firm To the Board of Directors and Stockholders of Wendy's/Arby's Group, Inc. Atlanta, Georgia We have audited the internal control over financial reporting of Wendy's/Arby's Group, Inc. and subsidiaries (the "Company") as of January 3, 2010, based on... -

Page 145

... Index to Financial Statements (Item 8). 2. Financial Statement Schedules: Schedule I-Condensed Balance Sheets (Parent Company Only)-as of January 3, 2010 and December 28, 2008; Condensed Statements of Operations (Parent Company Only)-for the fiscal years ended January 3, 2010, December 28, 2008 and... -

Page 146

... year ended December 28, 2008 (SEC file no. 001-02207).** 10.6 -Form of Non-Incentive Stock Option Agreement under the Wendy's/Arby's Group, Inc. Amended and Restated 2002 Equity Participation Plan, as amended, incorporated herein by reference to Exhibit 99.6 to Wendy's/Arby's Group's Current Report... -

Page 147

...SEC file no. 001-02207).** 10.20-Form of Stock Unit Award Agreement under the Wendy's International, Inc. 2007 Stock Incentive Plan, incorporated herein by reference to Exhibit 10.4 to Wendy's/Arby's Group's Form 10-Q for the quarter ended September 27, 2009 (SEC file no. 001-02207).** 10.21-Form of... -

Page 148

... for the quarter ended June 28, 2009 (SEC file no. 001-02207).** 10.27-Amended and Restated Credit Agreement, dated as of July 25, 2005, amended and restated as of March 11, 2009, among Wendy's International, Inc., Wendy's International Holdings, LLC, Arby's Restaurant Group, Inc., Arby's Restaurant... -

Page 149

... Acquisition Group, L.P., incorporated herein by reference to Exhibit 10.36 to Wendy's/Arby's Group's Annual Report on Form 10-K for the fiscal year ended December 28, 2008 (SEC file no. 001-02207). 10.49-Letter Agreement dated August 6, 2007, between Triarc Companies, Inc. and Trian Fund Management... -

Page 150

... to Exhibit 10.47 to Wendy's/Arby's Group's Annual Report on Form 10-K for the fiscal year ended December 28, 2008 (SEC file no. 00102207).** 10.61-Form of Indemnification Agreement between Arby's Restaurant Group, Inc. and certain directors, officers and employees thereof, incorporated herein by... -

Page 151

....2 -Consolidated Financial Statements of Deerfield Capital Corp. and subsidiaries (and related reports of independent registered public accounting firm), incorporated herein by reference to Item 8 of the Annual Report on Form 10-K of Deerfield Capital Corp. for the year ended December 31, 2009 (SEC... -

Page 152

...by the undersigned, thereunto duly authorized. Wendy's/Arby's Group, Inc. (Registrant) By: /s/ ROLAND C. SMITH Roland C. Smith President and Chief Executive Officer Dated: March 4, 2010 Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below on March... -

Page 153

... I Wendy's/Arby's Group, Inc. (Parent Company Only) CONDENSED BALANCE SHEETS (In Thousands) January 3, 2010 December 28, 2008 Assets Current assets: Cash and cash equivalents ...Amounts due from subsidiaries...Deferred income tax benefit and other ...Total current assets...Restricted cash... -

Page 154

...Wendy's/Arby's Group, Inc. (Parent Company Only) CONDENSED STATEMENTS OF OPERATIONS (In Thousands) January 3, 2010 Year Ended December 28, 2008 December 30, 2007 Income: Equity in income (loss) from continuing operations of subsidiaries ...Investment income (loss) ...Costs and expenses: General... -

Page 155

...) Wendy's/Arby's Group, Inc. (Parent Company Only) CONDENSED STATEMENTS OF CASH FLOWS (In Thousands) January 3, 2010 Year-Ended December 28, 2008 December 30, 2007 Cash flows from continuing operating activities: Net income (loss)...Adjustments to reconcile net income (loss) to net cash... -

Page 156

...Continued) Wendy's/Arby's Group, Inc. (Parent Company Only) CONDENSED STATEMENTS OF CASH FLOWS-CONTINUED (In Thousands) January 3, 2010 Year Ended December 28, 2008 December 30, 2007 Detail of cash flows related to investments: Operating investment adjustments, net: Net recognized losses (gains... -

Page 157

...Arby's Restaurants, LLC (formerly Wendy's International Holdings, LLC) Arby's Restaurant Holdings, LLC Triarc Restaurant Holdings, LLC Arby's Restaurant Group, Inc. RTM Acquisition Company, LLC Wendy's/Arby's Support Center, LLC Sybra, LLC RTM Partners, LLC RTM Development Company, LLC RTM Operating... -

Page 158

...owned by Wendy's Restaurants of Canada Inc. Ontario Ontario Ontario Ohio Colorado Delaware Delaware Delaware Delaware Delaware Delaware New York Florida Delaware Delaware South Carolina (2) 99.7% capital interest owned by Wendy's/Arby's Group, Inc. (the "Company"). Certain members of management of... -

Page 159

... 3, 2010, relating to the consolidated financial statements and financial statement schedule of Wendy's/Arby's Group, Inc. and the effectiveness of the Company's internal control over financial reporting appearing in this Annual Report on Form 10-K of Wendy's/Arby's Group, Inc. for the year ended... -

Page 160

... S-3 of Wendy's/Arby's Group, Inc. of our report dated March 3, 2010 relating to the financial statements of TIMWEN Partnership, which appears in this Annual Report on Form 10-K of Wendy's/Arby's Group, Inc. /s/ PricewaterhouseCoopers LLP Chartered Accountants, Licensed Public Accountants Toronto... -

Page 161

...Form S-3 of Wendy's/Arby's Group, Inc. (the "Company") of our report dated March 22, 2010, relating to the consolidated financial statements of Deerfield Capital Corp. appearing in this Amendment No. 1 to the Annual Report on Form 10-K of the Company for the year ended January 3, 2010. /s/ Deloitte... -

Page 162

... financial statements, and other financial information included in this report, fairly present in all material respects the financial condition, results of operations and cash flows of the registrant as of, and for, the periods presented in this report; 4. The registrant's other certifying officer... -

Page 163

...Stephen E. Hare, the Senior Vice President and Chief Financial Officer of Wendy's/Arby's Group, Inc., certify that: 1. I have reviewed this annual report on Form 10-K of Wendy's/Arby's Group, Inc.; 2. Based on my knowledge, this report does not contain any untrue statement of a material fact or omit... -

Page 164

... undersigned officers of Wendy's/Arby's Group, Inc., a Delaware corporation (the "Company"), does hereby certify, to the best of such officer's knowledge, that: The Annual Report on Form 10-K for the year ended January 3, 2010 (the "Form 10-K") of the Company fully complies with the requirements of... -

Page 165

..., Officers, Corporate Information Board of Directors Nelson Peltz 2,4,6 Chairman, Wendy's/crby's Group, Inc. Chief Executive Officer and Founding Partner, Trian Fund Management, L.P. Peter W. May 2,4,6 Vice Chairman, Wendy's/crby's Group, Inc. President and Founding Partner, Trian Fund Management... -

Page 166

... centered on respect, teamwork, opportunity and accountability. Our Quality Food We are proud of the products we serve, made with quality ingredients, and we provide our customers with easy-to-use tools so they can make informed decisions about the food they eat. Our Commitment to Giving Back We...