United Healthcare 2003 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2003 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

48 UnitedHealth Group

recognize a liability for the fair value of the obligation assumed under the guarantee; 4) Interpretation

No. 46, “Consolidation of Variable Interest Entities — an Interpretation of ARB No. 51,” which requires

an enterprise to consolidate a variable interest entity if that enterprise has a variable interest that will

absorb a majority of the entity’s expected losses, receive a majority of the entity’s expected residual

returns, or both; 5) FAS No. 149, “Amendment of Statement 133 on Derivative Instruments and

Hedging Activities,” which amends and clarifies accounting for derivative instruments and hedging

activities under FAS No. 133, “Accounting for Derivative Instruments and Hedging Activities” and 6)

FAS No. 150, “Accounting for Certain Financial Instruments with Characteristics of Both Liabilities and

Equity,” which establishes standards for classifying and measuring as liabilities certain freestanding

financial instruments that represent obligations of the issuer and have characteristics of both liabilities

and equity.

Reclassifications

Certain 2001 and 2002 amounts in the consolidated financial statements have been reclassified to

conform to the 2003 presentation. These reclassifications have no effect on net earnings or

shareholders’ equity as previously reported.

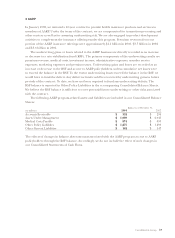

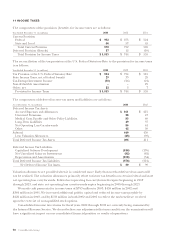

3 ACQUISITIONS

On February 10, 2004, our Health Care Services business segment acquired Mid Atlantic Medical

Services, Inc. (MAMSI). MAMSI offers a broad range of health care coverage and related administrative

services for individuals and employers in the mid-Atlantic region of the United States. This merger

significantly strengthens UnitedHealthcare’s market position in the mid-Atlantic region and provides

substantial distribution opportunities for other UnitedHealth Group businesses. Under the terms of the

purchase agreement, MAMSI shareholders received 0.82 shares of UnitedHealth Group common stock

and $18 in cash for each share of MAMSI common stock they owned. Total consideration issued was

approximately $2.7 billion, comprised of 36.4 million shares of UnitedHealth Group common stock

(valued at $1.9 billion based on the average of UnitedHealth Group’s share closing price for two days

before, the day of and two days after the acquisition announcement date of October 27, 2003) and

$800 million in cash. The purchase price and costs associated with the acquisition exceeded the

preliminary estimated fair value of the net tangible assets acquired by approximately $2.1 billion.

We have preliminarily allocated the excess purchase price over the fair value of the net tangible assets

acquired to finite-lived intangible assets of $360 million and associated deferred tax liabilities of

$126 million, and goodwill of approximately $1.9 billion. The finite-lived intangible assets consist

primarily of member lists and health care physician and hospital networks, with an estimated weighted-

average useful life of 19 years. The acquired goodwill is not deductible for income tax purposes. Our

preliminary estimate of the fair value of the tangible assets/(liabilities) as of the acquisition date, which

is subject to further refinement, is as follows:

(in millions - unaudited)

Cash, Cash Equivalents and Investments $736

Accounts Receivable and Other Current Assets 252

Property, Equipment, Capitalized Software and Other Assets 91

Medical Costs Payable (292)

Other Current Liabilities (132)

Net Tangible Assets Acquired

$

655