Vtech 2009 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2009 Vtech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

VTech Holdings Ltd Annual Report 2009 3

OPERATIONS

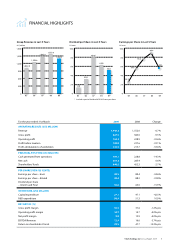

Revenue at the telecommunication

products (TEL) business for the year

declined by 9.8% over the financial

year 2008 to US$620.7 million.

In North America, still the largest

market for our TEL business, revenue

declined as consumer demand

was weak. Retailers also reduced

inventory in view of the slowing

economy. Despite the decrease in

sales, VTech continued to be the

largest supplier in the US cordless

phone market, and we expanded

our market share further during the

financial year.

In Europe, we continued to work on

an Original Design Manufacturing

(ODM) basis with major fixed line

telephone operators and well-known

brand names. The European market

was more stable than that in North

America, and we managed not only

to gain market share, but also to

increase revenue. The sole supplier

agreement we signed in September

2008 with Deutsche Telekom AG

(Deutsche Telekom) helped us to

increase our presence in Germany.

Revenue at the electronic learning

products (ELP) business dropped by

7.9% over the financial year 2008 to

US$566.9 million. The ELP business

initially saw rising sales in the first

half, but sales quickly turned

negative owing to the rapidly

deteriorating market conditions.

In Europe, sales declined more as

the European business was further

affected by the steep depreciation of

the Euro and Sterling against the US

dollar. In response to the worsening

market environment, we moved

aggressively to step up price

promotions to stimulate sales and

reduce inventory.

Despite a slowing second half, revenue

at the contract manufacturing services

(CMS) business managed to increase

by 5.0% over the previous financial

year to another record of US$260.6

million. This was a considerably

better performance than the global

Electronic Manufacturing Services

(EMS) industry, which has been badly

affected by the global slump in

manufacturing.

Our superior performance was due

to higher sales to existing customers,

as some of them outsourced more

production to VTech in search of

lower costs. We also continued to

gain new customers, who were

attracted by our growing reputation.

SENIOR MANAGEMENT CHANGE

Our Group Chief Operating Officer,

Mr. Edwin YING Lin Kwan, retired

on 1st January 2009. I would like to

express my sincere gratitude to him

for his valuable contributions to

the Group. Following his retirement,

Mr. Andy LEUNG Hon Kwong,

Chief Executive Officer of our CMS

business, was appointed as Executive

Director.

In addition, Dr. PANG King Fai, our

Group Chief Technology Officer, was

promoted to Group President on

1st January 2009. He continues to hold

the position of Executive Director.

OUTLOOK

There seems little doubt that

consumer sentiment will remain

weak throughout most of the

calendar year 2009. The International

Monetary Fund estimates that global

GDP will contract by 1.3% for the

year, and the decline is likely to be

even more severe in many of our

key markets.

Top line growth will therefore be very

difficult to achieve in the financial

year 2010, even though economies

may recover and we anticipate

increasing market shares for our TEL

business. We are, however, cautiously

optimistic that profitability will

improve, as the Euro, Sterling and

Renminbi show stability. We are

also benefiting from the fall in raw

material prices and labour costs,

which will ease cost pressure.

To drive growth for the Group, we will

continue to pursue our strategy based

on product innovation, gains in

market share, geographic expansion

and operational excellence.

We are cautiously optimistic

that profitability will improve, as

the Euro, Sterling and Renminbi

show stability. We are also

benefiting from the fall in raw

material prices and labour costs,

which will ease cost pressure.

‘‘

’’