Unum 2006 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2006 Unum annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

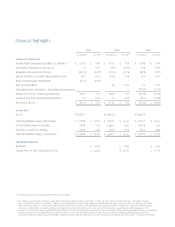

Financial highlights

OPERATING STATEMENT DATA

Income from Continuing Operations, As Adjusted **

Net Realized Investment Gain (Loss)

Regulatory Reassessment Charges

Special Tax Items and Debt Extinguishment Costs

Broker Compensation Settlements

Gain on Dispositions

Individual Income Protection - Closed Block Restructuring

Income (Loss) from Continuing Operations

Income (Loss) from Discontinued Operations

Net Income (Loss)

BALANCE SHEET

Assets

Total Stockholders’ Equity (Book Value)

Net Unrealized Gain on Securities

Net Gain on Cash Flow Hedges

Total Stockholders’ Equity, As Adjusted **

PER COMMON SHARE DATA

Dividends

Closing Price on Last Trading Day of Year

* Per Share Amounts for Operating Statement Data Assume Dilution

** We analyze our performance using non-GAAP fi nancial measures which exclude certain items and the related tax thereon from net income. We believe “Income

from Continuing Operations, As Adjusted,” which is a non-GAAP fi nancial measure and excludes realized investment gains and losses, which are recurring, and certain

other items as specifi ed, is a better performance measure and a better indicator of the profi tability and underlying trends in our business. Realized investment gains

and losses are dependent on market conditions and general economic events and are not necessarily related to decisions regarding our underlying business. The

exclusion of certain other items specifi ed above also enhances the understanding and comparability of our performance and the underlying fundamentals in our operations,

but this exclusion is not an indication that similar items may not recur. We also believe that book value per common share excluding unrealized gains and losses

on securities and the net gain on cash fl ow hedges, which also tend to fl uctuate dependent on market conditions and general economic trends, is an important measure.

2006 2005 2004

(in millions) per share* (in millions) per share* (in millions) per share*

$ 603.3

1.5

(267.4)

78.9

(12.7)

-

-

403.6

7.4

$ 411.0

$ 52,823.3

$ 1.80

0.01

(0.79)

0.23

(0.04)

-

-

1.21

0.02

$ 1.23

$ 513.1

(4.3)

(51.6)

42.8

-

4.0

-

504.0

9.6

$ 513.6

$ 51,866.8

$ 1.64

(0.02)

(0.16)

0.14

-

0.01

-

1.61

0.03

$ 1.64

$ 514.8

18.8

(87.8)

51.1

-

2.7

(701.0)

(201.4)

(51.6)

$ (253.0)

$ 50,832.3

$ 1.74

0.06

(0.29)

0.17

-

0.01

(2.37)

(0.68)

(0.18)

$ (0.86)

$ 7,718.8

534.8

194.2

$ 6,989.8

$ 22.53

1.56

0.57

$ 20.40

$ 0.30

$ 20.78

$ 7,363.9

1,040.7

273.3

$ 6,049.9

$ 24.66

3.49

0.91

$ 20.26

$ 0.30

$ 22.75

$ 7,224.1

1,309.8

236.9

$ 5,677.4

$ 24.36

4.41

0.80

$ 19.15

$ 0.30

$ 17.94