Wacom 2004 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2004 Wacom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

16 Wacom Annual Report 2004

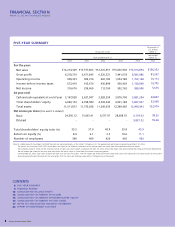

CONSOLIDATED STATEMENTS OF CASH FLOWS

Wacom Co., Ltd. and Consolidated Subsidiaries

Thousands of

U.S. dollars

(Note 1)

Year ended

March 31

2004

Thousands of yen

Year ended March 31

2003 2004

Cash flows from operating activities:

Income before income taxes...................................................................

Adjustments to reconcile income before income taxes to net

cash provided by operating activities----

Depreciation and amortization.........................................................

Gain on sale of investment securities ...............................................

Gain on sale of fixed assets ...............................................................

Loss on sale of subsidiaries’ stock......................................................

Loss on sale and disposal of fixed assets...........................................

Loss on write-down of investment securities ...................................

Litigation settlement .........................................................................

Other, net ...........................................................................................

Changes in assets and liabilities ----

Increase in notes and accounts receivable........................................

Decrease (increase) in inventories.....................................................

Increase in notes and accounts payable ...........................................

Increase (decrease) in accrued retirement benefits .........................

Other, net ...........................................................................................

Sub total ...........................................................................................

Interest and dividends received ........................................................

Interest paid .......................................................................................

Income taxes paid ..............................................................................

Net cash provided by operating activities ......................................

Cash flows from investing activities:

Payments for purchases of fixed assets..................................................

Proceeds from sale of fixed assets..........................................................

Payments for purchases of investment securities..................................

Proceeds from sale of investment securities..........................................

Payment for additional investment in consolidated

subsidiaries............................................................................................

Decrease of net cash resulting from exclusion of a

consolidated subsidiary from the scope of consolidation .................

Increase in time deposits.........................................................................

Decrease in time deposits .......................................................................

Increase in insurance funds.....................................................................

Proceeds from refund of insurance funds .............................................

Other, net ................................................................................................

Net cash used in investing activities................................................

Cash flows from financing activities:

Increase (decrease) in short-term debt, net...........................................

Proceeds from long-term debt ...............................................................

Payments of long-term debt...................................................................

Payments of other long-term liabilities .................................................

Dividends paid .........................................................................................

Proceeds from issuance of stock.............................................................

Other, net ................................................................................................

Net cash used in financing activities ...............................................

Effect of exchange rate changes on cash and cash equivalents ............

Net increase in cash and cash equivalents ...............................................

Cash and cash equivalents at beginning of year.....................................

Cash and cash equivalents at end of year (Note 2) .................................

The accompanying notes are an integral part of the financial statements.

¥1,130,868

246,182

(4)

(38)

9,564

21,173

-

447,575

67,869

(183,191)

64,076

56,876

(42,208)

60,462

1,879,204

15,262

(49,034)

(776,878)

1,068,554

(98,740)

530

(97,473)

52

(6,300)

(13,145)

(145,364)

173,538

(38,250)

114,890

(14,390)

(124,652)

140,000

200,000

(812,030)

(93,502)

(86,470)

534,510

(12,176)

(129,668)

(203,730)

610,504

3,070,700

¥3,681,204

¥936,403

278,680

(11,501)

-

-

3,699

7,039

-

73,578

(78,532)

(331,172)

955,422

171,915

117,653

2,123,184

125,617

(73,615)

(401,427)

1,773,759

(169,182)

5

(20,000)

14,766

(1,000)

-

(216,210)

244,225

(38,544)

11,744

(10,168)

(184,364)

(534,014)

1,150,000

(1,494,970)

(73,461)

(86,470)

(38,544)

-

(1,038,915)

(63,134)

487,346

2,583,354

¥3,070,700

$10,705

2,330

(0)

(0)

91

200

-

4,237

642

(1,734)

607

538

(400)

573

17,789

144

(464)

(7,354)

10,115

(935)

5

(923)

0

(60)

(124)

(1,376)

1,643

(362)

1,088

(136)

(1,180)

1,325

1,893

(7,687)

(885)

(819)

5,060

(114)

(1,227)

(1,929)

5,779

29,068

$34,847