Vonage 2011 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2011 Vonage annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

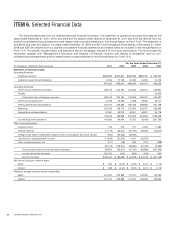

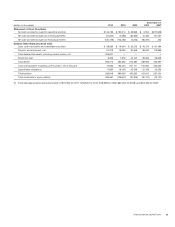

ITEM 7. Management’s Discussion and Analysis of Financial

Condition and Results of Operations

You should read the following discussion together with

“Selected Financial Data” and our consolidated financial state-

ments and the related notes included elsewhere in this Annual

Report on Form 10-K. This discussion contains forward-looking

statements, which involve risks and uncertainties. Our actual

results may differ materially from those we currently anticipate as

a result of many factors, including the factors we describe under

“Item 1A—Risk Factors,” and elsewhere in this Annual Report on

Form 10-K.

OVERVIEW

We are a leading provider of communications services

connecting people through broadband devices worldwide. We

rely heavily on our network, which is a flexible, scalable Session

Initiation Protocol (SIP) based Voice over Internet Protocol, or

VoIP, network. This platform enables a user via a single

“identity,” either a number or user name, to access and utilize

services and features regardless of how they are connected to

the Internet, including over 3G, 4G, Cable, or DSL broadband

networks. This technology enables us to offer our customers

attractively priced voice and messaging services and other fea-

tures around the world.

In 2009, we shifted our primary emphasis from the domes-

tic home phone replacement market to the international long

distance market. With Vonage World we offer unlimited calling

domestically and to more than 60 countries, including India,

Mexico, and China, for a flat monthly rate. We believe the value

and convenience provided by Vonage World is particularly

appealing to international long distance callers compared to

offers from our competitors.

In addition to our landline telephony business, we are lever-

aging our technology to offer services and applications for

mobile and other connected devices to address large existing

markets. We introduced our first mobile offering in late 2009 and

have continued to build upon our mobile services strategy with

two product introductions in mid-2011. In early 2012, we

introduced Vonage Mobile, our all-in-one mobile application that

provides free calling and messaging between users who have

the application, as well as low-cost international calling to more

than 200 countries to any other phone. In addition, calls by

users of the mobile application to Vonage home or business

lines are also free. This mobile application works over WiFi, 3G

and 4G and in more than 90 countries worldwide. Vonage

Mobile consolidates the best features of our prior applications,

while adding important functionality, better value, and improved

ease of use. Vonage Mobile users can instantly add calling

credit from within the application through iTunes or the Android

Market for calls to users without the application. Vonage Mobile

uses the phone's existing mobile number and contact list, elimi-

nating the need for unique user names and duplicate identities

for contacts and allowing users to build a free global calling and

messaging network from their existing contacts using the appli-

cation's multiple invitation system.

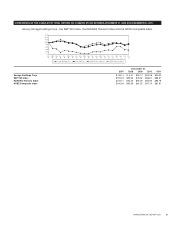

We have made significant financial progress over the past

four years providing a solid foundation for the future. We have

managed a significant strategic shift while transforming the cost

structure in our core business to drive significant improvements

in profitability. We enhanced the value of our product by inves-

ting in upgraded systems, streamlined processes, and improved

customer experience, which we believe have helped stabilize

our subscriber base while driving structural cost reductions

throughout the company. In addition to reducing ongoing costs,

these structural improvements enabled us to absorb incremental

costs resulting from a growth in international minutes as we

added new customers to our Vonage World plan. By lowering

international termination costs, lowering domestic calling rates,

and reducing the cost of our devices by nearly a third, we have

significantly improved our profitability.

In 2011, our core business generated substantial net

income and cash flow on relatively flat service revenues, driven

by an aggressive focus on driving efficiencies throughout our

operations. Through two refinancings in the past 14 months, we

have reduced our debt by over 50% and lowered interest rates

from highs of 20% to less than 4%, saving $43 million in annual

interest expense from the debt structure in place in 2010.

We had approximately 2.4 million subscriber lines for broad-

band telephone replacement services as of December 31, 2011.

We bill customers in the United States, Canada, and the United

Kingdom. Customers in the United States represented 94% of

our subscriber lines at December 31, 2011.

Recent Developments Net deferred tax assets represent

the temporary differences between the financial reporting bases

and the tax return bases of our assets and liabilities. Our net

deferred tax assets primarily consist of net operating loss carry

forwards (“NOLs”). We are required to record a valuation allow-

ance which reduces these net deferred tax assets if we con-

clude that it is more likely than not that taxable income

generated in the future will be insufficient to utilize the future

income tax benefit from these net deferred tax assets prior to

expiration. We periodically review this conclusion, which

requires significant management judgment. Until the fourth

quarter of 2011, we recorded a valuation allowance which

reduced our net deferred tax assets to zero. In the fourth quarter

of 2011, based upon our sustained profitable operating

performance over the past three years excluding certain losses

associated with our prior convertible notes and our December

2010 debt refinancing and our positive outlook for taxable

income in the future, our evaluation determined that the benefit

resulting from our net deferred tax assets (namely, the NOLs) are

likely to be usable prior to their expiration. Accordingly, we

released the related valuation allowance against our United

States and Canada net deferred tax assets, and a portion of the

allowance against our state net deferred tax assets as certain

NOLs may expire prior to utilization due to shorter utilization

periods in certain states, resulting in a one-time non-cash

income tax benefit of $325,601 that we recorded in our state-

ment of operations and a corresponding net deferred tax asset

of $325,601 that we recorded on our balance sheet on

December 31, 2011. In subsequent periods, we would expect to

recognize income tax expense equal to our pre-tax income

multiplied by our effective income tax rate, an expense that has

not been recognized prior to the reduction of the valuation

allowance and that will reduce our net income and earnings per

share. In the future, if available evidence changes our conclusion

that it is more likely than not that we will utilize our net deferred

tax assets prior to their expiration, we will make an adjustment

to the related valuation allowance at that time.

24 VONAGE ANNUAL REPORT 2011