Wacom 2004 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2004 Wacom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Wacom Annual Report 2004 11

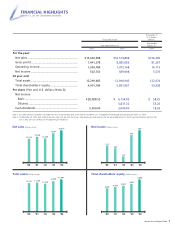

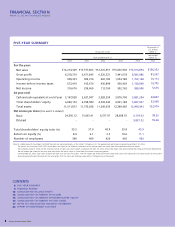

Net income per share (Basic) (Yen) Return on equity (ROE) (%) Total shareholders' equity ratio (%)

$35 million (up 19.9% year-on-year), at the end of the

fiscal year under review, while income before income

taxes grew relatively smoothly to ¥ 1,131 million, or

U.S. $11 million (up 20.8% year-on-year).

Cash flows from operating activities

Net cash provided by operating activities amounted to

¥1,069 million, or U.S. $10 million (down 39.8% year-

on-year), primarily due to income taxes paid of ¥ 777

million, or U.S. $7 million (up 93.5% year-on-year), in

spite of the favorable income before income taxes of

¥1,131 million, or U.S. $11 million.

Cash flows from investing activities

Net cash used in investing activities amounted to ¥ 125

million, or U.S. $1 million (down 32.4% year-on-year),

mainly as the combined result of payments of ¥ 6

million, or U.S. $0.06 million, for additional investment

in Wacom NET Co., Ltd. in the context of making it our

wholly-owned subsidiary; payments of ¥ 97 million, or

U.S. $0.9 million, for purchases of investment securities

to establish a South Korean subsidiary; and proceeds of

¥115 million, or U.S. $1 million, from the refund of

insurance funds.

Cash flows from financing activities

Net cash used in financing activities amounted to ¥ 130

million, or U.S. $1 million (down 87.5% year-on-year),

mainly as the combined result of the expenditure of

¥812 million, or U.S. $8 million (down 45.7% year-on-

year), for payment of long-term borrowings and

proceeds of ¥ 535 million, or U.S. $5 million, from

issuance of stock.

As a result, consolidated total assets and

shareholders' equity as of the end of the fiscal year

under review were ¥ 12,991 million, or U.S. $123

million, and ¥ 5,698 million, or U.S. $54 million,

respectively, with the equity ratio at 43.9% and return

on equity (ROE) at 11.1%.

Source and Application of Funds

Of the net funds of ¥ 472 million procured by means of

the public stock offering on April 24, 2003 (number of

stocks issued: 1,300 shares; issue price: ¥ 390,000), ¥ 58

million was applied to capital expenditures for building

a new business system, and the remaining ¥ 414 million

to working capital.

8.9

6.1

2.5

11.1

’01 ’02 ’03 ’04

24,050

15,003

6,578

28,089

6,154

’00

10.6

’01 ’02 ’03 ’04’00

35.5 37.0 40.9

43.9

39.8

’01 ’02 ’03 ’04’00

*On November 20, 2003, each share of common stock

was split into five shares. Accordingly, the '04 amount was

calculated on the basis that such a stock split was carried out

at the beginning of the period.

*