Vonage 2011 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2011 Vonage annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

VONAGE HOLDINGS CORP.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(In thousands, except per share amounts)

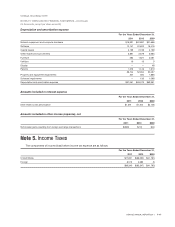

taxpayers. During 2003 and 2004, we submitted an appli-

cation to the New Jersey Economic Development Author-

ity, or EDA, to participate in the program and the

application was approved. The EDA then issued a certifi-

cate certifying our eligibility to participate in the program.

The program requires that a purchaser pay at least 75%

of the amount of the surrendered tax benefit. In tax years

2009, 2010, and 2011, we sold approximately, $0, $2,194,

and $0, respectively, of our New Jersey State net operat-

ing loss carry forwards for a recognized benefit of approx-

imately $0 in 2009, $168 in 2010, and $0 in 2011,

respectively. Collectively, all transactions represent

approximately 85% of the surrendered tax benefit each

year and have been recognized in the year received.

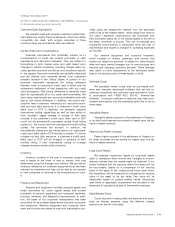

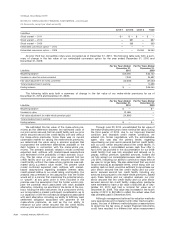

Note 6. Long-Term Debt and Revolving Credit Facility

A schedule of long-term debt at December 31, 2011 and 2010 is as follows:

December 31,

2011

December 31,

2010

3.25-3.75% 2011 Credit Facility — due 2014 $42,500 $ —

9.75% 2010 Credit Facility, net of discount — 173,004

$42,500 $173,004

At December 31, 2011, future payments under long-term debt obligations over each of the next five years and there-

after are as follows:

2011 Credit Facility

2012 28,333

2013 28,333

2014 14,167

Minimum future payments of principal 70,833

Current portion 28,333

Long-term portion $42,500

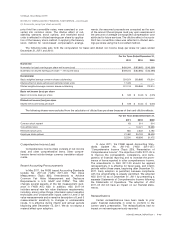

December 2010 Financing

On December 14, 2010, we entered into a credit

agreement (the “2010 Credit Facility”) consisting of a

$200,000 senior secured term loan. The co-borrowers

under the 2010 Credit Facility were us and Vonage Amer-

ica Inc., our wholly owned subsidiary. Obligations under

the 2010 Credit Facility were guaranteed, fully and

unconditionally, by our other United States subsidiaries

and were secured by substantially all of the assets of each

borrower and each of the guarantors. An affiliate of the

chairman of our board of directors and one of our princi-

pal stockholders was a lender under the 2010 Credit

Facility.

Use of Proceeds

We used the net proceeds of the 2010 Credit Facility

of $194,000 ($200,000 principal amount less original dis-

count of $6,000), plus $102,090 of cash on hand, to

(i) exercise our existing right to retire debt under our prior

senior secured first lien credit facility, for 100% of the

contractual make-whole price, (ii) retire debt under our

prior senior secured second lien credit facility at a more

than 25% discount to the contractual make-whole price,

and (iii) cause the conversion of all then outstanding third

lien convertible notes into 8,276 shares of our common

stock We also incurred $11,444 of fees in connection with

the 2010 Credit Facility and repayment of our prior 2008

financing. We agreed to make an additional cash payment

to the holders of our prior senior secured second lien

credit facility in an aggregate amount of $9,000 if we

engaged in Qualifying Discussions (as defined in the

Master Agreement) prior to June 30, 2011 that result in a

merger or acquisition transaction (as defined in the Master

Agreement) that is consummated prior to June 30, 2012.

No such discussions occurred prior to June 30, 2011.

In accordance with FASB ASC 470 “Debt Mod-

ification and Extinguishment”, substantially all of the

repayment of the Prior Financing was treated as an

extinguishment of notes resulting in a loss on early

extinguishment of notes of $26,531. For the portion of the

repayment of the Prior Financing treated as a debt mod-

ification, we carried forward $1,072 of unamortized dis-

count, which will be amortized to interest expense over

the life of the debt using the effective interest method in

addition to the $6,000 of original issue discount in con-

nection with the 2010 Credit Facility. The accumulated

amortization as of December 31, 2011 and December 31,

2010 was $7,072 and $76, respectively, including accel-

eration of $6,081 and $0, respectively. The amortization

for 2011 was $915.

Repayments

In 2011, we made repayments of the entire $200,000

under the 2010 Credit Facility, with $20,000 designated to

cover our 2011 mandatory amortization, $50,000 des-

ignated to cover our 2011 annual excess cash flow man-

datory repayment, if any, and $130,000 designated to

cover the outstanding principal balance under the 2010

Credit Facility at the time of the 2011 Credit Facility

financing. A loss on extinguishment of $11,806, represent-

ing a $1,000 prepayment fee to holders of the 2010 Credit

Facility, professional fees of $54, and acceleration of

unamortized debt discount and debt related costs of

$6,081 and $4,671, respectively, was recorded in 2011 as

a result of the repayments.

F-20 VONAGE ANNUAL REPORT 2011