Vodafone 2007 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2007 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone Group Plc Annual Report 2007 127

Financials

Defined benefit schemes

The most recent full formal actuarial valuations for defined benefit schemes have been updated by qualified independent actuaries for the financial year

ended 31 March 2007 to provide the IAS 19 disclosures below.

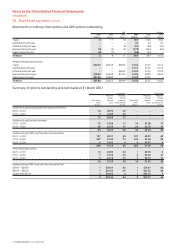

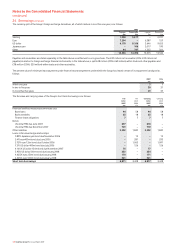

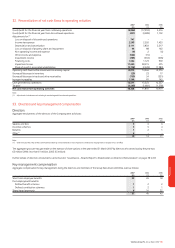

Major assumptions used

2007(1) 2006(1) 2005(1)

%%%

Weighted average actuarial assumptions used to determine benefit obligations:

Rate of inflation 2.7% 2.5% 2.5%

Rate of increase in salaries 4.4% 4.2% 4.1%

Rate of increase in pensions in payment and deferred pensions 2.7% 2.5% 2.5%

Discount rate 5.1% 4.8% 5.1%

Weighted average actuarial assumptions used to determine net periodic benefit cost:

Rate of inflation 2.5% 2.5% 2.3%

Rate of increase in salaries 4.2% 4.1% 3.9%

Discount rate 4.8% 5.1% 5.3%

Expected long term rate of return on plan assets during the year 6.5% 6.4% 6.5%

Expected rates of return:

Equities 7.8% 7.3% 7.5%

Bonds(2) 4.8% 4.2% 4.4%

Other assets 5.3% 3.4% 4.5%

Notes:

(1) Figures shown represent a weighted average assumption of the individual schemes.

(2) For the year ending 31 March 2007 the expected rate of return for bonds consisted of a 5.1 per cent rate of return for corporate bonds and a 4.0 per cent rate of return for government bonds.

The expected return on assets assumption is derived by considering the expected long term rates of return on plan investments. The overall rate of return is a

weighted average of the expected returns of the individual investments made in the group plans. The long term rate of return on equities and property are

derived from considering current “risk free” rates of return with the addition of an appropriate future “risk premium” from an analysis of historic returns in

various countries. The long term rates of return on bonds and cash investments are set in line with market yields currently available at the balance sheet date.

Mortality assumptions used are consistent with those recommended by the individual scheme actuaries, and reflect the latest available tables, adjusted for

the experience of the Group where appropriate, and are used in accordance with statutory and local funding requirements. The largest scheme in the Group is

the UK scheme and the tables used for this scheme indicate a further life expectancy for a male/female pensioner currently aged 65 of 19.4/22.4 years

(2006: 17.8/20.7 years, 2005: 16.9/19.9 years) and a further life expectancy for a male/female non-pensioner member currently aged 40 of 22.1/25.1 years

(2006: 20.3/23.3 years, 2005: 19.4/22.4 years) from age 65.

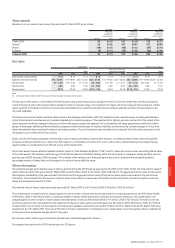

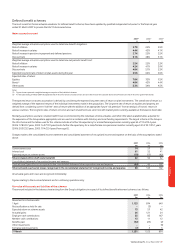

Charges made to the consolidated income statement and consolidated statement of recognised income and expense on the basis of the assumptions stated

above:

2007 2006 2005

£m £m £m

Current service cost 74 57 53

Interest cost 61 52 41

Expected return on scheme assets (73) (57) (42)

Total included within staff costs (note 34) 62 52 52

Consolidated statement of recognised income and expense:

Total actuarial (gains)/losses recognised in the consolidated statement of recognised income and expense (65) 43 102

Total cumulative actuarial losses recognised in the consolidated statement of recognised income and expense 80 145 102

All actuarial gains and losses are recognised immediately.

Figures relating to the income statement are for continuing operations only.

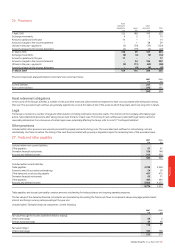

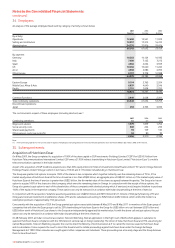

Fair value of the assets and liabilities of the schemes

The amount included in the balance sheet arising from the Group’s obligations in respect of its defined benefit retirement schemes is as follows:

2007 2006 2005

£m £m £m

Movement in scheme assets:

1 April 1,123 874 640

Reclassification as held for sale –(3) –

Expected return on scheme assets 73 57 42

Actuarial gains 26 121 24

Employer cash contributions 55 85 167

Member cash contributions 13 11 12

Benefits paid (32) (27) (7)

Other movements – – (9)

Exchange rate movements (7) 55

31 March 1,251 1,123 874