Vodafone 2007 Annual Report Download - page 136

Download and view the complete annual report

Please find page 136 of the 2007 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

134 Vodafone Group Plc Annual Report 2007

Notes to the Consolidated Financial Statements

continued

Performance bonds

Performance bonds require the Group to make payments to third parties in

the event that the Group does not perform what is expected of it under the

terms of any related contracts.

Group performance bonds include £57 million (2006: £152 million) in

respect of undertakings to roll out 3G networks in Spain.

Credit guarantees – third party indebtedness

Credit guarantees comprise guarantees and indemnities of bank or other

facilities, including those in respect of the Group’s associated undertakings

and investments.

Other guarantees and contingent liabilities

Other guarantees principally comprise commitments to support disposed

entities.

In addition to the amounts disclosed above, the Group has guaranteed

financial indebtedness and issued performance bonds for £25 million (2006:

£33 million) in respect of businesses which have been sold and for which

counter indemnities have been received from the purchasers.

The Group also enters into lease arrangements in the normal course of

business, which are principally in respect of land, buildings and equipment.

Further details on the minimum lease payments due under non-cancellable

operating lease arrangements can be found in note 30.

Legal proceedings

The Company and its subsidiaries are currently, and may be from time to

time, involved in a number of legal proceedings, including inquiries from or

discussions with governmental authorities, that are incidental to their

operations. However, save as disclosed below, the Company and its

subsidiaries are not involved currently in any legal or arbitration proceedings

(including any governmental proceedings which are pending or known to be

contemplated) which may have, or have had in the twelve months preceding

the date of this report, a significant effect on the financial position or

profitability of the Company and its subsidiaries.

The Company is a defendant in four actions in the United States alleging

personal injury, including brain cancer, from mobile phone use. In each case,

various other carriers and mobile phone manufacturers are also named as

defendants. These actions have not progressed beyond an early stage and no

accurate quantification of any losses which may arise out of the claims can

therefore be made as at the date of this report. The Company is not aware

that the health risks alleged in such personal injury claims have been

substantiated and will be vigorously defending such claims.

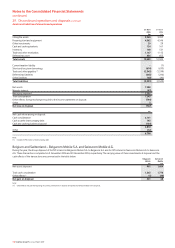

A subsidiary of the Company, Vodafone 2, is responding to an enquiry (“the

Vodafone 2 enquiry”) by Her Majesty’s Revenue and Customs (“HMRC”) with

regard to the UK tax treatment of its Luxembourg holding company,

Vodafone Investments Luxembourg SARL (“VIL”), under the Controlled

Foreign Companies section of the UK’s Income and Corporation Taxes Act

1988 (“the CFC Regime”) relating to the tax treatment of profits earned by

the holding company for the accounting period ended 31 March 2001.

Vodafone 2’s position is that it is not liable for corporation tax in the UK under

the CFC Regime in respect of VIL. Vodafone 2 asserts, inter alia, that the CFC

Regime is contrary to EU law and has made an application to the Special

Commissioners of HMRC for closure of the Vodafone 2 enquiry. In May 2005,

the Special Commissioners referred certain questions relating to the

compatibility of the CFC Regime with EU law to the European Court of Justice

(the “ECJ”) for determination (“the Vodafone 2 reference”). HMRC

subsequently appealed against the decision of the Special Commissioners to

make the Vodafone 2 reference but its appeal was rejected by both the High

Court and Court of Appeal. The Vodafone 2 reference has still to be heard by

the ECJ. Vodafone 2’s application for closure was stayed pending delivery of

the ECJ’s judgment.

In September 2006, the ECJ determined in the Cadbury Schweppes case

(C-196/04) (the “Cadbury Schweppes Judgment”) that the CFC Regime is

incompatible with EU law unless it applies to wholly artificial arrangements

intended to escape national tax normally payable. The correct application of

the Cadbury Schweppes Judgment to Vodafone 2’s case is a matter for the

Special Commissioners to determine.

At a hearing in March 2007, the Special Commissioners heard submissions

from both parties as to whether the Vodafone 2 reference should be

maintained or withdrawn by the Special Commissioners in light of the

Cadbury Schweppes Judgement. The Special Commissioners are expected to

rule on this question in the coming months.

In addition to the Vodafone 2 enquiry, on 31 October 2005, HMRC

commenced an enquiry into the residence of Vodafone Investments

Luxembourg Sarl (the “VIL enquiry”). VIL’s position is that it is resident for tax

purposes solely in Luxembourg and therefore it is not liable for corporation

tax in the UK. On 8 December 2006, HMRC confirmed that it had closed the

VIL enquiry.

The Company has taken provisions, which at 31 March 2007 amounted to

approximately £2.1 billion, for the potential UK corporation tax liability and

related interest expense that may arise in connection with the Vodafone 2

enquiry. The provisions relate to the accounting period which is the subject of

the proceedings described above as well as to accounting periods after

31 March 2001 to date. The provisions at 31 March 2007 reflect the

developments during the year, in particular the Cadburys Schweppes

Judgment.

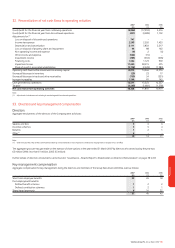

The Company has recently been served with a Complaint filed in the

Supreme Court of the State of New York by Cem Uzan and others against the

Company, Vodafone Telekomunikasyon A.S. (“VTAS”), Vodafone Holding A.S.

and others. The Plaintiffs make certain allegations in connection with the sale

of the assets of the Turkish company Telsim Mobil Telekomunikasyon

Hizmetleri A.S. (“Telsim”) to the Group’s Turkish subsidiary which acquired the

assets from the SDIF, a public agency of the Turkish state, in a public auction

in Turkey pursuant to Turkish law in which a number of mobile

telecommunications companies participated. The Plaintiffs seek an Order

requiring the return of the assets of Telsim to them or damages. The

Company believes these claims have no merit and will vigorously defend

the claims.

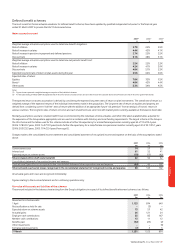

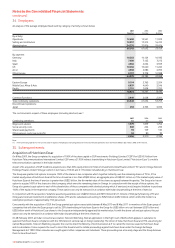

31. Contingent liabilities

2007 2006

£m £m

Performance bonds 109 189

Credit guarantees – third party indebtedness 34 64

Other guarantees and contingent liabilities 90 19