Vtech 2009 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2009 Vtech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT DISCUSSION AND ANALYSIS

60

50

40

30

20

10

0

18

15

12

9

6

3

0

6 VTech Holdings Ltd Annual Report 2009

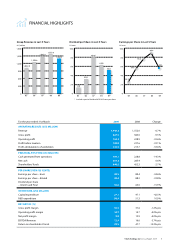

Profit Attributable to Shareholders

in Last 5 Years

US$ million

Group R&D Expenditure

in Last 5 Years

US$ million

240

200

160

120

80

40

0

143.2

182.9

215.7

128.8

56.9

12.9

Group EBITDA/Revenue and EBIT/Revenue

in Last 5 Years

%

10.7

16.6

14.7

14.9

13.3

11.3

12.9

6.1

7.9

EBIT/Revenue

EBITDA/Revenue

GROSS PROFIT/MARGIN

The gross profit for the financial year

2009 was US$527.5 million, a decrease

of US$55.5 million or 9.5% compared

to the US$583.0 million recorded in

the previous financial year. Gross

margin for the financial year reduced

from 37.6% to 36.4%. The decrease in

gross margin arose mainly from cost

pressure from rising labour costs

in China and raw material cost

increases. In addition, the prices of

the Group’s products were reduced

as poor conditions in the global

markets led to softening of consumer

demand and necessitated aggressive

retail level promotions.

OPERATING PROFIT/MARGIN

The operating profit for the year

ended 31st March 2009 was US$154.3

million, a decrease of US$74.6 million

or 32.6% over the previous financial

year. The operating profit margin also

decreased from 14.7% in the previous

financial year to 10.7% in the financial

year 2009. The decrease was mainly

attributable to the decline in gross

profit and gross margin together

with the steep depreciation of the

Euro and Sterling against the

US dollar.

Selling and distribution costs

decreased by 6.6% from US$248.5

million in the previous financial year

to US$232.1 million in the financial

year 2009. The decrease was mainly

attributable to the decreased spending

on advertising and promotional

activities of the Group. Royalty

payments to licensors for the use of

popular cartoon characters for certain

ELPs also decreased, which led the

decline in selling and distribution

costs in the financial year 2009. As a

percentage of Group revenue, selling

and distribution costs were 16.0% in

the financial year 2009, the same as

the previous financial year.

Administrative and other operating

expenses increased from US$54.3

million in the previous financial year

to US$84.2 million in the financial

year 2009. An exchange loss of

US$27.6 million arising from the

Group’s global operations in the

ordinary course of business was

recorded under administrative

and other operating expenses in

the financial year 2009 as the Euro

and Sterling weakened abruptly

against the US dollar. This contrasted

with an exchange gain of US$10.7

million recorded in the previous

financial year. Excluding the effect

of exchange differences, the

administrative and other operating

expenses decreased by US$8.4 million

compared to the previous financial

year. Administrative and other

operating expenses as a percentage

of Group revenue, excluding the

effect of exchange differences,

improved from 4.2% in the previous

financial year to 3.9% in the financial

year 2009.

Research and development activities

are vital for the long-term development

of the Group. During the financial

year 2009, the research and

development expense was US$56.9

million, an increase of 10.9% over the

previous financial year. Research

and development expenses as a

percentage of Group revenue increased

from 3.3% in the previous financial

year to 3.9% in financial year 2009.

NET PROFIT AND DIVIDENDS

The profit attributable to shareholders

for the year ended 31st March 2009

was US$143.2 million, a decrease of

US$72.5 million as compared to the

previous financial year. The ratios of

EBIT and EBITDA to revenue were

10.7% and 12.9% respectively.

51.3

45.2

40.3

38.5

56.9

05 06 07 08 09 05 06 07 08 09 05 06 07 08 09