Vodafone 2007 Annual Report Download - page 139

Download and view the complete annual report

Please find page 139 of the 2007 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone Group Plc Annual Report 2007 137

Financials

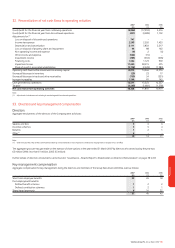

In conjunction with the acquisition of Hutchison Essar, the Group entered into a share sale and purchase agreement with a Bharti group company regarding

the Group’s 5.60% direct shareholding in Bharti Airtel. On 9 May 2007, the Bharti group company irrevocably agreed to purchase this shareholding and the

Group expects to receive $1.6 billion in cash consideration for such shareholding by November 2008. The shareholding will be transferred in two tranches, the

first before 31 March 2008 and the second by November 2008. Following the completion of this sale, the Group will continue to hold an indirect stake of

4.39% in Bharti Airtel.

EU Roaming

On 23 May 2007, the European Parliament voted to introduce regulation on retail and wholesale roaming prices. The Group expects roaming revenues to be

lower year on year in 2008 due to the combined effect of Vodafone’s own initiatives and this direct regulatory intervention.

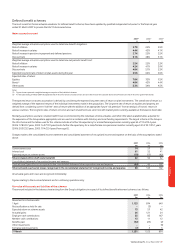

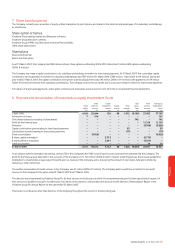

36. Related party transactions

Transactions with joint ventures and associated undertakings

Transactions between the Company and its subsidiaries, joint ventures and associates represent related party transactions. Transactions with subsidiaries have

been eliminated on consolidation. Transactions between the Company and its joint ventures are not material to the extent that they have not been eliminated

through proportionate consolidation. Except as disclosed below, no material related party transactions have been entered into, during the year, which might

reasonably affect any decisions made by the users of these Consolidated Financial Statements.

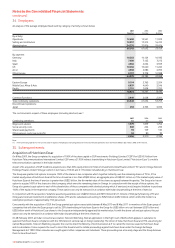

2007 2006 2005

£m £m £m

Transactions with associated undertakings:

Sales of goods and services 245 288 194

Purchase of goods and services 295 268 243

Amounts owed to joint ventures included within short term borrowings(1) 842 378 1,142

Note:

(1) Loan arises through Vodafone Italy being part of a Group cash pooling arrangement. Interest is paid in line with short term market rates.

Amounts owed by and owed to associated undertakings are disclosed within notes 17 and 27.

Dividends received from associated undertakings are disclosed in the consolidated cash flow statement.

Group contributions to pension schemes are disclosed in note 25.

Compensation paid to the Company’s Board of directors and members of the Executive Committee is disclosed in note 33.

Transactions with directors

During the three years ended 31 March 2007, and as of 25 May 2007, neither any director nor any other executive officer, nor any associate of any director or

any other executive officer, was indebted to the Company.

During the three years ended 31 March 2007, and as of 25 May 2007, the Company has not been a party to any other material transaction, or proposed

transactions, in which any member of the key management personnel (including directors, any other executive officer, senior manager, any spouse or relative

of any of the foregoing, or any relative of such spouse), had or was to have a direct or indirect material interest.

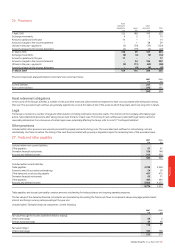

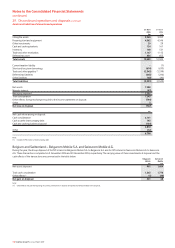

37. Financial information of joint ventures and associated undertakings

Summary aggregated financial information of 50% or less owned entities accounted for using proportionate consolidation or under the equity method,

extracted on a 100% basis from accounts prepared under IFRS at 31 March and for the years then ended, is set out below.

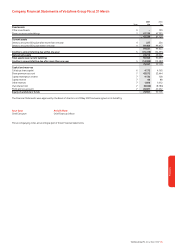

2007 2006 2005

50% or less owned entities classified as associated undertakings £m £m £m

Revenue 30,981 30,204 25,141

Profit for the financial year 6,435 5,768 4,883

Non-current assets 38,055 42,776 36,385

Current assets 5,094 5,868 5,763

Total assets 43,149 48,644 42,148

Total equity shareholders’ funds 27,296 29,951 24,155

Minority interests 858 961 939

Total equity 28,154 30,912 25,094

Non-current liabilities 4,640 9,367 5,579

Current liabilities 10,355 8,365 11,475

Total liabilities 14,995 17,732 17,054

Total equity and liabilities 43,149 48,644 42,148