Vonage 2011 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2011 Vonage annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.VONAGE HOLDINGS CORP.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

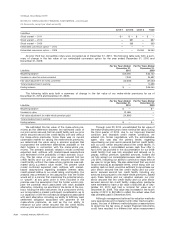

(In thousands, except per share amounts)

November 2008 Financing

On October 19, 2008, we entered into definitive agree-

ments (collectively, the “Credit Documentation”) for a

financing consisting of (i) a $130,300 senior secured first

lien credit facility (the “First Lien Senior Facility”), (ii) a

$72,000 senior secured second lien credit facility (the

“Second Lien Senior Facility”), and (iii) the sale of $18,000

of our third lien convertible notes (the “Convertible Notes”).

The funding for this transaction was completed on

November 3, 2008.

For the First Lien Senior Facility, an aggregate value of

$105,322, or a discount of $24,978, was recorded. This

discount was amortized to interest expense over the life of

the debt using the effective interest method. The accumu-

lated amortization was $24,798 at December 31, 2010,

including the acceleration of unamortized discount on notes

related to the prepayment and repayment of the First Lien

Senior Facility of $14,539 at December 31, 2010. The amor-

tization for the year ended December 31, 2010 and 2009

was $ 4,006 and $4,596, respectively.

For the Second Lien Senior Facility, an aggregate value

of $67,273, or a discount of $4,727, was recorded. This

discount was amortized to interest expense over the life of

the debt using the effective interest method. The accumu-

lated amortization was $4,727 at December 31, 2010,

including the acceleration of unamortized discount on notes

related to the prepayment and repayment of the Second

Lien Senior Facility of $3,360 at December 31, 2010. The

amortization for the year ended December 31, 2010 and

2009 was $601 and $650, respectively.

For the Convertible Notes, an aggregate value of

$55,884 or a premium of $37,884 was recorded. Given the

magnitude of the premium, this amount was recorded as

additional-paid-in capital as prescribed in FASB ASC

470-20-25 “Debt with Conversions and Other Options-

Recognition”.

Consolidated Excess Cash Flow Prepayments

Beginning March 31, 2010, because it was the first

quarter during which we had more than $75,000 of speci-

fied unrestricted cash in any quarter, we offered to prepay

without premium 50% of the Consolidated Excess Cash

Flow (as defined in the Credit Documentation) each quar-

ter.

First Lien Senior Facility Prepayments

Consolidated Excess Cash Flow — March 31, 2010. On

April 22, 2010, we offered to prepay $24,032 of loans under

the First Lien Senior Facility. While certain holders of loans

under the First Lien Senior Facility waived their right to receive

the prepayment as permitted under the Credit Doc-

umentation, the $24,032 offered was paid on April 27, 2010 to

holders that did not waive the prepayment including certain

affiliates or associates of the Company’s directors. Of this

amount, $23,187 was applied to the outstanding principal

balance, and $845 was applied to accrued but unpaid inter-

est. A loss on extinguishment of $4,034, representing accel-

eration of unamortized debt discount, debt related costs, and

administrative agent fees of $3,312, $662 and $60,

respectively, was recorded in the three-month period ended

June 30, 2010 as a result of the prepayment.

Consolidated Excess Cash Flow — June 30, 2010. On

July 16, 2010, we offered to prepay $40,776 of loans under

the First Lien Senior Facility. While certain holders of loans

under the First Lien Senior Facility waived their right to

receive the prepayment as permitted under the Credit

Documentation, $4,655 was paid on July 21, 2010 to hold-

ers that did not waive the prepayment, who were affiliates

or associates of the Company’s directors. Of this amount,

$4,499 was applied to the outstanding principal balance

and $156 was applied to accrued but unpaid interest. A

loss on extinguishment of $731, representing acceleration

of unamortized debt discount, debt related costs, and

administrative agent fees of $605, $120 and $6,

respectively, was recorded in the three-month period ended

September 30, 2010 as a result of the prepayment.

Consolidated Excess Cash Flow — September 30,

2010. On November 15, 2010, we offered to prepay loans

under the First Lien Senior Facility and the Second Lien

Senior Facility in an aggregate amount of $11,084. The

holders of the First Lien Senior Facility and Second Lien

Senior Facility waived their right to prepayment.

Second Lien Senior Facility Prepayments

Consolidated Excess Cash Flow — June 30, 2010. On

July 16, 2010, concurrent with the prepayment offer under

the First Lien Senior Facility, we offered to prepay $40,776

of loans under the Second Lien Senior Facility less $4,655

required to prepay amounts under the First Lien Senior

Facility prepayment offer. While certain holders of loans

under the Second Lien Senior Facility waived their right to

receive the prepayment as permitted under the Credit

Documentation, $13,281 was paid on July 21, 2010 to hold-

ers that did not waive the prepayment, who were affiliates or

associates of the Company’s directors. Of this amount

$13,128 was applied to the outstanding principal balance of

which $3,668 represents payment of PIK interest, which was

recorded as a component of cash flows from financing

activities, and $153 was applied to accrued but unpaid

interest. A loss on extinguishment of $813, representing

acceleration of unamortized debt discount, debt related

costs, and administrative agent fees of $472, $325 and $16,

respectively, was recorded in the three-month period ended

September 30, 2010 as a result of the prepayment.

Other Prepayments under First Lien Senior Facility and

Second Lien Senior Facility

The First Lien Senior Facility and Second Lien Senior

Facility included make-whole premiums that were bifur-

cated from the underlying debt instrument and valued as a

separate financial instrument because the economic and

risk characteristics of the make-whole premiums meet the

criteria for separate accounting as set forth in FASB

ASC 815. The First Lien Senior Facility and Second Lien

Senior Facility make-whole premiums were paid on

December 14, 2010 and a nominal fair value as of

December 31, 2009.

Third Lien Convertible Notes

Subject to conversion, repayment or repurchase of the

Convertible Notes, the Convertible Notes were to mature in

October 2015. Subject to customary anti-dilution adjust-

ments (including triggers upon the issuance of common

stock below the market price of the common stock or the

conversion price of the Convertible Notes), the Convertible

Notes were convertible into shares of our common stock at

a rate equal to 3,448.2759 shares for each $1,000 principal

amount of Convertible Notes, or approximately $0.29 per

share. During the three months ended, December 31, 2010

we received additional Notices of Conversion from the

remaining note holders indicating their desire to convert

their Convertible Notes. In the aggregate in 2010 and 2009,

$18,000 principal amount of Convertible Notes were con-

verted into 62,069 shares of our common stock. As of

December 31, 2010, there were $0 principal amount of

Convertible Notes outstanding.

F-22 VONAGE ANNUAL REPORT 2011